When it comes to crypto investing, many will still choose to interact directly with the US (DXY) market in order to gauge their investment returns. The rise of inflation in 2022 has certainly compelled global investors to look for higher returns without the scary crypto volatility. As a result, Stablecoins ( a 1:1 peg to a fiat currency) has become the go to for novice investors looking to dabble in this space.

When it comes to crypto investing, many will still choose to interact directly with the US (DXY) market in order to gauge their investment returns. The rise of inflation in 2022 has certainly compelled global investors to look for higher returns without the scary crypto volatility. As a result, Stablecoins ( a 1:1 peg to a fiat currency) has become the go to for novice investors looking to dabble in this space.

In this guide, we will analyze the best platforms in the world that offers the best yields for your money. But first… let’s take a look at

Today’s Content:

- What are Stablecoins?

- Can Stablecoins fail?

- What’s causing the strength of the USD?

- What’s the Dollar Milkshake theory?

- APR to APY Calculator

- What is the Best Way to Earn Interest on Stablecoins?

- The 6 Best Websites to Earn a High Interest on Stablecoins

- Frequently Asked Questions

- Conclusion

Here is a quick list of platforms where you can earn interest on your Stablecoins:

| Platform | Crypto Interest Account |

|---|---|

| Flynt Finance | Best for Highest Interest |

| YouHodler | Best for Crypto Banking |

| CoinRabbit | Best for Privacy |

| Binance | Largest Exchange in the World |

| Crypto.com | Established Crypto Platform |

What are Stablecoins?

Stablecoins were created to solve the problem of price volatility within crypto assets that fluctuate wildly by tying it to a nation’s money (fiat currencies) like the U.S. dollar.

1 USDT = ~1 U.S. Dollar

1 USDC = ~1 U.S. Dollar

The largest of these Stablecoins is known as Tether or USDT; followed by the likes of USDC, BUSD, Dai and so on.

“Stablecoins” have a wide definition and includes more than just U.S. Dollar type tokens. They also exist in EUR, CHF, CNY, KRW, SGD, Lira, Rupiah, etc.

Generally, USD Stablecoins are a form of U.S. Dollar token designed in crypto format so you can move it around like cold hard cash in the digital realm. This is not at all similar with the USD sitting in your traditional bank account.

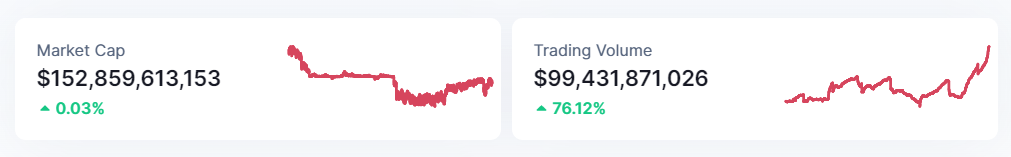

The total market cap for Stablecoins (as of July 2022) according to CoinMarketCap is over US$150 billion with a daily trading volume of about $100 billion a day.

USDT at $65 billion is the world’s most popular Stablecoin, followed by USDC at $55 billion.

Can Stablecoins Fail?

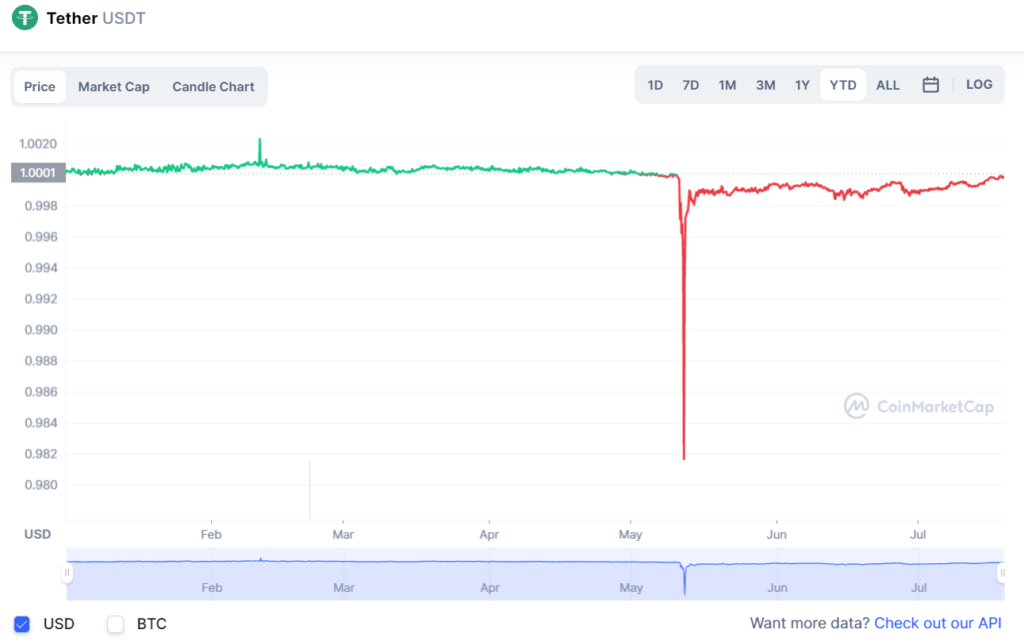

While holders of Tether may assume that 1 USDT would always be roughly US$1.00; sometimes this is not the case as you can see from the chart below. Although this fiat asset-backed Stablecoin is one of the longest serving assets out there, nobody should bet on it at a 100% certainty.

