Are you looking to jump on the bitcoin bandwagon and start investing in this digital currency?

Are you looking to jump on the bitcoin bandwagon and start investing in this digital currency?

Before you do, it’s important to understand the risks and take steps to keep your investment safe.

After all, your bitcoin is only as secure as the measures you take to protect it.

In this blog post, we will provide a step-by-step guide on how to securely invest and store your Bitcoin.

From choosing a secure wallet to enabling two-factor authentication, we will cover everything you need to know to keep your Bitcoin safe and secure.

Whether you are new to the world of cryptocurrency or an experienced investor, this post will provide valuable insights and tips to help you protect your investment.

So, if you want to learn how to safely invest and store your Bitcoin, read on!

Protecting Your Bitcoin Investment: Best Practices

When it comes to investing and storing your Bitcoin, it’s important to take certain precautions to ensure the safety of your investment.

Here are some steps you can take to safely invest and store your Bitcoin:

1. Keep your Bitcoin in a secure wallet

A Bitcoin wallet is a digital storage space for your Bitcoin, and it’s important to choose a wallet that is secure and has a good track record. Some popular options include hardware wallets, which are physical devices that store your Bitcoin offline, and software wallets, which are apps that you can download to your phone or computer.

2. Use a strong and unique password

When setting up your Bitcoin wallet, it’s crucial to use a strong and unique password that is not used for any other accounts. This will help prevent unauthorized access to your wallet and protect your Bitcoin from hackers.

3. Enable two-factor authentication

Many Bitcoin wallets offer the option to enable two-factor authentication, which adds an extra layer of security to your account. With two-factor authentication, you will be required to enter a code that is sent to your phone or email in addition to your password when logging in to your wallet.

4. Keep your wallet software up to date

It’s important to regularly update your Bitcoin wallet software to ensure that you have the latest security features and patches. This will help protect your wallet from potential vulnerabilities and keep your Bitcoin safe.

5. Use a reputable exchange

If you plan to buy and sell Bitcoin, it’s important to use a reputable exchange that has a good track record and follows industry best practices for security. Be sure to do your research and only use exchanges that have a strong reputation and good customer reviews.

Check out: 10+ Best Cryptocurrency Exchanges to buy and trade Bitcoin Cryptocurrency

6. Don’t share your private keys

Your private keys are the keys to your Bitcoin wallet, and they should never be shared with anyone. If someone else has access to your private keys, they can potentially steal your Bitcoin, so it’s important to keep them safe and secure. If you’re curious, read more about private key here.

7. Be wary of scams

The Bitcoin space is full of scams, so it’s important to be cautious and do your research before investing in any opportunity. Be wary of anyone who offers too-good-to-be-true returns or guarantees, and never send Bitcoin to someone you don’t know or trust.

8. Use a hardware wallet for maximum security

As mentioned earlier, a hardware wallet is a physical device that stores your Bitcoin offline, and it can provide an extra level of security for your investment. A hardware wallet is a good option if you have a significant amount of Bitcoin and want to keep it safe from potential hacks or other threats.

9. Be aware of tax implications

In some countries, Bitcoin and other cryptocurrencies are subject to taxes, so it’s important to be aware of the tax implications of your investment.

Crypto tax laws and regulations can vary by country, making it difficult to understand and properly file your taxes on bitcoin and other cryptocurrencies.

Failing to properly file your crypto taxes can result in costly penalties and fines.

Fortunately, there are a variety of crypto tax tools available to help you keep track of your transactions, calculate your taxes, and minimize your tax liabilities.

These tools can make the process of filing your crypto taxes much easier, no matter where you are located. Here are seven of the best crypto tax tools to consider using.

Here are some additional practices to help protect the security of your Bitcoin:

10. Be cautious when downloading and installing software or apps related to cryptocurrency.

11. Avoid using public Wi-Fi networks for cryptocurrency transactions.

12. Regularly update your operating system and software to protect against security vulnerabilities.

13. Monitor your accounts regularly for any suspicious activity.

14. Educate yourself on the best practices for securing your Bitcoin wallet

15. Avoid sharing your private keys or seed phrases with anyone.

16. Use a different password for each of your cryptocurrency accounts.

17. Avoid using the same password for multiple accounts, including non-crypto accounts.

18. Use a password manager to securely store your passwords.

19. Enable notifications on your accounts so you can be alerted to any suspicious activity.

20. Regularly review the security settings on your accounts and enable any additional security measures that are available.

