Let’s be honest… The term “business as usual” is going to take on a whole new meaning once this pandemic is over. The virus may end the late 20th century way of life. Some businesses may come back to a new normal, while many won’t come back at all… Leaving millions unemployed searching for new opportunities to provide for their family. One thing is crystal clear… Having to rely on someone else in order to put food on your table is downright scary. That’s why now is the perfect time to find a way to protect & make money on your own terms. Something YOU have control over. I know it may seem overwhelming to get started… Which is why I’ve written this guide to help you in this time of crisis. Here you’ll find my step–by–step blueprint for ideas on how you could make money from home as well as protect your finances from internal & external theft. No special licenses or certifications are required… And you can get started with little or no money. All you need is a phone, a laptop and something you love doing. But first, let’s analyse the pre-existing economic conditions before the outbreak. Understanding what was already baked into the cake years ago can offer clues as to why every institution, country, state and city was unprepared for the coronavirus pandemic, despite many prior warnings:

Let’s be honest… The term “business as usual” is going to take on a whole new meaning once this pandemic is over. The virus may end the late 20th century way of life. Some businesses may come back to a new normal, while many won’t come back at all… Leaving millions unemployed searching for new opportunities to provide for their family. One thing is crystal clear… Having to rely on someone else in order to put food on your table is downright scary. That’s why now is the perfect time to find a way to protect & make money on your own terms. Something YOU have control over. I know it may seem overwhelming to get started… Which is why I’ve written this guide to help you in this time of crisis. Here you’ll find my step–by–step blueprint for ideas on how you could make money from home as well as protect your finances from internal & external theft. No special licenses or certifications are required… And you can get started with little or no money. All you need is a phone, a laptop and something you love doing. But first, let’s analyse the pre-existing economic conditions before the outbreak. Understanding what was already baked into the cake years ago can offer clues as to why every institution, country, state and city was unprepared for the coronavirus pandemic, despite many prior warnings: Pre-existing Economic Conditions

(before Covid-19)

What has the economy got to do with our health system? Well, both are highly interdependent. Without a sound economy, we wouldn’t have an effective global health infrastructure.We see this today with the things we urgently need but don’t have. We don’t have enough coronavirus tests, or test materials — including, amazingly, cotton swabs and common reagents. We don’t have enough ventilators, negative pressure rooms, and ICU beds. And we don’t have enough surgical masks, eye shields, and medical gowns.It’s unfathomable to see countries spending billions and billions on high tech weaponry year after year for every possible war scenario yet having spent virtually nothing on disaster preparedness for a potential new communicable virus.

— Sven Henrich (@NorthmanTrader) March 22, 2020

On a planet with over 7.5b people no less.

Going into this current crisis we were faced with some of the biggest macro imbalances the world has ever seen – very similar to what happened in 1929.

Going into this current crisis we were faced with some of the biggest macro imbalances the world has ever seen – very similar to what happened in 1929. - The largest equity bubble of all time (Pension Crisis and Buyback Bubble).

- The largest wave of retirees of all time (The Pension Crisis, where retirees own all the stocks and credit)

- The largest corporate credit bubble of all time (The Doom Loop).

- The student loan bubble.

- The Indexation bubble.

- The ETF/market structure bubble.

- The Foreign Borrowings Bubble (The Dollar Standard Bubble).

- The bubble on monetary policy (The Central Bank Bubble)

- An EU banking crisis.

Not even the “strongest economy ever” can survive a 2-week shutdown. New York City, the world’s major financial center had to put out a desperate call for rain ponchos to be used as medical gowns. Rain ponchos! In 2020! In America! Many of us would like to pin the cause on one political party or another, on one government or another. But the harsh reality is that it all failed — no country, state, or city was prepared — and despite hard work and often extraordinary sacrifice by many people within these institutions. So the problem runs much deeper than you think.The problem for the economy is the debt, not the #Coronavirus. If businesses and their employees had savings, they could afford to take time off to help fight the Coronavirus. Being leveraged to the hilt and living paycheck to paycheck is the problem. Blame the Fed, not nature!

— Peter Schiff (@PeterSchiff) March 18, 2020

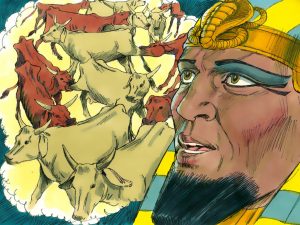

Here’s a story taken from the Book of Genesis: Pharaoh had a dream. In it, he was standing by the river. Out came 7 fat cattle. Then, 7 lean cattle came up out of the river and ate the fat cattle. A similar dream involved ears of corn, with the good ones devoured by the thin ears. Pharaoh was troubled. His dream interpreters were stumped. So, they sent for the Hebrew man who was said to be good at this sort of thing — Joseph. Pharaoh described what had happened in his dreams. Without missing a beat, Joseph told him what they meant. The 7 fat cattle and 7 fat ears of corn represented years of plenty with bountiful harvests. The 7 lean cattle and thin ears of corn represented years of famine. Joseph gave his advice: Pharaoh should put into place an activist, counter-cyclical economic policy. He should tax 20% of the output during the fat years and then he would be ready with some grain to sell when the famine came. Genesis reports what happened next: …the seven years of plenty ended and famine struck, and when Egypt was famished, Joseph opened the storehouses, and sold food to the Egyptians. People from all countries came to Egypt to buy grain, because the famine struck all the earth. Modern governments today should act like Pharaoh. They should run counter-cyclical fiscal and monetary policies. In the fat years, they should store up surpluses. In the lean years, they should open the doors of the granaries so that people might eat. This seems sensible enough, until you realize that modern governments do not run surpluses. Only deficits. The US hasn’t run a real surplus (not including Social Security payments) since 1969. That’s 43 years without closing the granary doors. Not surprisingly, you can look in there. You won’t find anything. Except I.O.Us. Instead of actually storing up grain in the fat years, the feds ate every bit of it. And more. Now, come the years of famine, they have no grain to give out.

