Money, don’t you wish you had a little more – to save for your holiday or even to pay off your debt, grow a nest egg to feel more laid back about your personal finance.

Money, don’t you wish you had a little more – to save for your holiday or even to pay off your debt, grow a nest egg to feel more laid back about your personal finance.

All this simply comes down to how you think about money.

I’ve spent the last decade making money on the internet.

To not lose it to inflation this decade I had to do something entirely different.

I tried something counter intuitive. Converting $100 of fiat currency into Satoshis every month.

The first time I bought bitcoin was in October 2017.

I remember spending tens of thousands of hours reading, listening and watching YouTube trying to wrap my head around it.

It was like trying to solve a Rubiks cube.

To understand Bitcoin, you will also have to solve this Rubiks cube on your own.

Here are some of that content:

2) Introduction to Bitcoin by Andreas Antonopolous

3) Coinzodiac.com/bitcoin

While I had no idea how most aspects work beneath the hood at the beginning, I noticed an enduring trend.

The price of one Bitcoin had gone from around $1,000 at the beginning of 2017 to over $10,000 by November. A whopping 10X gain in a matter of months!

So, I decided to buy $100 worth of Sats to test out how it all works.

Since its only $100/month I use my credit card to buy bitcoin for convenience sake.

You could also use peer-to-peer bitcoin platforms like LocalCoinSwap or Noones.

To buy and forget, use DCA focused platforms like SwanBitcoin.

Heck, you can even Earn Sats. ( 1 BTC = 100,000,000 Satoshis or Sats )

On Oct 1st 2017, the price of 1 BTC was $4400. $100 got me 2,272,727 Satoshis. Yes. Two million Sats.

Since BTC was highly volatile, my strategy was to spread it out and make $100 purchases each month. I figured that would be the best way to remain sane rather than trying to time my trade in a lump sum.

Most importantly I do not want to lose sleep over trading something that’s highly volatile.

Understand that money is a game that plays in your mind every second. Don’t let your emotion get in the way of your plan.

Volatility is growth

Look at the best athletes in the world. What is their one common trait? They’re highly volatile. Unpredictable. But that also makes them an incredibly scary prospect to face against.

The extreme ups and downs in performance or price often gives you the highest potential.

You have to take some risks to make more money. A life of no risk equals a life of no growth.

The psychological trick is to choose volatility in price for a small percentage of your investments. The money you make from high-growth investments like Bitcoin can offset the lower returns of your other investments. A 5% investment in Bitcoin can raise your entire investment portfolio by a total of 20%. Most people’s psychology can deal with a 5% loss.

Why do the majority of people fail to manage their personal finance? It’s because we pay too much attention to instantaneous price signals and not enough on understanding long term mass psychology.

On Nov 1st 2017, bitcoin’s price was $6400. $100 got me another 1,562,500 Satoshis.

By December, Bitcoin shot up to over $10,000. I felt a strong urge to FOMO in. Which was common. For the record I did. And nearly paid an expensive price for a lesson in psychology.

But for the sake of this lesson I’m trying to teach you here, let’s assume I stuck to my guts and continued with a more disciplined approach of $100 buy-ins.

A hundred dollars got me 1,000,000 Sats on Dec 1st.