21. Avoid clicking on links in emails or online that could lead to phishing attacks.

22. Use a VPN when conducting cryptocurrency transactions to encrypt your internet connection and protect your privacy.

23. Avoid storing large amounts of cryptocurrency in online wallets and instead use offline storage options such as a hardware wallet.

24. Be wary of anyone claiming to be able to recover lost or stolen cryptocurrency, as this is often a scam.

How to Safely Invest in Bitcoin

To start investing in crypto, there are two important things you need:

- An exchange or online platform- to buy Bitcoin

- A wallet – to keep your Bitcoin

Step 1: Get a Bitcoin wallet

No matter which way you choose to purchase your Bitcoin, you’ll need a wallet to store your digital assets.

There are many different types of wallets out there you can choose from -mobile wallet, desktop wallet, paper wallet, and hardware wallet. Here’s a quick wallet guide that may help you decide.

Major cryptocurrency exchanges like Binance provide a free wallet for all registered users. You can use it to buy, sell and keep your coins. However, these exchange-hosted wallets are not safe, they are vulnerable to attack.

So if you’re investing a significant amount and looking to hold the coins for the long-term, I suggest you use a Bitcoin hardware wallet like Trezor and Ledger.

A Bitcoin hardware wallet is basically a physical “thumb drive-like” electronic device that you can use it to store, send and receive cryptocurrencies. It’s by far the most secure option when it comes to storing your Bitcoin.

Can’t decide which hardware wallet you should get? Check out our Trezor vs. Ledger review and comparison.

Step 2: Find a cryptocurrency exchange

Next, you need to find a place where you can buy Bitcoin using your local currency.

There are several ways to purchase your first Bitcoin, you can

- Buy Bitcoin from a Bitcoin ATM machine (the offline way)

- Buy Bitcoin directly from another person on Noones or LocalCoinSwap (Peer-to-peer method)

- Exchange your unused gift cards for Bitcoin on Noones or LocalCoinSwap

- Buy Bitcoin with debit card or credit card instantly on ChangeNOW

- Buy Bitcoin with bank account from an online exchange like Luno, or Coinmama

- Or set up Bitcoin auto-buy with Swan Bitcoin or Relai (use invite code TMAVERICK to save 0.5% on fees)

Of all the methods, the easiest way for most people is to use a cryptocurrency exchange.

All you need to do is sign up for a free account, verify your identity and connect your bank account.

As banking is now regulated country by country, you’ll need to find an exchange that accepts your currency.

Here are few main options where you can buy Bitcoin based on your country:

- USA: Swan Bitcoin, Kraken

- Canada: CoinSmart

- Malaysia: Luno

- Singapore: Luno, Coinhako, Crypto.com

- Australia: Independent Reserve

- China: Huobi, OKCoin

- Taiwan: Maicoin

- India: Bitbns

- South Africa: Luno

- UK: Coinbase,CEX

- Europe: Relai, CEX

- Russia: Coinmama

- Japan: Coinmama, Kraken

- South Korea: Korbit, Coinplug

Most exchanges may ask you to complete the KYC (Know-Your-Customer) in order to remain compliant with Anti-Money Laundering laws (AML). Before you can start buying or selling, you’ll need to submit personal documents such as your national ID, passport, photo, or proof of address to verify your identity.

It can take days or even weeks to get your account approved depending on the capacity of the exchange.

Did you know? New users missed the 2017 bull run because they couldn’t sign up or get verified! Many exchanges were forced to halt onboarding new users due to overwhelming demand.

Tip: Complete your account set up as soon as possible to avoid missing opportunities, even if you’re not going to buy Bitcoin now. Afterall it’s free!

Step 3: Transfer Funds to the exchange

After getting your crypto account approved, you can start buying any fraction of a single bitcoin. Each online exchange has different deposit methods, maximum/minimum limit order and fees.

Here’s an overview of the top 10 cryptocurrency exchanges with all the details, fees structure that maybe helpful for you.