Here’s a story taken from the Book of Genesis: Pharaoh had a dream. In it, he was standing by the river. Out came 7 fat cattle. Then, 7 lean cattle came up out of the river and ate the fat cattle. A similar dream involved ears of corn, with the good ones devoured by the thin ears. Pharaoh was troubled. His dream interpreters were stumped. So, they sent for the Hebrew man who was said to be good at this sort of thing — Joseph. Pharaoh described what had happened in his dreams. Without missing a beat, Joseph told him what they meant. The 7 fat cattle and 7 fat ears of corn represented years of plenty with bountiful harvests. The 7 lean cattle and thin ears of corn represented years of famine. Joseph gave his advice: Pharaoh should put into place an activist, counter-cyclical economic policy. He should tax 20% of the output during the fat years and then he would be ready with some grain to sell when the famine came. Genesis reports what happened next: …the seven years of plenty ended and famine struck, and when Egypt was famished, Joseph opened the storehouses, and sold food to the Egyptians. People from all countries came to Egypt to buy grain, because the famine struck all the earth. Modern governments today should act like Pharaoh. They should run counter-cyclical fiscal and monetary policies. In the fat years, they should store up surpluses. In the lean years, they should open the doors of the granaries so that people might eat. This seems sensible enough, until you realize that modern governments do not run surpluses. Only deficits. The US hasn’t run a real surplus (not including Social Security payments) since 1969. That’s 43 years without closing the granary doors. Not surprisingly, you can look in there. You won’t find anything. Except I.O.Us. Instead of actually storing up grain in the fat years, the feds ate every bit of it. And more. Now, come the years of famine, they have no grain to give out. That might be the end of the story. But it’s not. Economists insist that the feds can follow a Pharaonic policy even with their bins empty. How? By borrowing money…and in the extreme…printing it. You are probably getting ahead of me here, dear reader. You are wondering whether that would have worked in Ancient Egypt. Could Pharaoh have saved the expense of stocking up grain, and simply borrowed it when he needed it? Well, there’s only so much grain available. Borrowing from those who still have some doesn’t help. At best, it just moves it around. At worst, it takes the ‘seed’ grain needed for the next year’s planting. Without it, the next year’s harvest will be smaller, leaving even more people hungry. You know how it ends…Forget the mattress! Keeping large sums of cash at home is risky. The best place to protect your money is in an FDIC-insured bank where it’s safe and sound. Learn how the FDIC safeguards your #money at https://t.co/O2cb1bTUJs pic.twitter.com/R8pFVxBPrM

— FDIC Gov (@FDICgov) March 24, 2020

The Economic Impact

When an economy shuts, it holds its breath. Question is how long can you hold your breath before it causes irreparable damage? Your brain works fine without oxygen for a minute. A Navy SEAL could probably hold his breath for two to three minutes without any issues. But for most people, past the three minute mark, they’ll begin to lose consciousness. As each minute passes, 2 million brain cells die, causing increasingly irreversible damage. Once ten to fifteen minutes have elapsed, there’s no turning back.

When an economy shuts, it holds its breath. Question is how long can you hold your breath before it causes irreparable damage? Your brain works fine without oxygen for a minute. A Navy SEAL could probably hold his breath for two to three minutes without any issues. But for most people, past the three minute mark, they’ll begin to lose consciousness. As each minute passes, 2 million brain cells die, causing increasingly irreversible damage. Once ten to fifteen minutes have elapsed, there’s no turning back. A. Unemployment

It works the same way with money. All economic entities — businesses and consumers — can go a little while without income. But wait too long, and the harm becomes permanent. We might have to cancel plans, lay off workers, or lose our homes. And if we go without cash for too long, we’ll have to shut down. Remember, our economy is fragile. There’s little cash-cushion to soften the blow from a sharp economic cutoff. 195 million jobs are expected to be lost worldwide by the second quarter of 2020 according to the International Labour Organization. They’re calling it a “Job Catastrophe“. (For context, in 2008-2009 we lost somewhere around 22 million jobs worldwide.) 30 million unemployment claims in the U.S. alone so far… And we haven’t seen the peak yet. Millions more people are going to be out of work in the coming weeks…

It works the same way with money. All economic entities — businesses and consumers — can go a little while without income. But wait too long, and the harm becomes permanent. We might have to cancel plans, lay off workers, or lose our homes. And if we go without cash for too long, we’ll have to shut down. Remember, our economy is fragile. There’s little cash-cushion to soften the blow from a sharp economic cutoff. 195 million jobs are expected to be lost worldwide by the second quarter of 2020 according to the International Labour Organization. They’re calling it a “Job Catastrophe“. (For context, in 2008-2009 we lost somewhere around 22 million jobs worldwide.) 30 million unemployment claims in the U.S. alone so far… And we haven’t seen the peak yet. Millions more people are going to be out of work in the coming weeks… The virus has disrupted:

— Balaji S. Srinivasan (@balajis) April 27, 2020

– K-12

– bars

– cities

– retail

– sports

– hotels

– airlines

– offices

– colleges

– subways

– concerts

– medicine

– Hollywood

– immigration

– conferences

– supply chains

– meat packing

– movie theaters

– aircraft carriers

Do you think it all snaps back?

