I’ve bought some bitcoins and the price has increased, should I sell or hold it?

I’ve bought some bitcoins and the price has increased, should I sell or hold it?

This is one of the most common questions new crypto investors ask.

As we all know, there’s more than one way to approach the crypto market.

You can either

- Day trade to make a quick buck

- Buy and HODL cryptocurrency for long-term investment

Trading and investing both aim to increase the value of investment, but they pursue that goal in different ways.

So, which crypto strategy is best for you? The key is to understand the difference between trading and hodling.

What is HODL?

HODL is an acronym that stands for “hold on for dear life”.

In early Bitcoin forums, someone misspelled the word “hold” in the message and readers interpreted it as an abbreviation for “hold on for dear life”.

Now it turns out becoming a meme which means hold onto your cryptocurrency investment and ignore the sentiments despite extreme price volatility.

Traders vs Investors

Investors and traders make money differently.

In general, traders are those who take advantage of the small fluctuation of price. They earn money via price movement.

They try to out-predict the market movement in the short term.

They try to study the market, feed off the news, read and follow “prophets” of the market to try to time themselves to either go in or get out.

Entering and exiting positions over a short timeframe (as short as days, hours, minutes or even seconds), quickly to make smaller, more frequent profits.

On the other hand, crypto investors or HODLers have a longer-term outlook.

They seek larger returns by buying good cryptocurrencies that have a fundamental use case and hold them, over a very long time.

Liquidity and price volatility matter less to long-term investors because they often hold coins through market’s ups and downs for years or decades.

So which is the better investment strategy?

Here’s the truth: 95% of Traders Lose Money

There’s nothing wrong with making profits by day trading.

It’s as simple as buy low and sell high, right?

In fact, it’s so hard to resist the emotional temptation to not to sell your cryptocurrency when you’re seeing the price goes through the roof.

But bots, robots or automated trading entities are controlling the crypto markets.

According to Bloomberg, as high as 80% of total transaction volumes on Bitcoin trading exchanges consist of bots.

This basically means that bots will always get the highest bid and/or lowest ask prices in the market.

When it comes to day trading, human traders can never outperform robot traders.

Often, we only heard the stories about the biggest win in crypto trading.

But for each impressive quick win, we don’t hear the many other stories of losses.

On the contrary, long-term investors operate on a very long-term time horizon.

They buy and keep the right cryptocurrency that is underpriced and less in demand now, but will be extremely valuable in the near future.

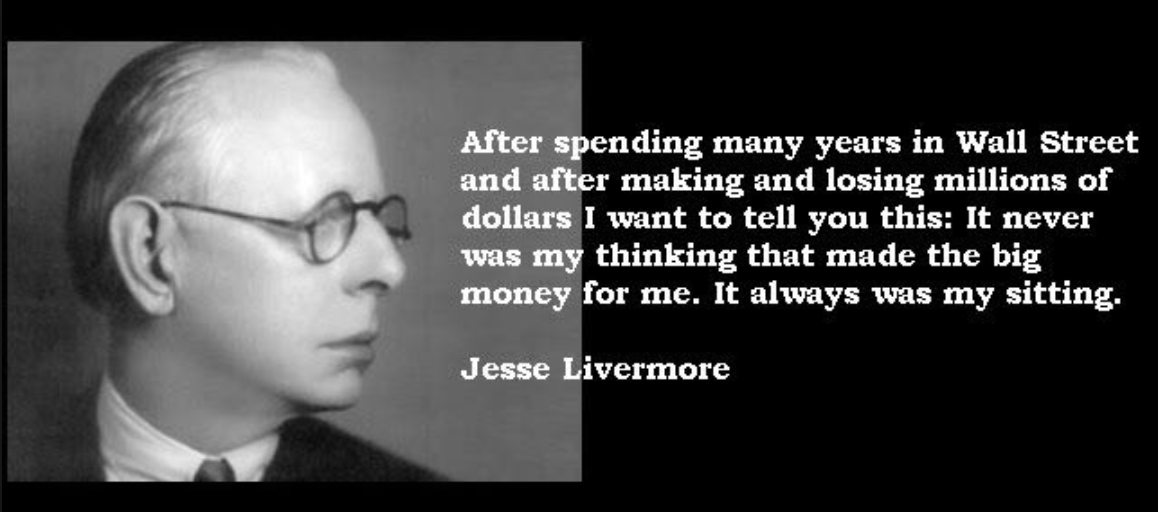

Sometimes, doing nothing would be the best thing.

If you invested $1,000 in Amazon 10 years ago, you’d make about $20,000 today.Even Warren Buffett admitted he was too dumb to realize Amazon’s Jeff Bezos would succeed on the scale that he has. He opted not to invest in Amazon when he had plenty of opportunities. He did not understand or appreciate the value of tech.

$1,000 in Microsoft = ~$8,000

$1,000 in Netflix = ~$100,000

$1,000 in Apple = ~$9,000

$1,000 in Bitcoin = ~10,000,000 (Even after an 85% crash in 2018)

If only the majority of investors were patient enough… Food for Thought!

All trading is a zero-sum game.

If you’re buying and selling crypto with the hope of getting quick profits, then what you’re doing is speculating.

Speculative trading is a zero-sum game. In order for you to win, 9 have to lose.

In an unfair market, the average investor will more likely lose to people who have an unfair advantage and are gaming the market. ~hodlbot.io

More importantly, trading doesn’t add value to society. It doesn’t help to make a better world. It only adds to your bottom line.

Investors, by contrast, invest in the economy as a whole by holding crypto assets.

Willem Van den Bergh couldn’t have explained it better,

Every time you choose to retain money you decrease the available amount in circulation…This leads to the increase of purchasing power per unit of that money. The result is that prices fall and all participants in that economy become wealthier. By holding Bitcoin the price per unit increases. The more people hold Bitcoin in the long run, the more volatility drops towards a gradual increase in price. This convergence towards a stable increase in price makes Bitcoin more attractive to new audiences, creating a feedback loop.

By holding Bitcoin and see it succeed together is a positive-sum game.

Get rich quick vs Get rich slow

Day trading is lauded as the best way to get rich quick. In fact, there’s never short of trading gurus and experts who will teach you how to make money fast from trading cryptocurrency.

Unfortunately, nobody has psychic powers.

But still, people look to ‘pundits‘ on twitter, TV and social media as their go-to guide to buying and selling Bitcoin.

It turns out that these pundits’ predictions are only right about 47% of the time. And they rake in millions from the eyeballs they get, newsletters, financial products and services they sell.

Have you ever heard of anyone getting rich taking advice from talking heads?

Here’s the truth- there’s no get rich quick scheme.

That’s just someone trying to get rich off of you.

Traders usually jump from one cryptocurrency to another, change their mind and positions quickly based on the market sentiments and trends. They focus on charts and graphs to make short term profits.

I do NOT believe this is a H&S top in $BTC pic.twitter.com/nwng4QwK4Y

— Peter Brandt (@PeterLBrandt) June 10, 2019

Zoom out to get a bigger picture, we have long-term, patient investors who understand that Bitcoin is a revolutionary technology that’ll change the world forever.

Andreessen Horowitz is a great example, “We’ve been investing in crypto assets for 5+ years. We’ve never sold any of those investments, and don’t plan to any time soon. We structured the a16z crypto fund to be able to hold investments for 10+ years.”

Ask yourself: Are you going to spend your life staring at the crazy candle-stick stock chart or do something to better yourself?

Trading is Hard. HODLing is EVEN Harder.

For traders, to make quick profits is all about entering and exiting trades at the right time with the right cryptocurrency. It doesn’t matter whether Bitcoin, Ethereum or any altcoin they trade will achieve mass adoption or fail.

It simply doesn’t matter. As long as you time your entry and exit points correctly, you’ll make a profit.

Essentially, trading is the most addictive form of gambling.

If you’re not careful, you can easily find yourself spending more than 10-12 hours a day looking at your computer screen.

Attempting to process all the data and follow the mainstream media to show you how to make a fortune. It can be very stressful and probably fruitless.

However, if you believe in Bitcoin and cryptocurrency for real, ask yourself which assets have high potential, functional, real use cases and will matter most in the coming decade.

The HODL attitude requires psychological & emotional work. The unprepared investor cannot sit tight, only the one who has worked to imagine the market relentlessly punching him in face. ~ Tuur Demeester

Invest in the cryptocurrency, left it alone and/or plan to invest consistently over time, regardless of market conditions and fluctuations in prices. Take it off an exchange, store it securely in your own hardware wallet for decades and access it one day to find that it’s worth millions in fiat money.

1. buy btc

2. withdraw btc to your keys

3. do nothingStep 3 is the hardest, by far! Very counterintuitive

— Pierre Rochard [🌮⚡️🔑] (@pierre_rochard) June 3, 2019

Final Thought

Look at it this way: Remove all the emotions, volatility and uncertainties from cryptocurrency investing, it’s no doubt keeping the right coin passively for longer term (decades) without attempting to time the market would be the best choice.

I’m not a financial advisor, my recommendations shouldn’t be used as professional investment advice.