Now, let’s transfer funds from your bank account to the exchange account.

Login to your bank account and make a bank transfer. Enter the total amount you’d like to transfer, and the bank details provided by your exchange. The process is very straightforward -just like you’d normally do for transferring funds to your friends or families.

When you money is deposited in your exchange account (this can take minutes, hours or even days- all depends on your bank), you’re ready to buy Bitcoin.

Step 4: Trade local fiat for Bitcoin

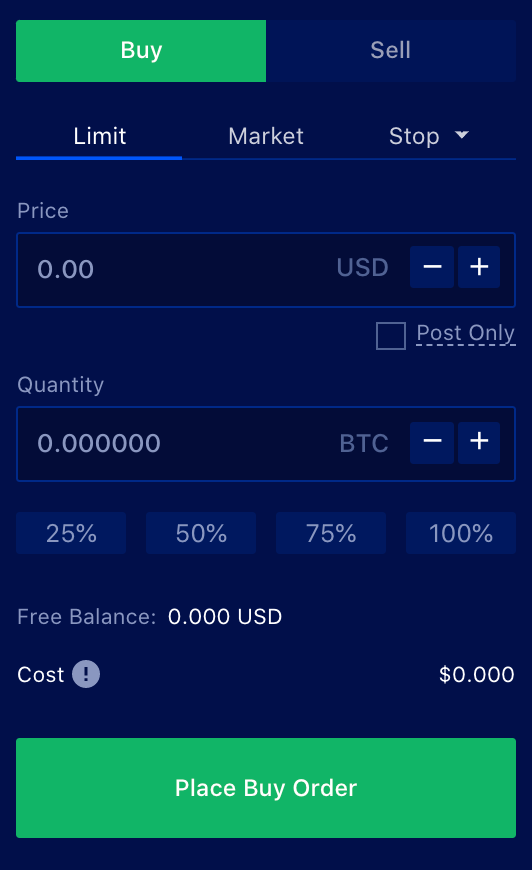

Even if you’ve never traded ANYTHING before, you can easily use an online exchange to trade your fiat money for Bitcoin.

Think of a crypto exchange like a platform that matches people who want to buy with people who want to sell.

To start buying crypto on the exchange:

- Select the correct trading pair (eg. BTC/USD)

- Select BUY. In general, you have two main options here:

- A limit order: Choose LIMIT ORDER, if you want to pay a lower fee for waiting. You set your own price at which you want to buy. And the order will only be executed if the market price reach the price you set.

- A market order: Choose MARKET ORDER, if you want to buy/sell the amount you want immediately, at the best available price in the market.

- Enter the amount you want to buy. You’ll see the quantity of BTC you’re purchasing and your fee.

- Click “Place Buy Order” to buy Bitcoin (BTC).

Do note that different exchanges will support different cryptocurrencies. And most exchanges only offer trades for top crypto like Bitcoin (BTC) and sometimes Ethereum (ETH). For those new to cryptocurrencies, Bitcoin will be the first crypto that you’ll want to buy.

If you’re looking for altcoins or rare cryptocoins, you can sign up for different exchange like Binance.

Binance is a popular crypto exchange that has a greater selection of crypto with highly competitive fees. Allowing you to easily trade your Bitcoin with ETH, XRP and 140+more coins all in one place.

If you dread of going through the lengthy sign-up process or dealing with complex trading charts, you can always purchase Bitcoin instantly with your credit card on ChangeNOW. It’s quick, safe and easy. Read more here…

Once you complete your trade, you will see the balance of your Bitcoin in your exchange account.

Rule #1 in crypto is…Never keep your coin on an exchange.

Step 5: Transfer Bitcoin to your own Wallet

Remember, Not Your Keys, Not Your Bitcoin.

No matter whichever way you choose to buy Bitcoin, the process only ends when you move your coin from the exchange to a wallet that only you hold the keys to.

Leaving bitcoins on exchanges are extremely risky! Because they are the most attractive targets for hackers in the crypto world.

So, don’t keep your money on an online exchange any longer than you need to.

Once the transaction is completed, move your Bitcoin off the exchange to a hardware wallet like Ledger and Trezor.

If you have yet to own a bitcoin hardware wallet, choose a reliable wallet here.