B. Market Crash

Global shares took a hit in the middle of March 2020. It was the sharpest decline in history even steeper than the Great Depression of 1929. It took just 15 days for the US index to fall 20% from its all-time high compared to 30 days in October 1929.

This time is different. The velocity of the market decline in unlike anything before.

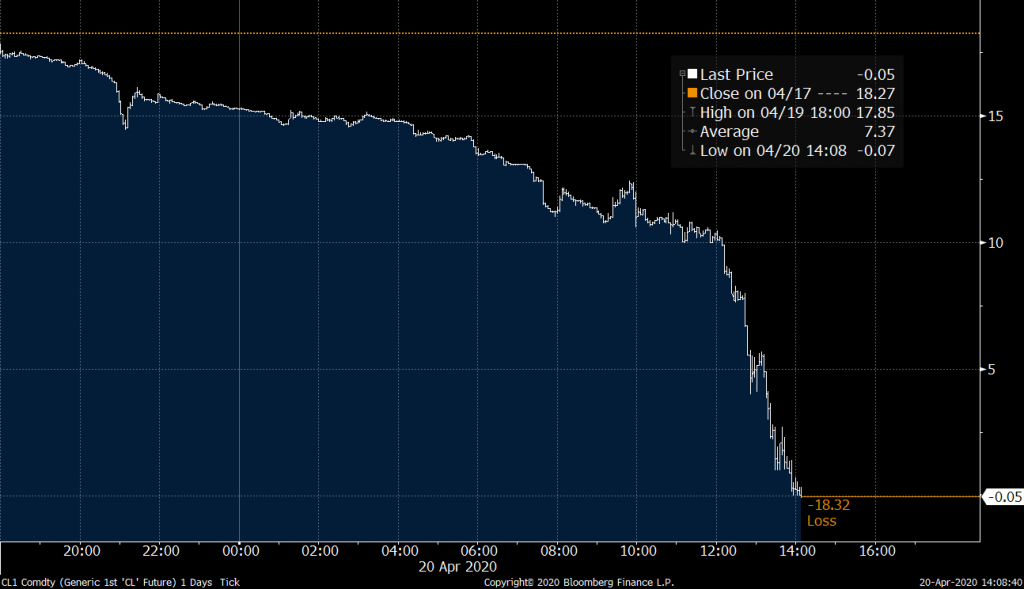

C. Oil Price Crash

Worldwide lockdowns have kept people inside homes causing demand for oil to dry up completely. Before this happened, an oil war was already brewing between Saudi Arabia and Russia which directly impacts the United States through the Petrodollar system. If global shares and unemployment numbers weren’t shocking enough, the price of oil plunging below zero should make your jaw-drop! Energy companies are struggling to keep afloat as nobody wants the oil that’s been delivered to their doorstep. This has profound consequences, and we’re already seeing the ripple effects on economies heavily reliant on oil. Deflation.

If global shares and unemployment numbers weren’t shocking enough, the price of oil plunging below zero should make your jaw-drop! Energy companies are struggling to keep afloat as nobody wants the oil that’s been delivered to their doorstep. This has profound consequences, and we’re already seeing the ripple effects on economies heavily reliant on oil. Deflation.