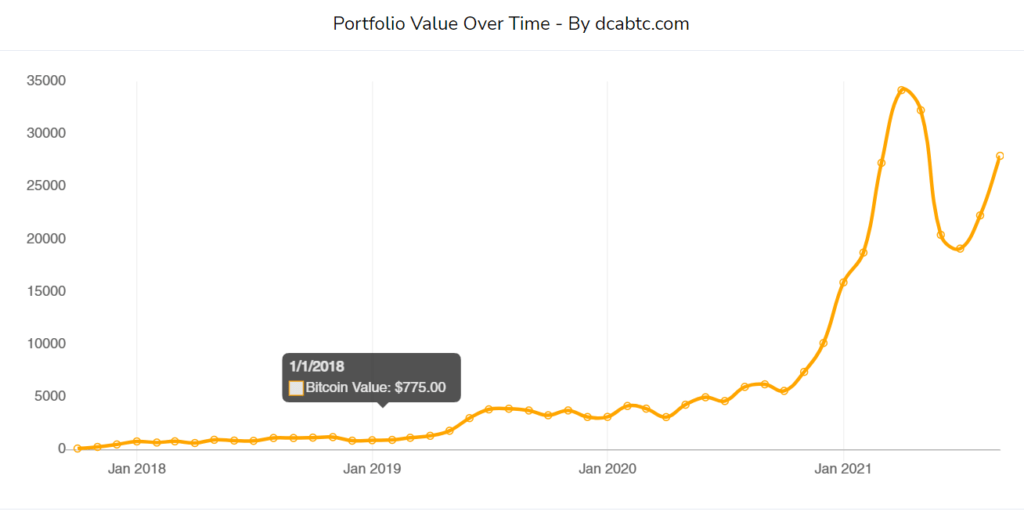

» In 2017, three months in; $300 total invested. I owned 4,835,227 Sats which is worth $677 on January 1st 2018.

January 1st 2018

1 BTC = $14,000

Total invested = $300

Total bitcoin = 4,835,227 Sats

Total worth = $677

February 1st 2018

1 BTC = $10,000

Total invested = $400

Total bitcoin = 5,835,227 Sats

Total worth = $584

March 1st 2018

1 BTC = $10,400

Total invested = $500

Total bitcoin = 6,796,765 Sats

Total worth = $707

» By April, Bitcoin experienced a massive correction; dipping more than 50%. But because of my small and consistent allocation, the volatility don’t matter much to me.

My $100 bought me more Sats during this dip and that is how you make the bulk of your gains, buying during times of excessive, irrational fear.

April 1st 2018

1 BTC = $7,000

Total invested = $600

Total bitcoin = 8,225,336 Sats

Total worth = $576

May 1st 2018

1 BTC = $9,000

Total invested = $700

Total bitcoin = 9,336,447 Sats

Total worth = $840

June 1st 2018

1 BTC = $7,500

Total invested = $800

Total bitcoin = 10,669,780 Sats (0.10669780 BTC)

Total worth = $800

July 1st 2018

1 BTC = $6,400

Total invested = $900

Total bitcoin = 12,232,280 Sats (0.12232280 BTC)

Total worth = $783

August 1st 2018

1 BTC = $7,500

Total invested = $1000

Total bitcoin = 13,565,613 Sats (0.13565613 BTC)

Total worth = $1017

September 1st 2018

1 BTC = $7,000

Total invested = $1100

Total bitcoin = 14,994,184 Sats (0.14994184 BTC)

Total worth = $1050

October 1st 2018

1 BTC = $6,500

Total invested = $1200

Total bitcoin = 16,532,645 Sats (0.16532645 BTC)

Total worth = $1075

November 1st 2018

1 BTC = $6,300

Total invested = $1300

Total bitcoin = 18,119,946 Sats (0.18119946 BTC)

Total worth = $1142

December 1st 2018

1 BTC = $4,000

Total invested = $1400

Total bitcoin = 20,619,946 Sats (0.20619946 BTC)

Total worth = $825

» My first 85% Bitcoin correction – Towards the end of 2017 the bull market turned into a bear market for the entirety of 2018.

January 1st 2019

1 BTC = $3,800

Total invested = $1500

Total bitcoin = 23,251,524 Sats (0.23251524 BTC)

Total worth = $884

February 1st 2019

1 BTC = $3,500

Total invested = $1600

Total bitcoin = 26,108,666 Sats (0.26108666 BTC)

Total worth = $914

March 1st 2019

1 BTC = $3,900

Total invested = $1700

Total bitcoin = 28,672,768 Sats (0.28672768 BTC )

Total worth = $1118

April 1st 2019

1 BTC = $4,100

Total invested = $1800

Total bitcoin = 31,111,792 Sats (0.31111792 BTC)

Total worth = $1276

May 1st 2019

1 BTC = $5,400

Total invested = $1900

Total bitcoin = 32,963,643 Sats (0.32963643 BTC)

Total worth = $1780

June 1st 2019

1 BTC = $8,500

Total invested = $2000

Total bitcoin = 34,140,113 Sats (0.34140113 BTC)

Total worth = $2902

July 1st 2019

1 BTC = $10,500

Total invested = $2100

Total bitcoin = 35,092,493 Sats (0.35092493 BTC)

Total worth = $3685

August 1st 2019

1 BTC = $10,400

Total invested = $2200

Total bitcoin = 36,054,031 Sats (0.36054031 BTC)

Total worth = $3750

September 1st 2019

1 BTC = $9,700

Total invested = $2300

Total bitcoin = 37,084,958 Sats (0.37084958 BTC)

Total worth = $3597

October 1st 2019

1 BTC = $8,300

Total invested = $2400

Total bitcoin = 38,289,777 Sats (0.38289777 BTC)

Total worth = $3178

November 1st 2019

1 BTC = $9,200

Total invested = $2500

Total bitcoin = 39,376,733 Sats (0.39376733 BTC)

Total worth = $3623

December 1st 2019

1 BTC = $7,400

Total invested = $2600

Total bitcoin = 40,728,084 Sats (0.40728084 BTC)

Total worth = $3014

January 1st 2020

1 BTC = $7,200

Total invested = $2700

Total bitcoin = 42,116,972 Sats (0.42116972 BTC)

Total worth = $3032

February 1st 2020

1 BTC = $9,400

Total invested = $2800

Total bitcoin = 43,180,801 Sats (0.43180801 BTC)

Total worth = $4059

March 1st 2020

1 BTC = $8,500

Total invested = $2900

Total bitcoin = 44,357,271 Sats (0.44357271 BTC )

Total worth = $3770

April 1st 2020

1 BTC = $6,600

Total invested = $3000

Total bitcoin = 45,872,422 Sats (0.45872422 BTC)

Total worth = $3028

May 1st 2020

1 BTC = $8,900

Total invested = $3100

Total bitcoin = 46,996,017 Sats (0.46996017 BTC)

Total worth = $4183

June 1st 2020

1 BTC = $10,100

Total invested = $3200

Total bitcoin = 47,986,116 Sats (0.47986116 BTC)

Total worth = $4847

July 1st 2020

1 BTC = $9,200

Total invested = $3300

Total bitcoin = 49,073,072 Sats (0.49073072 BTC)

Total worth = $4515

August 1st 2020

1 BTC = $11,700

Total invested = $3400

Total bitcoin = 49927772 Sats (0.49927772 BTC)

Total worth = $5842

September 1st 2020

1 BTC = $11,900

Total invested = $3500

Total bitcoin = 50768108 Sats (0.50768108 BTC)

Total worth = $6041

October 1st 2020

1 BTC = $10,600

Total invested = $3600

Total bitcoin = 51711504 Sats (0.51711504 BTC)

Total worth = $5481

November 1st 2020

1 BTC = $13,700

Total invested = $3700

Total bitcoin = 52441431 Sats (0.52441431 BTC)

Total worth = $7184

December 1st 2020

1 BTC = $18,800

Total invested = $3800

Total bitcoin = 52973345 Sats (0.52973345 BTC)

Total worth = $9959

»Summary purchase for the last 3 years – Although 2020 has been a good year, I‘ve managed to get less and less Sats for my $100. It looks like my dollars have been depreciating against the asset.

I’ve almost tripled my modest investment of $3800 to $9959. While I’ve acquired half of one bitcoin. My patience and consistency is about to pay off handsomely!

January 1st 2021

1 BTC = $29,300

Total invested = $3900

Total bitcoin = 53,314,641 Sats (0.53314641 BTC)

Total worth = $15,621

February 1st 2021

1 BTC = $33,500

Total invested = $4000

Total bitcoin = 53,613,148 Sats (0.53613148 BTC)

Total worth = $17,960

March 1st 2021

1 BTC = $49,600

Total invested = $4100

Total bitcoin = 53,814,760 Sats (0.53814760 BTC )

Total worth = $26,692

April 1st 2021

1 BTC = $59,000

Total invested = $4200

Total bitcoin = 53,984,251 Sats (0.53984251 BTC)

Total worth = $31,851

May 1st 2021

1 BTC = $57,000

Total invested = $4300

Total bitcoin = 54,159,689 Sats (0.54159689 BTC)

Total worth = $30,871

June 1st 2021

1 BTC = $37,000

Total invested = $4400

Total bitcoin = 54,429,959 Sats (0.54429959 BTC)

Total worth = $20,139

July 1st 2021

1 BTC = $33,500

Total invested = $4500

Total bitcoin = 54,728,466 Sats (0.54728466 BTC)

Total worth = $18,334

August 1st 2021

1 BTC = $40,000

Total invested = $4600

Total bitcoin = 54,978,466 Sats (0.54978466 BTC)

Total worth = $21,991

September 1st 2021

1 BTC = $48,800

Total invested = $4700

Total bitcoin = 55,183,384 Sats (0.55183384 BTC)

Total worth = $26,929

October 1st 2021

1 BTC = $48,000

Total invested = $4800

Total bitcoin = 55,391,717 Sats (0.55391717 BTC)

Total worth = $26,588

November 1st 2021

1 BTC = $61,000

Total invested = $4900

Total bitcoin = 55,555,651 Sats (0.55555651 BTC)

Total worth = $33,889

December 1st 2021

1 BTC = $57,000

Total invested = $5000

Total bitcoin = 55,731,089 Sats (0.55731089 BTC)

Total worth = $31,767

Verdict

Total invested = $5000

Total bitcoin = 55,731,089 Satoshis (0.55731089 BTC)

Total worth = $31,767 (On Dec 1st 2021)

Percent Change = ~600% Gain

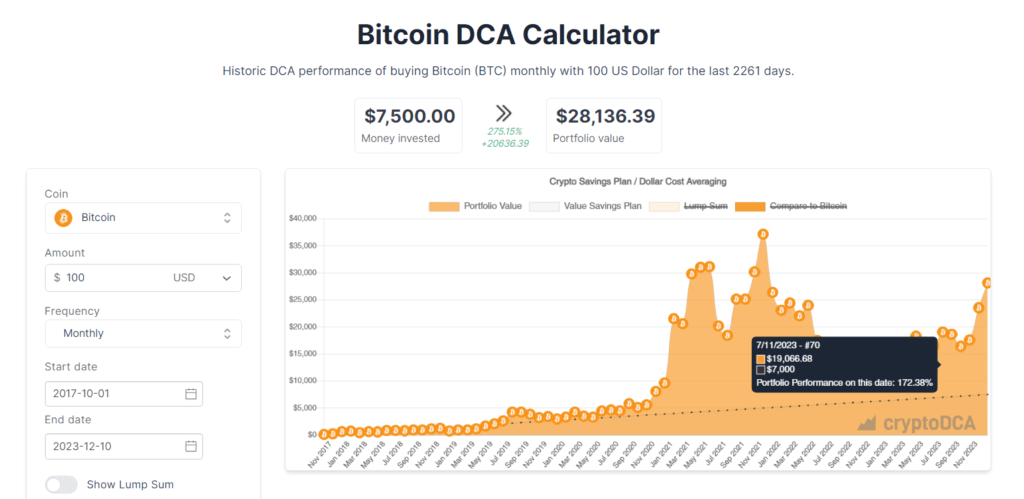

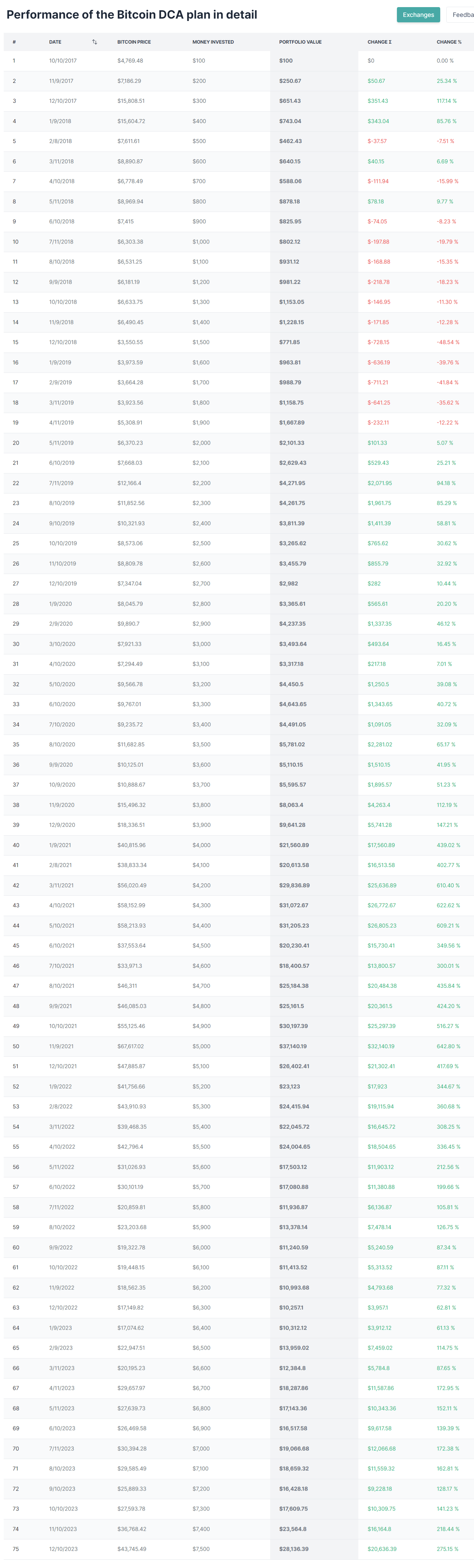

*Update December 2023 – Result of Buying BTC for 6 years via DCA

I continued to add $100 worth of BTC every single month even during bitcoin’s price correction in 2022. As you can see, I was getting more bitcoin for my $100, which was good for my long term plan despite seeing an overall drop in my portfolio value.

I now own 64,000,000 Sats with a total of $7500 invested; My portfolio is now worth $28,136.39 This is a 275% increase in my portfolio which beats any investment manager like J.P. Morgan or Blackrock.

For more details, check out how dollar cost average buying of bitcoin looks like over the course of 6 years, check the table below:

» Ah ha! The power of compound interest! It truly is the eighth wonder of the world. So it is true Albert Einstein did say that “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”

Looks like bitcoin is re-instilling the values of savings once again. Bitcoin does not erode over time, 1 Satoshi = 1 Satoshi.

How to HODL in a Bull or Bear Market

Investing in Bitcoin is counter intuitive…

Let me explain:

Normally in any other kinds of assets, you would have to time your buy and sell orders just right in order to make profit right!? You don’t do that with Bitcoin because bitcoin is becoming money.

It is being monetized in real-time by people who believe in it!

Bitcoin was designed to be the only kind of money in the world with a hard limit on its supply cap.

You just can’t print more of it even if some powerful individual wants to.

This is guaranteed by a set of rules known as the Nakamoto Consensus which dictates how the network should be run.

This can only happen because Bitcoin is the most decentralized network in the world.

“Leverage is the reason some people become rich and others do not become rich.”

— Robert T. Kiyosaki

Bitcoin continues to grow exponentially in spite of an incessant wave of attacks because it leverages on two key ingredients; capital and people.

Vires in numeris. Strength in Numbers.

As more & more people use the Bitcoin network to secure their value, it becomes more resilient and harder to attack even by the State.

It wasn’t always like this in the formative years of Bitcoin’s introduction.

Early on, Satoshi needed a way to bootstrap the Bitcoin network. He did it with an incentive mechanism called the Halvings to keep the protocol decentralized – so everyone, even you today could participate in the network without being beholden to its leaders or even creator ad infinitum.

Would a person in a position of power ever give up his power for the greater good of the company/network/country!? I think you can answer that question on your own if you’re being honest.

Before Bitcoin, private digital currencies that were invented like Ecash or E-gold, were riddled with problems stemming from centralization. Governments would just shut it down because they felt that they were challenging their authority to issue money (fiat currencies).

A centralized system requires one person to shoulder all of its risk. (99% of what we have today are highly centralized)

A decentralized system divides risk among individuals who are also participants in the security of the network. (Bitcoin is the most decentralized network in the world)

When you HODL bitcoins, you’re accepting the personal risk of losing your own funds if you do not secure it properly. You’re not passing the buck to an intermediary like Tony here, who promises to keep your money safe and sound.

In order to minimize that risk, you have to first learn how to secure your bitcoins properly. You can do this with a brain wallet where you memorize the 24 word recovery phrase of your Ledger Nano used to secure your bitcoin private keys. (Forgetting and losing your recovery phrase would result in losing your bitcoins forever.)

This is the “Risk Sharing Principle“. Accountability and self-custody of your own valuable bitcoins.

Bitcoin was designed as a new financial system, one that didn’t require the trust of another Big Brother.

In a world where trust in authorities is breaking down at rapid pace, this is not just a technological breakthrough but a social revolution.

By owning Bitcoin, you are your own central bank.

You are the backbone of your own personal financial dependence.

There is no way to shut Bitcoin down without first turning off the internet.

Hodling is about regaining our own financial sovereignty.

Early Hodlers continued believing in Bitcoin in spite of overwhelming negativity and information. That’s why their perseverance paid off tremendously today as their bitcoin today is worth millions.

The unprepared investor or trader will not be able to sit tight if they do not have a fundamental notion of Bitcoin as money.

So it’s important to keep in mind: When you’re selling your bitcoins, you’re essentially trading something incredibly scarce for something incredibly abundant.

You’re trading the future for the past.

But if you can’t bear the thought of your fictitious fiat money sum of 1’s and 0’s dropping by 85% or more, you should de-risk into other assets. (You should never sell all your bitcoins even if you want to take some profit!)

Switch off the noise

There’s a lot of noise when it comes to Bitcoin.

If you’ve done well, people will want to talk you out of your precious bitcoin.

If you’ve done poorly with your investment, then people want to sell you the latest snake oil (buy my Xcoin, it’s better than bitcoin).

Many before you have proclaimed Bitcoin dead countless times. Don’t fall for these sweeping headlines.

Is Bitcoin dead yet?https://t.co/jQ60iYJWJK pic.twitter.com/QLRtGTxxgk

— Jameson Lopp (@lopp) December 20, 2021

Turning off the noise is crucial.

I spend a lot of time reading and learning especially from Andreas Antonopolous, Michael Saylor, and many more from this list on Twitter.

It’s easy to learn and switch off all the pretenders or ”Gooroos” in trading and experts in ”Blockchain”.

A disciplined mind that can shut off the noise is a superpower.