Step 6: Track and report your gains

Crypto tax laws and regulations may vary by country. The amount of taxes you have to pay depends on your profit and how often you trade.

Start tracking you trades right from the beginning and you’ll save yourself grief.

You can keep track of all your purchases and sales in Excel. While it’s free to use, it’s not the most effective way.

Thankfully, there are a multitude of crypto tax tools available to simplify your filing, no matter where you live. To avoid paying unnecessary taxes and penalties, it’s a good idea to use some of these crypto tax software to help you keep records of your crypto transactions and calculate your crypto taxes.

Essential Tips for Successfully Investing in Bitcoin

Here are some additional tips for safely investing your Bitcoin:

-

Research and educate yourself: Before investing in Bitcoin, it’s important to do your research and educate yourself about the technology and the risks involved. Read up on the basics of Bitcoin and the blockchain, and learn about the different types of wallets, exchanges, and investment opportunities. This will help you make informed decisions and reduce your risk of losing money.

-

Start small and gradually increase your investment: When starting out with Bitcoin investing, it’s generally a good idea to start small and gradually increase your investment as you gain more experience and knowledge. This will allow you to learn the ropes and test the waters without risking a significant amount of money.

-

Use a reputable and secure exchange: If you plan to buy and sell Bitcoin, it’s important to use a reputable and secure exchange that follows industry best practices for security. Look for exchanges that are transparent, have good customer reviews, and are regulated by the relevant authorities.

-

Monitor your investment: Once you have invested in Bitcoin, it’s important to monitor your investment and stay up to date with the latest developments in the market. This will help you make informed decisions and adjust your investment strategy as needed.

-

Seek professional advice: If you are unsure about any aspect of investing in Bitcoin, it’s a good idea to seek the advice of a professional. This could be a financial advisor, a tax professional, or someone with experience in the cryptocurrency space. They can provide valuable insights and guidance to help you make the most of your investment.

By following these tips, you can help ensure the safety of your Bitcoin investment and maximize your chances of success.

What is the safest way to store my bitcoin?

The safest way to store your bitcoin is to use a hardware wallet.

This is a physical device that stores your private keys offline, which makes it impossible for them to be stolen by hackers.

Hardware wallets are considered to be the most secure way to store bitcoin because they keep your private keys isolated from the internet and away from potential threats.

Here are some of the best bitcoin hardware wallets to secure your Bitcoin and Crypto investments:

These hardware wallets are considered to be some of the best because they offer strong security for your bitcoin, as well as a variety of features that make them easy to use.

It is important to carefully research and compare different hardware wallets before choosing one, to make sure it meets your needs and offers the level of security you require.

- Trezor vs. Ledger: Which Hardware Wallet is Best for You?

- 3 Best Hardware Wallets for Storing Bitcoin and Cryptocurrencies (for long term)

Another option is to use a paper wallet, which is a printout of your private and public keys.

This can also be a secure way to store your bitcoin, but it is important to keep the paper wallet safe and secure in a location where it cannot be lost or damaged.

It is also a good idea to make multiple copies of your paper wallet and store them in different locations.

Conclusion

By following these tips, you can help ensure the safety of your Bitcoin investment and protect your digital assets from potential threats.

Spend some time to educate yourself, start implementing the methods to maximize your security, privacy and stay safe on all your devices.

Hope this library of Bitcoin resources help you as much as they’ve helped me.

Do you have any tips on crypto security that you think everyone should know about? Do share with us in the comment below.

And lastly, if you liked this post, don’t forget to share it on Facebook, Pinterest, and Twitter.

I’ve handpicked a few guides for you to read next:

- 3 Best Hardware Wallets for storing Bitcoin and Cryptocurrencies

- 12 Best Bitcoin Wallets You Should Use to Secure Your Crypto Assets

- FAQ for beginners: Everything You Need to Know about Bitcoin before you buy

- 11 Best Exchanges to Start Margin Trading Crypto (For Beginners)

- 7 Best Peer-to-Peer (P2P) Bitcoin Exchanges (Private, Secure, Low Fees)

- 10+ Legit Ways to Earn Free Bitcoin (#3 is My Favorite)

I live and breathe making an income online.

I’ll be sharing more ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails.