Did you know that you could claim back 10% GST instantly on purchases over $300 when you fly out of Australia?

Did you know that you could claim back 10% GST instantly on purchases over $300 when you fly out of Australia?

Regardless if you are a permanent Australian resident or a temporary tourist, you can learn how this tourist refund works to save you extra money.

I’ve done lots of research for my recent one-month trip to Australia- from finding the best hotel deals, cheap domestic flights, and exotic cuisine to some lesser-known beautiful places to visit.

It has never crossed my mind that I can actually use the Tourist Refund Scheme (TRS) to save money until we met our friend who’s staying in Brisbane over a lunch in the middle of the trip.

I wondered, “how could I save money by spending?”

And I’d rather spend money on experiences than on material things.

“If you want to buy electronic gadgets, it’s much cheaper to buy it in Australia,” Chris said.

“My girlfriend has bought her Macbook Air and iPhone here,” he continued, trying to share his trick with us.

Guess what? My friend was right.

What is Tourist Refund Scheme (TRS)?

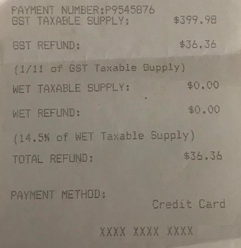

With TRS, you can get a refund of the Goods and Services Tax (GST) and Wine Equalisation Tax (WET) for items purchased in Australia within 60days of your departure. There are exceptions, of course!

This scheme is open to all overseas visitors and Australian residents, but not for operating air crew.

It’s fairly easy to get a 10% refund of what you paid. Keep reading.

Conditions for claiming refund of TRS

1. You have spent over $300 (GST inclusive) in any retail shop. You may combine tax invoices from the same store (with the same Australian Business Number).

If you’re buying products from different stores, you’ll need to spend at least $300 at each place to be eligible to claim back the GST.

2. The items have to be purchased within 60 days before you leave Australia.

3. You have to bring the original tax invoice with you. There are no special TRS refund forms will be given at the shop. You just need to present the regular tax invoice at a TRS facility.

Tip: For purchase exceeding $1000, you’ll need to make sure they include your name and address on the tax invoice. I’ve seen a tourist failed to get his tax refund at Melbourne TRS office just because the salesperson forgot to enter his personal details on the invoice!

4. You have to wear or carry the goods on board the aircraft. Don’t keep your goods in your checked bag. This is because you need to present the items along with your passport, tax invoice and international boarding pass to an officer at the airport TRS office.

Note: If the products to be claimed are gels, aerosols, liquids, or oversized goods, then you must check in the item. Inform the counter staff that you want to make a tax refund, they’ll contact with an officer at the TRS facility. Then you’ll need to present these items to the officer prior to check-in.

Tourist refund application process

- After performing luggage drop, check-in and clearing customs, head to a TRS facility at the airport.

- Present your items, passport, boarding pass and invoice to the TRS officer.

- You can have the refund deposited to a credit card, debit card or Australian Bank. You can also request to be paid by cheque.

- The officer will stamp your tax invoice as “Processed” and a claim receipt will be issued to you.

Payments generally take 60 days to process.

Payments generally take 60 days to process.

The claim is available up to 30minutes before your flight departure.

Make sure you allocate enough time to make your claim. Remember you still need to queue at the TRS facility.

It took me less 15 minutes to complete the entire TRS refund process and I received my TRS refund using my debit card in less than a week!

Tourist Refund Scheme app

To speed up the claiming process, you can download the TRS mobile app and enter all the details (payment method, details of the goods and your travel information) before you go to the airport. The information will be stored as a QR code. At the TRS office, you just need to show them your QR code, your purchased items, and original tax invoice.

To speed up the claiming process, you can download the TRS mobile app and enter all the details (payment method, details of the goods and your travel information) before you go to the airport. The information will be stored as a QR code. At the TRS office, you just need to show them your QR code, your purchased items, and original tax invoice.

You can download the TRS app from iTunes or Google play.

The TRS facilities are available at International airports in Perth, Melbourne, Sydney, Gold Coast, Brisbane, Cairns, Darwin and Adelaide.

There go you! Now you know how to save your money with TRS refund!

What’s your experience with claiming back your GST refund?

For more information on Australian Tourist Refund Scheme, visit the Department of Immigration website.

Book domestic and international flights via Skyscanner for the best prices.

Learn How to find cheap hotel rooms here.

Lonely Planet Australia

is a comprehensive travel guide to the country, offers the most up-to-date advice on what to see and skip, and what hidden discoveries await you. It is ideal for those who want to both explore the top sights and take the road less traveled.