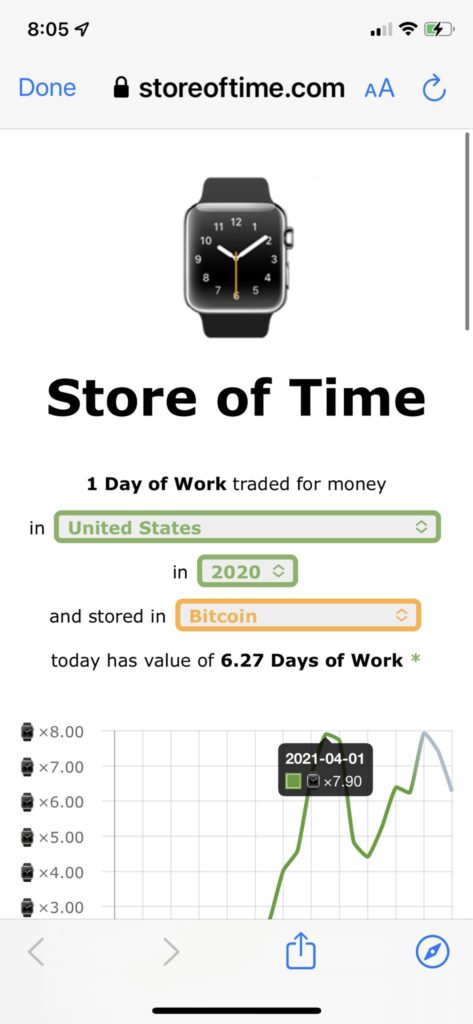

View Bitcoin as time

Since time immemorial, we have substituted our time for money. As the saying goes; Time is money.

We were programmed from childhood to see money as a way of buying basic necessities like putting food on the table or a roof over our heads.

But what is money really!? – but a representation of the collective economic energy stored by humanity.

If money is simply a plaything for politicians to buy votes, do you think it is an ideal representation of our time on earth?

If money requires no time to create, can it endure long enough for civilization to not crumble under its own weight!?

More profoundly, how do you tell the time if the clocks you use can never be trusted?

That is why more and more people are increasingly adept at adopting Bitcoin as a unit of our time.

Why? Because Bitcoin cannot simply be inflated away to infinity based on the whims of political forces.

#Inflation is the problem and #Bitcoin is the solution. https://t.co/hQYCtNAg6G

— Michael Saylor⚡️ (@saylor) December 11, 2021

Hone your psychology to notice B.S.

Our minds are great at rationalizing an investment. But we tend to lie to ourselves about money without even realizing it. Dogecoin is a cryptocurrency like Bitcoin without the good stuff and is an example of an asset class that fools many people’s minds.

When you thoroughly understand Bitcoin and then compare it to Dogecoin, it’s pretty obvious what it is and why you shouldn’t throw thousands of dollars into it. Elon Musk said it himself, it’s a Meme, that’s it! He’s just trying to laugh upon the fact that the very concept of money is a joke now.

The easiest way to trick the mind is to do the research, analyze the findings, read back the results, and show them to people you trust for feedback. When you do, you’ll find a reason to stay away from investments that are psychological tricks designed to steal money out of your wallet and give it to the nearest Joe Schmo wearing a rainbow hat with a propeller on top.

Think long-term, not short-term

Many content creators want to make more money. The problem is they don’t understand the power of long-term thinking. I’ve learned that publishing content for 5 years straight can completely change your financial position.

The challenge is most content creators become impatient at the 3–6 month mark. So they give up and miss out on all the gains. If they knew that 5 years could make their content creator goals a reality, they might keep going.

The thing is no financial success is guaranteed. But you can certainly look at people who have the same goal and work out the odds.

When you’ve studied the lives and practices of today’s most successful entrepreneurs, investors, athletes and builders; you’ll find one common trait: a deep, visceral understanding of the importance of Time & Patience.

The majority of people on the other hand are impatient and tend to bail to make fast money. The thing about quick gains is that they are quick to vanish too.

If you want to stay ahead, don’t follow the majority!

Success after all is a war of attrition. If you stick around long enough, eventually something is going to happen.

The same is true with investing in Bitcoin. Many people ask me whether I worry about the day-to-day swings in price. I tell them the price today is meaningless. What matters is the price in 5–10 years which I am highly confident would be higher than what it is today.

The last 13 years have already shown us what’s possible with Bitcoin. Thinking about making more dollars in the short term from trading is the product of gambling, casinos, and the lottery.

Fortunes are made over 5–10 year time periods hodling bitcoin.

Bringing It All Together

How you think about Bitcoin is just as important as learning how to keep the money you’ve made. Don’t underestimate faulty beliefs or closed-mindedness, as both can destroy your finances.

You quietly make real money when you become aware of how you think about money in the first place. The people who make more money adopt the financial psychology of the best investors: patience, deep thinking, a willingness to take calculated risks, and an open mind.

You only live once.

It’s time for us to escape this rat race they call fiat!