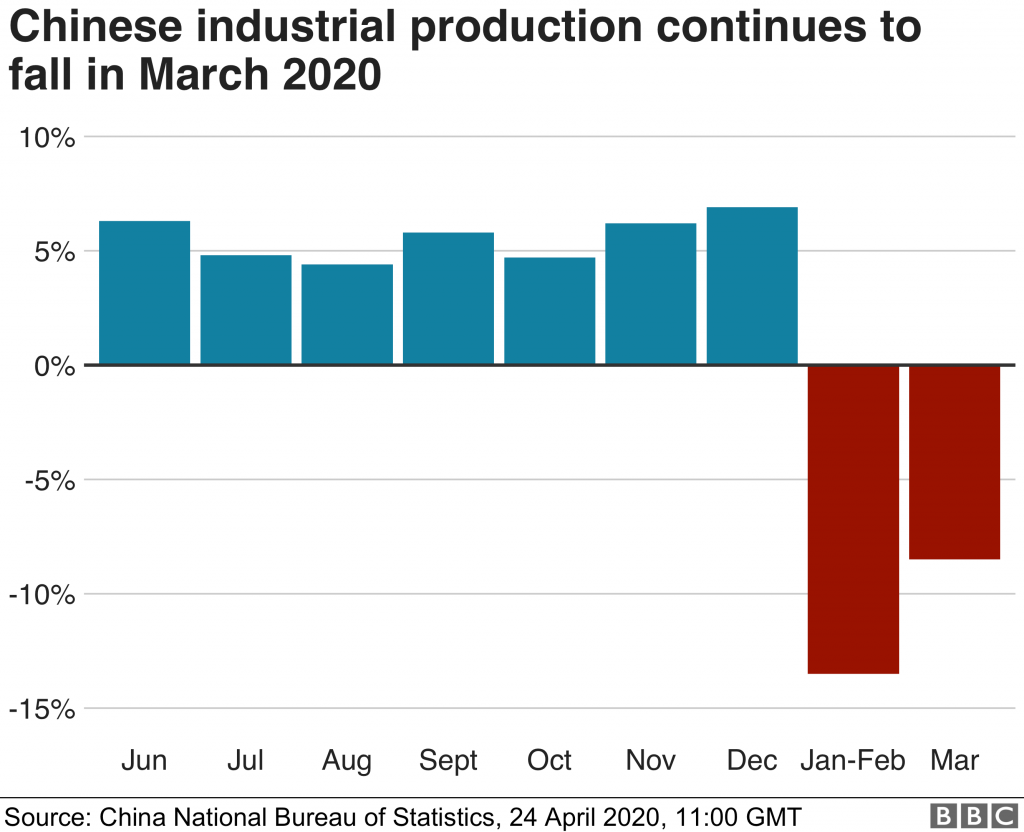

D. Supply Chain Disruption

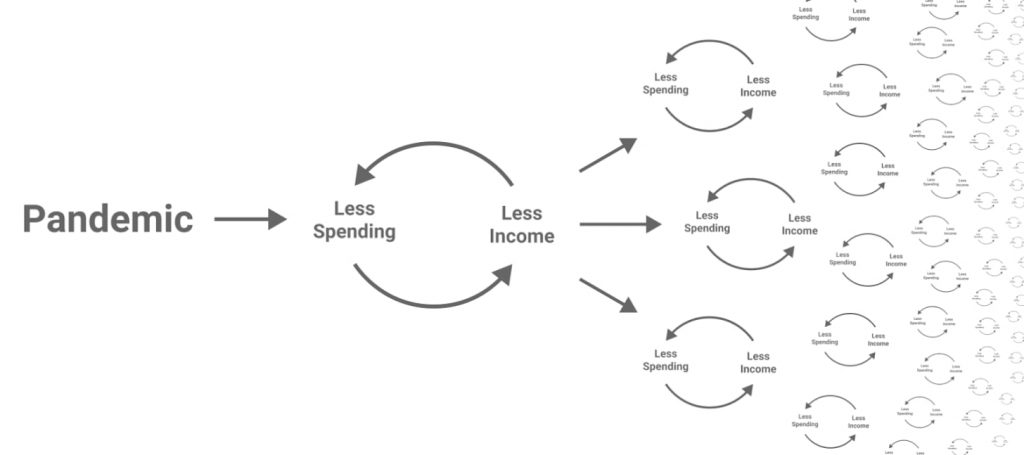

Understanding the Covid-19 Recessions @NathanBaschez

On the flip side, the U.S. is the biggest importer of goods. There is now a rallying cry to bring manufacturing back to the U.S. as people are mad that their essential supplies are mostly located on the other side of the world.

On the flip side, the U.S. is the biggest importer of goods. There is now a rallying cry to bring manufacturing back to the U.S. as people are mad that their essential supplies are mostly located on the other side of the world.

Supply chains have been designed from the top-down to be ruthlessly efficient, but unfortunately, they’re rigid and ineffective in such times.

Here are some items almost exclusively made in China: Tylenol, all antibiotics, antianxiety medication (18 million subscriptions in the U.S. and heavily physically addictive), tissues, Clorox, vitamin C, salt, pepper, birth control pills, etc. The list is huge.

Many small businesses (Amazon sellers) rely heavily on China to restock their inventories. BUT their factories/suppliers are not returning calls. Some are CLOSED DOWN for good. Many more will go out of business if the demand remains as such within the next few months.

Supply chains have been designed from the top-down to be ruthlessly efficient, but unfortunately, they’re rigid and ineffective in such times.

Here are some items almost exclusively made in China: Tylenol, all antibiotics, antianxiety medication (18 million subscriptions in the U.S. and heavily physically addictive), tissues, Clorox, vitamin C, salt, pepper, birth control pills, etc. The list is huge.

Many small businesses (Amazon sellers) rely heavily on China to restock their inventories. BUT their factories/suppliers are not returning calls. Some are CLOSED DOWN for good. Many more will go out of business if the demand remains as such within the next few months.

E. Global Food Supply Chain At Risk

The UN warns that the abrupt shutdown of countries could threaten the global food supply. The issue, however, is not food scarcity — at least, not yet. Rather, it’s the world’s drastic measures in response to the virus.Border closures, movement restrictions, and disruptions in the shipping and aviation industries have made it harder to continue food production and transport goods internationally — placing countries with few alternative food sources at high risk. This has forced large-scale farms that supply institutions to dump produce they can’t sell. All due to the fact that the system was built for global distribution not local. This supply and demand misalignment is wrecking havoc at every intersection. Airlines have grounded thousands of planes and ports have closed — stranding containers of food, medicine, and other products on tarmacs and holding areas. Heightened instability in global food supply will affect the poorest citizens most, warned the UN’s Committee on World Food Security (CFS) in a paper last month.Thread: On Sunday, John H. Tyson, chairman of Tyson Foods, published a front-page newspaper ad with an ominous message: “The food supply chain is breaking.”

— The Counter (@TheCounter) April 27, 2020

It was a frightening dispatch from a major meatpacker. But there's more to the story. 1/https://t.co/AKkfOXcP43 pic.twitter.com/1mPtgWYxbX

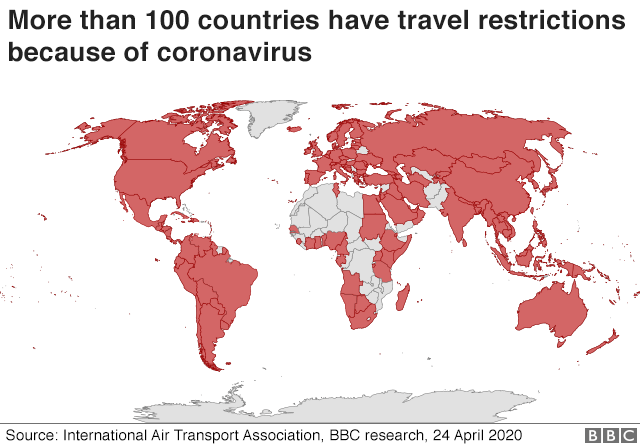

F. Travel Industry: Hardest-Hit

It took politicians months of bickering before coming to a decision to impose strict travel restrictions. Being reactive rather than proactive had grave consequences. As dealing with an invisible enemy with multiplicative abilities, it’s very costly to have lapses in judgement. As soon as restrictions were in-place, global travel demand plummeted. With most borders sealed, airline companies had no choice but to drastically cut the number of flights. Major airline companies are already looking forward to a government bailout. Other travel companies and everything in-between may never recover from this. Many would have to adapt and completely flip their businesses to correspond with the change in times.

As soon as restrictions were in-place, global travel demand plummeted. With most borders sealed, airline companies had no choice but to drastically cut the number of flights. Major airline companies are already looking forward to a government bailout. Other travel companies and everything in-between may never recover from this. Many would have to adapt and completely flip their businesses to correspond with the change in times.

The biggest U.S. airlines spent 96% of free cash flow over the last decade to buy back shares of their own stock in order to boost executive bonuses and please wealthy investors. Now, they expect taxpayers to bail them out to the tune of $50 billion. Like the banks, it’s the same old story.I'm not an economist, but I don't buy the framing that (say) airline bailouts are required because airlines are important to the economy. No planes or airports were destroyed. Pilots still know how to fly. We'll still have airlines. This is entirely about protecting shareholders.

— matt blaze (@mattblaze) April 15, 2020

It took 10 years to recover from the 2008 – 2009 financial crisis, to get from 10% back to 4% unemployment. But now we’re at more than 20% unemployment. And much supply & demand has been permanently destroyed, even without a lockdown due to the uncertainty. Would it take a decade or more to rebuild this time?No industry — not airlines, not hotels, not cruise ships — should be bailed out. They can stay in business by borrowing at rock-bottom rates, using their assets as collateral.

— Robert Reich (@RBReich) March 17, 2020

Taxpayer money should be used to bail out people, not corporations.

G. Important to Mention

- Most hospitals are reportedly empty in spite of an outbreak of seismic proportions. The underlying economics of healthcare wasn’t good either before Covid-19. Hospitals are in the business of treating patients, but what happens when they receive zero patients? They go bankrupt. 216 hospitals are furloughing workers now.

- Colleges are facing an uphill task of staying relevant with the times. With many turning to online classrooms, the tuition fees of tens of thousands of dollars seem ridiculous now. Many will have to shut down for good as student-loan delinquencies mount to unprecedented levels. Oh, and don’t forget the $1.6 Trillion student loan bubble.

- Housing market is facing yet another episode after the subprime mortgage crisis plunged the economy into chaos in 2007. Before Coronavirus, people in countries like Hong Kong were already protesting about the rising cost of rental and home ownership. Now its wiping out thousands of Airbnb super-hosts who bought 10, 20, 30 properties with mortgages that go default. Not to mention the contraction in Chinese demand for housing overseas.

- People are also beginning to notice a notable increase in the price of everyday goods. A debt deflation is pushing the dollar parabolic wrecking every other currency in its way. An initial liquidity crisis crashed Bitcoin to $3800 on 12 March momentarily before stabilizing around $5k – $6k with Edward Snowden calling it “too much panic, too little reason“. By the end of April, it shot up to $9k due to aggressive central bank stimulus to stop the economy from collapsing; Robert Kiyosaki calls Bitcoin, “People’s Money“.

If you have a phone, a computer and free time, now is the perfect time to start working towards a new stream of income and protecting your money against greed and incompetence of corporate criminals and politicians. We are in the age where defensive technologies and capabilities are rising. And it’s for YOU to benefit! That’s why I put together this step–by–step strategy showing you how. The reality is that times are uncertain, and we can’t clearly see when or how this will all play out… But you can do something about how YOU come out of it… This is the story of your life, and you want to make sure you are the hero of your story.Panicked individuals will crush the virus.

— Naval (@naval) April 24, 2020

Panicked governments will crush the individual.

The Future of Work & Money

The Coronavirus pandemic is changing the way we work, study, digest news, and entertain ourselves. Large physical gatherings of strangers are now seen as a national threat. This pandemic shatters societal trust. If we don’t trust each other then we can’t function. But work is a social thing, and we’re all capable of working digitally and remotely. Gatherings online are trustless environments. You do not need certainty that the stranger you’re working with might have the virus.

For now, the COVID-19 pandemic has upended businesses around the world, and lockdowns have forced companies and administrations to switch to remote working almost overnight.

This pandemic shatters societal trust. If we don’t trust each other then we can’t function. But work is a social thing, and we’re all capable of working digitally and remotely. Gatherings online are trustless environments. You do not need certainty that the stranger you’re working with might have the virus.

For now, the COVID-19 pandemic has upended businesses around the world, and lockdowns have forced companies and administrations to switch to remote working almost overnight.

Covid-19 simply accelerated these trends by ten-fold. Here’s a quick breakdown of the biggest changes from SimilarWeb, Apptopia and App Annie:The 20th century is ending.

— Balaji S. Srinivasan (@balajis) April 7, 2020

– Offices ⭢ remote work

– NFL, NBA ⭢ esports

– Movie theaters ⭢ streaming

– TV news ⭢ YouTube stars

– College ⭢ ISAs, MOOCs

– K-12 ⭢ internet homeschooling

– Corporate journalism ⭢ citizen journalism

– EU/EEC ⭢ 27 sovereign states

A. We are giving up our phones for our computers

Facebook, Netflix and YouTube have all seen user numbers on their phone apps stagnate or fall off as their websites have grown. B. We are seeking new ways to connect via video chat

B. We are seeking new ways to connect via video chat

Social app usage is exploding: Daily downloads of Houseparty have risen 25x. The video chat app was downloaded over 650,000 times on March 25.

As people want to see one another – its has given a big boost to apps like Google’s video chatting application, Duo, and Houseparty; and led to a renewed interest in Nextdoor, the social media site focused on connecting local neighborhoods.

C. We are now relying on services that allow us to work and learn from home

C. We are now relying on services that allow us to work and learn from home

Collaboration apps are now household names: Worldwide daily downloads of Zoom’s mobile app have increased by 14x since February 15. Video conferencing apps saw a record 62 million downloads during a single week in March.

The offices and schools have all moved into our basements and living rooms. Nothing is having a more profound impact on online activity than this change. School assignments are being handed out on Google Classroom. Meetings are happening on Zoom, Google Hangouts and Microsoft Teams.

D. We are now reading more online news

People are hungry for news: Web traffic to major news outlets has grown more than 50 percent over the last month. Amid the uncertainty about how bad the outbreak could get, people appear to want few things more than the latest news; and the biggest beneficiaries from the situation are local news sites, with huge jumps in traffic as people try to learn how the pandemic is affecting their hometowns.E. Video games are hot while sports is dying

Esports are thriving: Watch hours on Twitch have increased by 23%. Watch hours on YouTube Gaming Live increased by 10.7% and on Facebook Gaming by 3.8%. Twitch surpassed 3 billion hours watched on the platform in Q1 2020. With all major-league games called off, the use of ESPN’s website has fallen sharply since late January; at the same time, several video game sites have had surges in traffic, as have sites that let you watch other people play. Covid-19 has been a double edged sword for many of these companies and brands. While companies like Shopify are reporting that they’re handling Black Friday level traffic every single day, many others that sell physical “stuff” are hurt bad.They make that stuff in factories, and those factories are usually in China. And COVID-19 has shut down factories and shipping routes, causing all sorts of production delays. Amazon, which relies on a business model centered around making a box appear at your home in less than 2 days, has wait times that are as long as a month. So, for now, unfortunately, you’ll have to wait a month for your bespoke bed linens. Today creators have so many ways to make money on the internet, but it’s still very hard. Artists have been shape-shifting to adjust to new platforms and scale up their audiences to monetize their content. Those who are set to benefit from this surge of traffic are:As we help thousands of businesses to move online, our platform is now handling Black Friday level traffic every day!

— Jean-Michel Lemieux (@jmwind) April 16, 2020

It won't be long before traffic has doubled or more.

Our merchants aren't stopping, neither are we. We need 🧠to scale our platform.https://t.co/e2JeyjcEeC pic.twitter.com/6lqSrNUCte

- Digital Publishers

- Esport athletes

- YouTube Stars & Personalities

- Citizen Journalists

This pandemic is ushering in the information age at full force. Move online to stay relevant or fade away into the background. Today a blog is a must-have. It’s your namecard. Well, how would you best introduce yourself to thousands of strangers in the realm of cyberspace? Building a following on social media or someone elses’ backyard is like building a castle out of sand, as the implacable tide shifts in and out. Invest in the universal themes of the free and open web such as blogs, podcasts, newsletters. It brings asymmetry, you now have a lot more to gain than to lose venturing into cyberspace. Start a news site, break news on Twitter , provide insights into the latest trends. Twitter is a microphone. Fire people up with controversial ideas. You might even get hired on Twitter.Selling information is an arbitrage equation:

— Jack Butcher (@jackbutcher) March 30, 2020

You've spent massive amounts of time, energy, and effort accruing experience.

You record it once, and offer it for sale at a miniscule fraction of what you "paid" to learn it.

Bargain for customers.

Then you sell it 10,000 times.

Start a newsletter. Build your community. Make money being who you are. From ideas in your head. No one can compete with you on being you. You get rewarded for thinking differently. (While in school you get punished for being a maverick) You see, I was brought up with boundaries, curfews and rules. While a career in engineering would have brought me some form of illusory comfort & social conformity, building on the internet made it possible for me to choose where to work. It is where the meek and the mighty meet on equal terms. It grants the individual supreme sovereignty. I write about this with the entirety of my soul and a decade-long experience as a solo-preneur taking on the world; I write with my scars, hence my thought is inseparable from autobiography. This has become a personal growth engine for me, disguised as a worldly business pursuit. “In the middle of the journey of our life I found myself within a dark woods where the straight way was lost.” Dante Alighieri Everyone can now start a blog, launch a news outlet, publish a bestselling book without needing to come from a privileged background.Congratulation @nikcantmine for getting the job and @Trezor for hiring Nik. What a perfect match🙌🏻 https://t.co/a7Qa1FnYL3

— Katie Ananina (@KatieAnanina) April 25, 2020

You can even build websites like Facebook, Amazon, YouTube, Netflix and Slack without writing a single line of code. Imitation is flattery. You can recreate the internet’s biggest hits using a simple point-and-click visual web editor. Bubble and Zeroqode is leading the way in the no-code future. Better still, if you’re interested in UI and UX, it’s an opportunity to look under the hood to see how these popular sites were built piece by piece. Although you likely won’t want to build a carbon copy, you can easily adopt some frameworks to fit your product vision. What’s to say you can’t build the next Google or Facebook?There’s never been a better time to launch a digital product.

— Naval (@naval) April 10, 2020

These were websites started by kids in their dormitory meddling with things they don’t understand during their own free-time.

This is how to recession-proof your future income. Work on something without thinking about short-term monetary compensation. Provide immense value. Solve problems and the crowd will love you for it.

Is doing ALL this too late?

Heck, No. When the internet came along in the 90s, was it too late in the 2000s to build a way to connect friends and family? No, it wasn’t late for Facebook, neither was it late for Uber, Instagram, Airbnb, Google.

New ideas and audacious imaginations will continue to displace legacy ones. The internet will still be the wild west for billions of iterations.

It’s not going to change for the foreseeable future. Cyberspace is the final frontier. It’s the way we connect. It’s the way we live. This is the blind spot that the average Joe fails to see.

These were websites started by kids in their dormitory meddling with things they don’t understand during their own free-time.

This is how to recession-proof your future income. Work on something without thinking about short-term monetary compensation. Provide immense value. Solve problems and the crowd will love you for it.

Is doing ALL this too late?

Heck, No. When the internet came along in the 90s, was it too late in the 2000s to build a way to connect friends and family? No, it wasn’t late for Facebook, neither was it late for Uber, Instagram, Airbnb, Google.

New ideas and audacious imaginations will continue to displace legacy ones. The internet will still be the wild west for billions of iterations.

It’s not going to change for the foreseeable future. Cyberspace is the final frontier. It’s the way we connect. It’s the way we live. This is the blind spot that the average Joe fails to see.

This crisis is also changing the future of Banking Money. More accurately, there will be no more need for banks or middle men. This is something that would eventually take place with great certainty. Why?

Imagine an ATM in your pocket. Better still, imagine you have the whole U.S. Navy guarding your precious gold. Now that’s the technology given to us by Satoshi Nakamoto.

Bitcoin is the kind of money for a digital civilization without borders. 5000 years of monetary evolution have come down solely to this. It’s a native born on the internet, not bound by any borders, jurisdiction or entities.

It’s neutral. It’s solving problems on a global scale. The need for undebasable money. The need of the underbanked. It removes rent-seekers and parasites from governance. Thereby separating money from the state.

Bitcoin is the kind of money for a digital civilization without borders. 5000 years of monetary evolution have come down solely to this. It’s a native born on the internet, not bound by any borders, jurisdiction or entities.

It’s neutral. It’s solving problems on a global scale. The need for undebasable money. The need of the underbanked. It removes rent-seekers and parasites from governance. Thereby separating money from the state.

What we have come to know as fiat money all these decades is nothing more than a system of control by the elites. A plaything for the rich. While the poor and middle class subsisted on handouts and slave away their time for inferior money. Like an indentured servant. This is the kind of environment that Bitcoin thrives in. Massive handouts & crazy stimulus as a stopgap measure for the governments lack of preparedness and incompetence. We do not need to predict specific adverse events to know that a buffer is a must. Mother nature gave us two kidneys when we only need about a portion of a single one. Why? Because of contingency.Lesson 5. SAVE MONEY: RU NUTS? Why save money when QE FED counterfeiting is printing trillions of fake dollars-$82 billion a month to $125 billion a day? Why save when ZIRP, zero interest policy pays losers zero? Save gold-god’s money or Bitcoin-people’s money.

— therealkiyosaki (@theRealKiyosaki) April 1, 2020

How Stalin starved four million Ukrainians to death, in 1929. (Sovfoto/UIG/Getty Images)

Lost Your Job To Coronavirus?

Here’s What You Need To Know…

How to Work Online With No Experience – FAST Method for Non-Techies

The rumors are true. It is possible to make good money online even if you have no experience. I’ve done it in a myriad of avenues. It’s better than a JOB. It gives you freedom and peace of mind during a recession. Google will even help people find you!

How to Work Online With No Experience – FAST Method for Non-Techies

The rumors are true. It is possible to make good money online even if you have no experience. I’ve done it in a myriad of avenues. It’s better than a JOB. It gives you freedom and peace of mind during a recession. Google will even help people find you!

7 Steps to Prepare for the Next Market Crash

How you allocate your investment portfolio will depend on your risk tolerance, time horizon, and goals. But careful diversification gives you a good chance of weathering the storm relatively unscathed. Read on to learn how to protect yourself from a global recession and make yourself a fortune in the process…

7 Steps to Prepare for the Next Market Crash

How you allocate your investment portfolio will depend on your risk tolerance, time horizon, and goals. But careful diversification gives you a good chance of weathering the storm relatively unscathed. Read on to learn how to protect yourself from a global recession and make yourself a fortune in the process…

10+ Best Work From Home Jobs That Take Little or No Experience

Wondering how to make money without leaving your couch? In this increasingly digital world, working from home is no longer a pipe dream. There are tons of legitimate jobs that you can do from home, that do not require any experience.

10+ Best Work From Home Jobs That Take Little or No Experience

Wondering how to make money without leaving your couch? In this increasingly digital world, working from home is no longer a pipe dream. There are tons of legitimate jobs that you can do from home, that do not require any experience.

19 of the Best Affiliate Programs That Pay the Highest Commission

Everyone can start a blog and make one or two sales. But there are very few people who can make a full-time income with affiliate marketing, consistently for years. These are some of the highest affiliate earning programs on the internet that I’ve found success with.

19 of the Best Affiliate Programs That Pay the Highest Commission

Everyone can start a blog and make one or two sales. But there are very few people who can make a full-time income with affiliate marketing, consistently for years. These are some of the highest affiliate earning programs on the internet that I’ve found success with.

How to Escape the Rat Race (And… the Origin of New Year’s Day)

That feeling you have that you have to follow the rat race of life is imaginary. It’s like santa. It doesn’t exist. You block your own progress. This rat race of life is causing you to lose energy, be grumpy, don’t have energy to study or spend quality time with kids and wife. You seem or feel stuck? You are not chained. Nothing holds you there indefinitely.

How to Escape the Rat Race (And… the Origin of New Year’s Day)

That feeling you have that you have to follow the rat race of life is imaginary. It’s like santa. It doesn’t exist. You block your own progress. This rat race of life is causing you to lose energy, be grumpy, don’t have energy to study or spend quality time with kids and wife. You seem or feel stuck? You are not chained. Nothing holds you there indefinitely.

7+ Best Bitcoin Survey Sites to Earn Free Bitcoin

if you’re looking to invest in Bitcoin without any risk or want to increase your Bitcoin holdings, answering survey questions is one of the easiest ways to earn additional bitcoin for free online. Here’s how you can find paid surveys and earn free bitcoins.

7+ Best Bitcoin Survey Sites to Earn Free Bitcoin

if you’re looking to invest in Bitcoin without any risk or want to increase your Bitcoin holdings, answering survey questions is one of the easiest ways to earn additional bitcoin for free online. Here’s how you can find paid surveys and earn free bitcoins.

14 Creative Ways to Make Money While Staying Home During Coronavirus Pandemic

Here, we’ll be unveiling 14 ways to make money fast when you really need it. If you are willing to put an hour or two a day into something you are passionate about instead of watching TV or mindlessly scrolling through social media apps, you’ll be surprised at what you can achieve.

14 Creative Ways to Make Money While Staying Home During Coronavirus Pandemic

Here, we’ll be unveiling 14 ways to make money fast when you really need it. If you are willing to put an hour or two a day into something you are passionate about instead of watching TV or mindlessly scrolling through social media apps, you’ll be surprised at what you can achieve.

How to Survive Unemployment During Corona Financial Crisis

If you’re faced with (or possible) job loss, or looking to make extra money online, here are 11 things you can do to survive financially and ultimately come out of the Coronavirus stronger.

How to Survive Unemployment During Corona Financial Crisis

If you’re faced with (or possible) job loss, or looking to make extra money online, here are 11 things you can do to survive financially and ultimately come out of the Coronavirus stronger.

How to Get Rich Without Trading Bitcoin (or renting out your time)

How rich you are today is a relative question. A million dollars is worth a lot less today than it was in the past. Unfortunately, you’re not going to get rich renting out your time. The money you earned, depreciates faster than what you can make in your lifetime. While the rich are getting richer, everyone else is actually losing ground. Here’s how you can tilt the scales back in your favor.

How to Get Rich Without Trading Bitcoin (or renting out your time)

How rich you are today is a relative question. A million dollars is worth a lot less today than it was in the past. Unfortunately, you’re not going to get rich renting out your time. The money you earned, depreciates faster than what you can make in your lifetime. While the rich are getting richer, everyone else is actually losing ground. Here’s how you can tilt the scales back in your favor.

49 Best Freelance Websites To Find Online Jobs and Start Working from Home Today!

Looking to start freelancing but don’t where to find work? We’ve got you covered. Whether you’re looking to make some extra income, seeking a professional career, or simply enjoy the flexibility of freelancing, there’s never been a better time to be your own boss.

49 Best Freelance Websites To Find Online Jobs and Start Working from Home Today!

Looking to start freelancing but don’t where to find work? We’ve got you covered. Whether you’re looking to make some extra income, seeking a professional career, or simply enjoy the flexibility of freelancing, there’s never been a better time to be your own boss.

Great article