Pegs tend to break over time, as nature loves chaos (volatility is only natural). Engineering perceived calmness and stasis is expensive to sustain and it isn’t free. There is always counterparty risk.

As in the case of Terra Luna’s UST token holders who were subsequently wiped out around $60 billion in funds after the peg broke and their dollar engineered tokens crashed to pennies in a matter of days.

Prominent casualties included the likes of Zhu Su & Mike Novogratz. So it looks like even expert traders and investors make rookie mistakes!

The UST Stablecoin was supposed to protect these investors from crypto’s volatility, instead; they lost everything saving in a token that mimics the dollar (as a short term store of value).

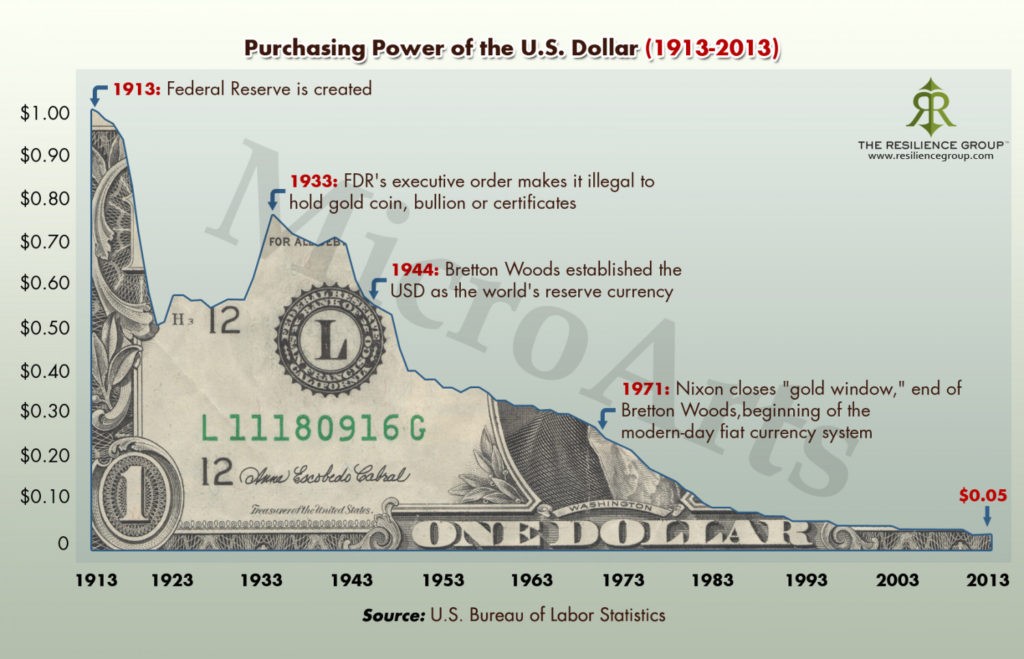

Just as our government tries to project calm and orderliness within society, the money that powers our society also projects an illusion of stability. The U.S. Dollar is designed to depreciate slowly over time but it is incredibly difficult to fathom the loss of purchasing power over decades or centuries when juxtaposed with a stable purchasing power measured over the course of days, weeks, and months.

In 1913, the Federal Reserve Act granted Federal Reserve banks the ability to manage the money supply in order to ”ensure” economic stability. Back then, a dollar could buy 30 Hershey’s chocolate bars.

As more dollars came into circulation, average prices of goods and services increased while the purchasing power of the dollar fell. By 1929, the value of the Consumer Price Index (CPI) was 73% higher than in 1913, but a dollar was now enough only for 10 rolls of toilet paper.

| Year | Event | Purchasing Power of $1 | What a Dollar Buys |

|---|---|---|---|

| 1913 | Creation of the Federal Reserve System | $26.14 | 30 Hershey’s chocolate bars |

| 1929 | Stock market crash | $15.14 | 10 rolls of toilet paper |

| 1933 | Gold possession criminalized | $19.91 | 10 bottles of beer |

| 1944 | Bretton Woods agreement | $14.71 | 20 bottles of Coca-Cola |

| 1953 | End of the Korean War | $9.69 | 10 bags of pretzels |

| 1964 | Escalation of the Vietnam War | $8.35 | 1 drive-in movie ticket |

| 1971 | End of the gold standard | $6.39 | 17 oranges |

| 1987 | “Black Monday” stock market crash | $2.28 | 2 boxes of crayons |

| 1997 | Asian financial crisis | $1.61 | 4 grapefruits |

| 2008 | Global Financial crisis | $1.20 | 2 lemons |

| 2020 | COVID-19 pandemic | $1.00 | 1 McDonald’s coffee |

Still we are attuned to believe that a dollar, euro, yen, etc. today will buy the same amount of energy tomorrow. When in reality it is guaranteed to lose 99% of its value over a century. (Beware: What goes down by 99%, can still go down by another 99% in accelerated fashion)

Still we are attuned to believe that a dollar, euro, yen, etc. today will buy the same amount of energy tomorrow. When in reality it is guaranteed to lose 99% of its value over a century. (Beware: What goes down by 99%, can still go down by another 99% in accelerated fashion)

Remember, it’s really easy to get lulled by a false sense of security from time to time – many still fail to recognize that Stablecoins are fundamentally incompatible with the new financial world Satoshi envisioned and that we all wish to create.

It is this very reason why the Bitcoin movement has surged particularly among those who realize that the impending disaster surrounding fiat currencies have no recourse.

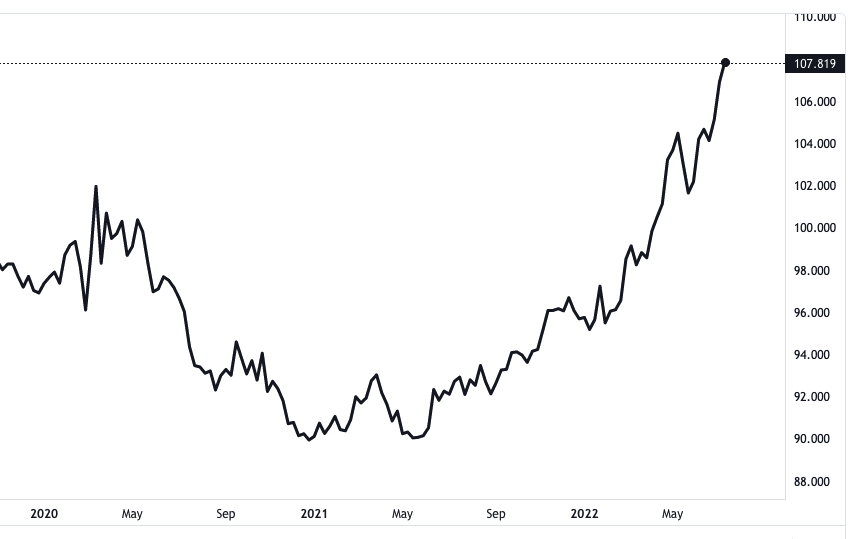

Having said that, why is the USD currently still trading at a 20-year high?

”I thought you just said the U.S. Dollar will continue to lose its value & relevance?”

Actually, The Dollar only appears strong when compared to other fiat currencies around the world.

The reality is, the dollar is not strong and it is not getting stronger. We all see it every single day in prices of everything. So do not make the USD your long-term unit of account. It is not an accurate measure of your wealth.

Let’s look into that next.

What’s Causing the Strength in USD?

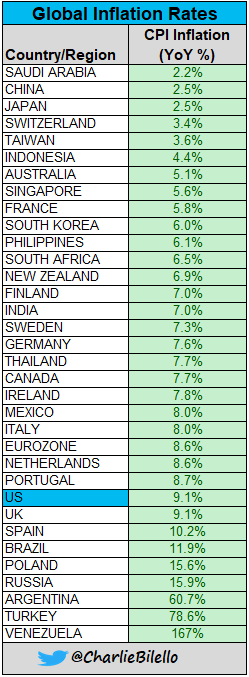

If you’ve been paying attention to the news, you may have heard that many countries are currently experiencing high inflation as the cost-of-living crisis deepens.

As a result, most central banks are attempting to undo this huge error by raising interest rates.

As investors become concerned with both the policies of foreign central banks, such as Japan and Europe, as well as the underlying economic strength of those countries, they choose to move their own currency into the USD for risk management and protection.

Of course, this becomes something of a self-fulfilling prophecy. How?

As the USD strengthens and other currencies weaken, this puts pressure on countries who have US Dollar denominated liabilities (think payments for oil or energy that are set in USD) or issue US Dollar debt. The weakness of their own currency relative to the US Dollar negatively impacts their ability to meet the obligations or interest payments.

Ultimately, it forces certain countries in emerging markets to either print more of their own currency to buy more US Dollars (which eventually leads to hyperinflation) or simply adopt the USD as their base currency.

In other words, other fiat currencies are being devalued at an even faster rate compared to USD.

That’s right, their currency disappears as the US Dollar swallows it.

Which leads to the US Dollar Milkshake Theory.

What’s the Dollar Milkshake Theory?

Brent Johnson coined the term to push forward his controversial theory that the world will be consumed by the USD which would wreak havoc on all foreign currencies especially in the emerging markets.

Here’s an explanation by James Lavish:

Let’s say you have a milkshake, and you’re sitting at another table, all the way across the room. Now let’s say I have a straw. A really long straw. So, even though you’re all the way across the room, I can plunk my straw into your milkshake and drink it.

This is what the US Dollar can do in the Dollar Milkshake Theory.

The milkshake, in this case, is a foreign currency. The straw is US Dollar denominated liabilities, US Dollar denominated debt, Eurodollars, central bank and major global bank liquidity, government bond interest rate differences, etc.

The one doing the drinking, of course, is the US Dollar itself.

And so, as weaker foreign currencies fall prey to the concerns and structural issues above, they eventually become consumed by the US Dollar. And eventually most, if not all, currencies are folded into the US Dollar.

What does this mean for the USD?

The USD will look like a safe haven for assets while other countries’ fiat slowly collapse as the dollar-system strengthens.

This will drive foreign investors to flood capital into the USD. However, in a counter-intuitive way; other countries will gradually move away from The Dollar as the reserve currency.

The rationale is, The Dollar is supposed to be the glue that facilitates global economic cooperation. It is not in the best interest of the rest of the countries that the USD becomes too strong to use. This is already happening as we speak and in accelerated fashion.

Hence, the best solution in the short to medium term would be to earn as much as you can in USD.

While earning interest in a traditional savings account brings an average of 1% APY and top-yielding CD rates pay over 2%. This is not at all enough to even outpace the ”official CPI” inflation rate of 9.1%. When in reality the inflation rate is closer to 18%.

Therefore, it is highly recommended that you earn a higher savings account rate via Stablecoins like USDC or USDT. The highest APY rate you can get today on Stablecoins is 14.5%. (Bookmark this page for updated rates!)

Annual Percentage Yield (APY) takes into account compound interest,

but Annual Percentage Rate (APR) doesn’t

What is the Best Way to Earn Interest on Stablecoins?

Investors may first choose to convert their USD savings into USDT or USDC via Instant Swap Services. Only through Stablecoins can investors earn more than 10% APY on their savings.

Then, when you divide your portfolio; think in terms of time preference rather than diversifying your assets.

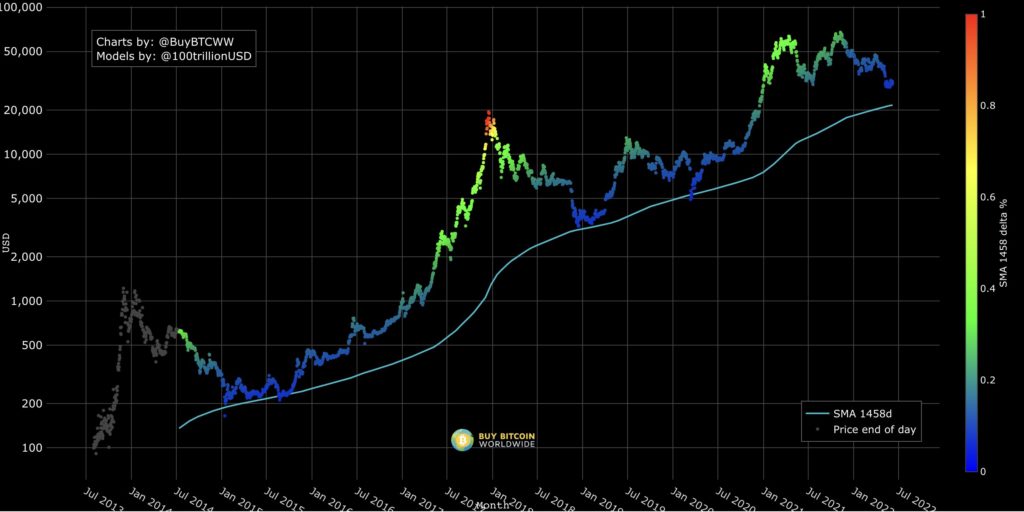

If you really want to be safe (conservative); Divide your portfolio based on the four-year moving average of bitcoin.

If you have money that you can afford to put away and hold for more than four years, you would be foolish to store it in a fiat currency; even if it is the strongest fiat currency in the world.

Yes. It would still be foolish to store money for more than four years in The Dollar or Stablecoins for that matter.

Any excess money that you want to hold for 4 years or more. Decades even, it should be in bitcoin. Maybe a home if you need a place to stay. For me, I just rent.

But, for less than four years; ideally you want to be storing in USDC or USDT while earning an APY of more than 10%. Four years of USD savings for me is still being too conservative. Two years is probably just right.

Regardless of where you stand, new investors tend to fall into one of two camps:

- Playing the long-term game: Storing bitcoin in a hardware wallet and Hodl Or;

- Trying to make a quick buck trading crypto

While trading has the potential to increase your net worth, the risk to reward ratio does not bode well for you. More than 80% of traders lose money. Including the ”Guroos” that are signaling to you as experts.

Ironically, trading becomes straight on gambling in many scenarios. I’ve seen it far too many times in the last 5 years. You may be able to draw fancy Stargazing charts, but at the end of the day, you really are at the mercy of random events and The Whales.

No doubt, if you weren’t trading or investing your excess funds, it would just be sitting there and get eaten up by inflation.

Fortunately, there are platforms that offer yields like a traditional bank account except you earn it in USDC or USDT terms. And you can earn as high as 14.5% APY.

But remember, “not your keys, not your coins”. Transferring your Stablecoins to these platforms also means giving away control of your assets. You have to trust the platform to not run away or get hacked.

While not all USDC Interest platforms are created equal, my list below breaks down these platforms in more detail.

| Platform | Annual Percentage | Pros & Cons |

|---|---|---|

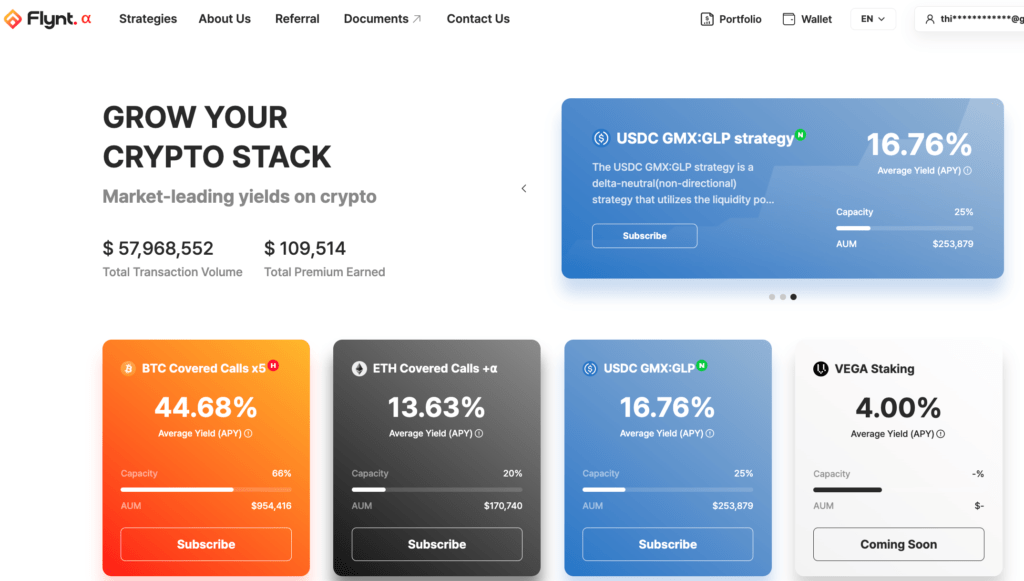

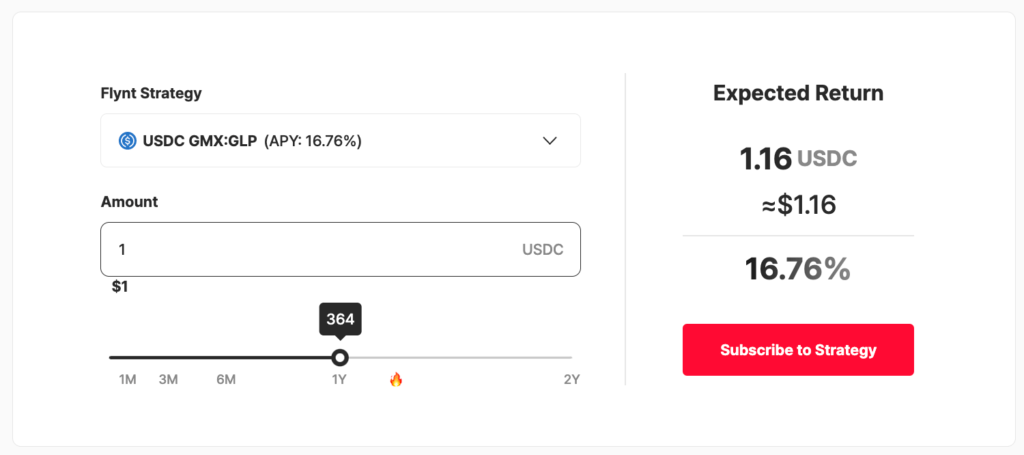

| Flynt Finance | BTC – 44.68% (APY) ETH – 13.63% USDC – 16.76% | - Highest APYs Offered - Flexible terms (1 week, 1 month, up to 2 years) - Medium Security |

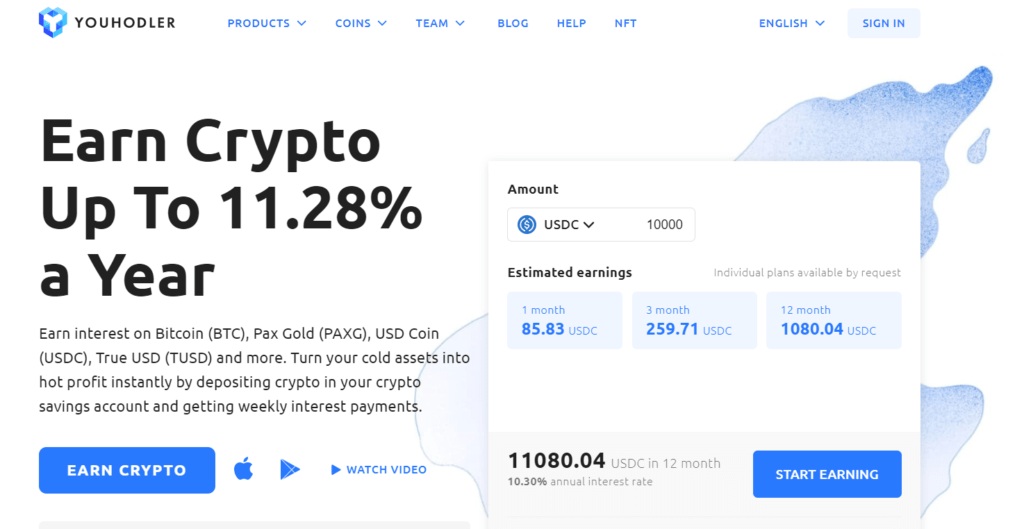

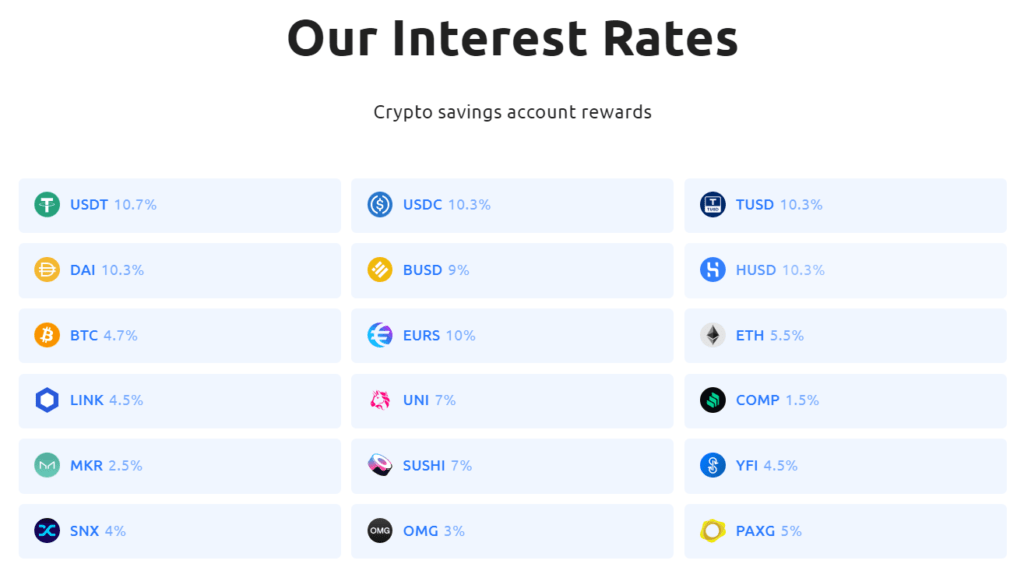

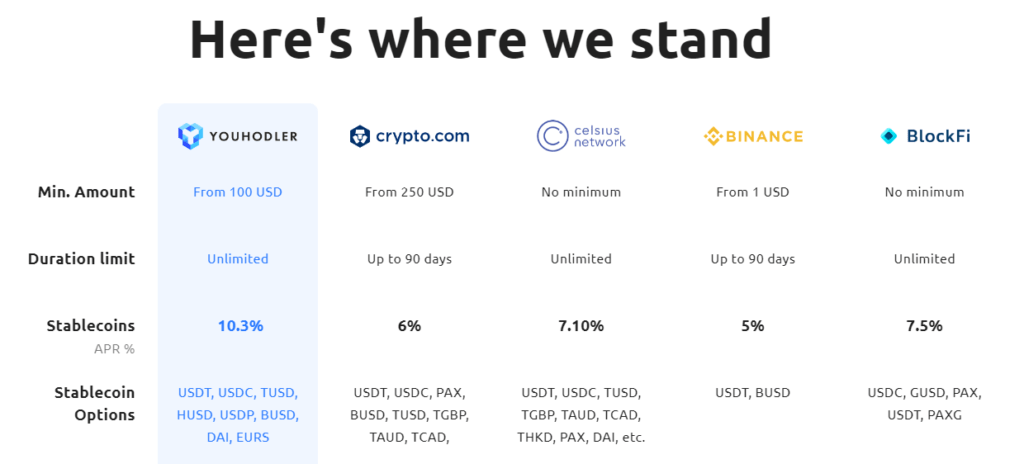

| YouHodler | BTC - 4.7% (APR) ETH - 5.5% USDT -10.7% USDC -10.3% | - Higher Yields for Stablecoins - Withdraw Anytime - Pays out Weekly - Not available in U.S. and China - Insured up to $150 mil |

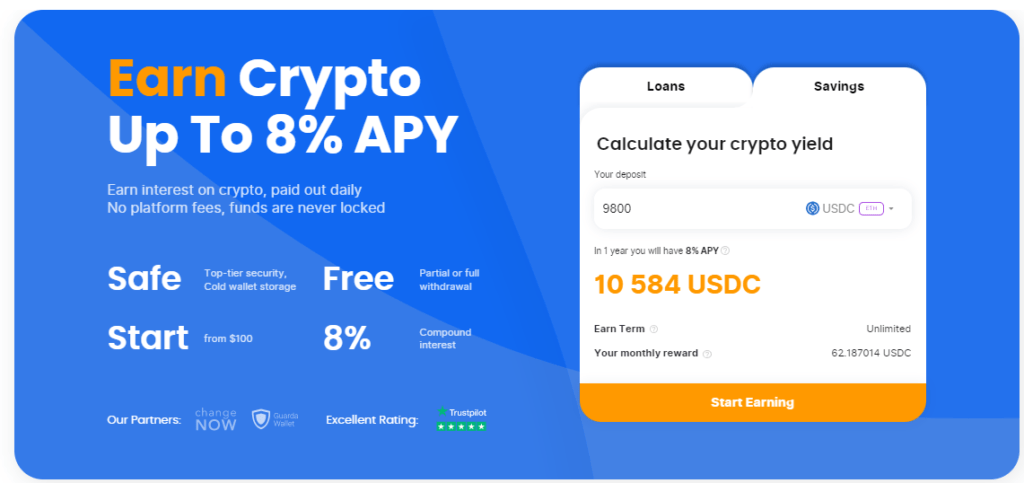

| CoinRabbit | USDT - 8% (APY) USDC - 8% BUSD - 8% | - Only Stablecoins Offered - Start from $100 - No KYC - Pays out Everyday - Withdraw anytime - No lock-in periods - Higher Risk - Low Trust |

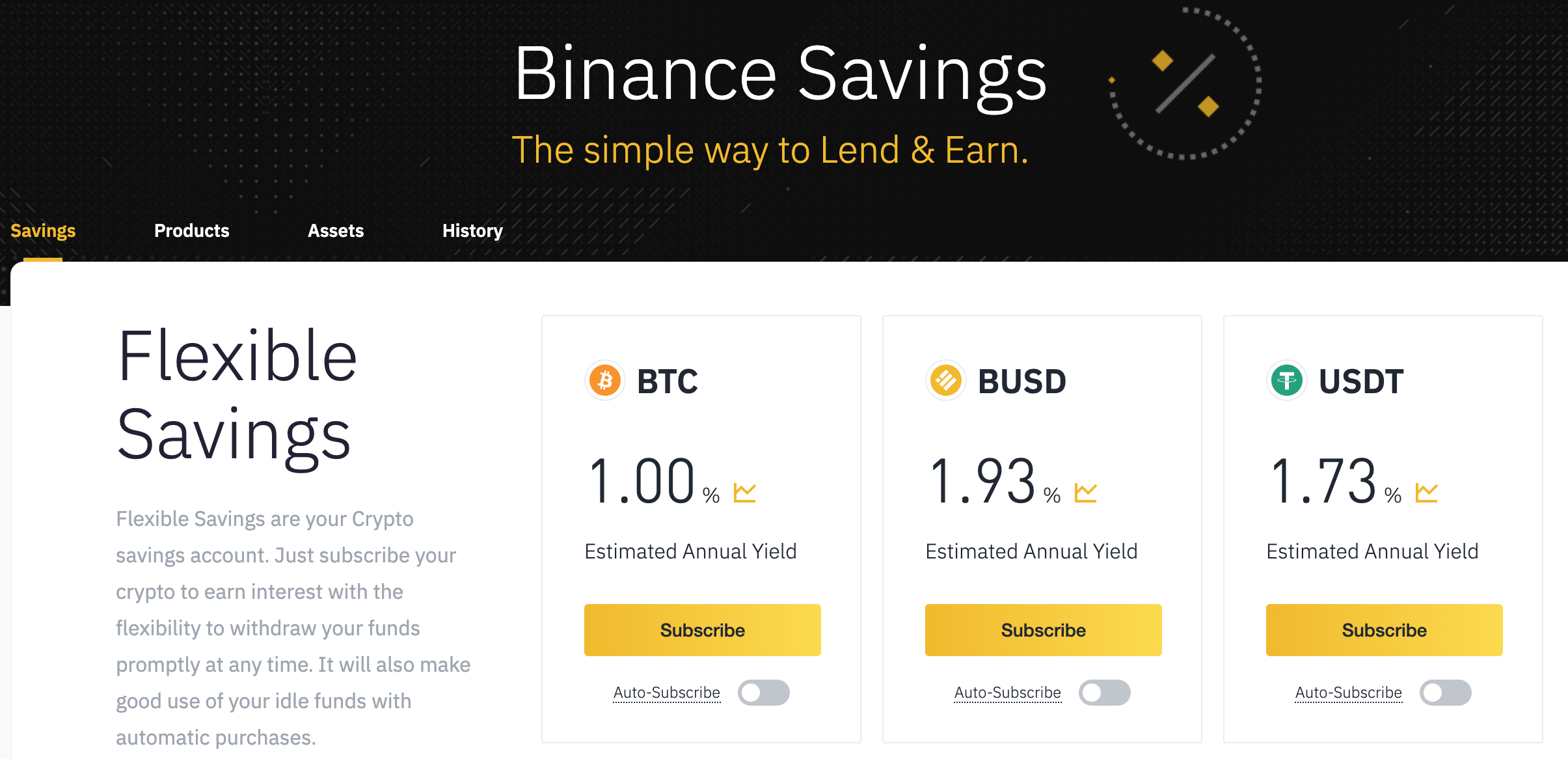

| Binance Savings | USDT - 10% (APR) USDC - 1.2% BTC - 5.0% ETH - 2.4% Rate based on: Flexible Term (Tier 1) | - Popular platform - Yields based on Tiers - Flexible or Fixed Savings - Earn Daily for Flexible - Offers many diff investment products |

| Crypto.com | USDC- 4.5% (APR) USDT- 4.5% Dai - 4.5% BTC - 3.0% ETH - 3.0% Rate based on: 3 Month Term CRO Stake <$4k (Tier 1) | - Popular platform - Flexible, 1 & 3 Month Term offered - Yields are much lower w/ Flexible - Yields based on Tiers - Paid Weekly |

Related reading:

5 Best Platforms To Earn Interest on Stablecoins In 2023

1. Flynt Finance

Earn 16.76% APY interest on your Stablecoins like USDC with Flynt Finance.

Earn 16.76% APY interest on your Stablecoins like USDC with Flynt Finance.

If you already own some Stablecoins, you can transfer them to Flynt and earn a weekly reward, all without having to worry about the technicalities of trading or the volatility of the market.

It’s suitable for short to medium-term investors who’re committed to beating inflation to the punch.

Flynt Finance is currently the best platform for this purpose. Minimum subscription amount is 500 USDC.

Here’s how you begin:

- First, create a free Flynt Finance Account

- Complete KYC (Know Your Customer) verification.

- Deposit crypto into your Flynt wallet.

- Select USDC strategy.

- Get paid weekly in cryptocurrency.

2. YouHodler

YouHodler is an EU and Swiss-based All-in-one Crypto Platform that offers Stablecoin Interest accounts that’s very competitive.

Simply deposit your USDC or any other Stablecoins into your YouHodler wallet and earn up to 10.7% APR with weekly payouts.

Even if you’re new to the crypto, you can still take advantage of the high-yields in a straightforward manner.

With YouHodler, you can also send fiat money (EUR, USD or GBP) via bank wire transfer or debit/credits card to your YouHodler account. Once you receive your funds, you can quickly convert it to any Stablecoins and start earning interest.

Three things you should know about YouHodler’s Saving account:

- Offer some of the highest interest rates on the market

- Grow your savings with weekly compound interest. This way, you can earn more and more interest every week.

- Maximize your interest rates and earn more crypto with their Dual Asset Service and Multi HODL™ features.

Compared to other platforms, Youhodler offers a large selection of Stablecoins. Even the yields being offered are much higher than popular platforms like Binance. Only drawback is that they are not available in the United States and China.

Other features include:

- Get weekly crypto compound interest payments

- Safe and secure. All your crypto assets are safe guarded with Ledger Vault’s advanced custody and security options. Plus, it’s covered by $150 million pooled crime insurance.

- No withdrawal fees.

- No minimum deposit.

- Quick and instant withdrawal.

- Mobile app is available for both Google Play and App Store

- User friendly and well integrated for beginners.

3. Crypto.Com

Crypto.com is a popular crypto All-in-one platform that offers a suite of services and products for retail investors. Their products include an interest savings account based on a Flexible, 1 month or 3 month terms.

The only thing I hate about the site is that you have to stake 4000 or more CRO tokens in order to earn a slightly higher interest rate, which may I remind you can earn from the above competitors.

**Sign up and enter referral code: heq9qnuzam to get USD$25 welcome bonus

4. CoinRabbit

CoinRabbit is an easy way to start earning interest on your Stablecoins.

With no KYC, no registration, no account, it is a particularly good platform for those who want to earn some interest but prefer not to reveal their identity.

Start by depositing as low as $100 and begin earning up to 8% on a myriad of Stablecoins in less than 5 minutes.

You can calculate your crypto yields and anticipate how much you will earn before you dive in. If you’re happy with the earnings, simply add more as you go and earn a consistent passive income daily.

You can increase your deposit amount or withdraw your funds anytime.

5. Binance Savings

Binance is the leading All-in-one crypto ecosystem that offers everything under the sun. They can be considered the Amazon.com of the crypto world. You can earn, buy, sell, trade on a wide variety of cryptocurrencies at highly competitive rates.

With Binance Savings , you get a ton of simple ways for your Stablecoins to go to work for you without the hassle of learning how to trade.

Binance Savings has two main features:

- Flexible Deposits (crypto savings account)

-

- Allowing you to earn interest with the flexibility to withdraw your money promptly at any time.

- The interest rate is flexible and changes over time.

- Fixed Deposits

-

- Yields bigger returns if you have larger amounts to invest.

- But you can’t access your funds for a fixed period of time 30 / 60 days

How to use Binance Lending to earn rewards:

- Go to Binance

- Click “Finance” > “Savings” on the top bar

- Select the type of lending product you’d like to use: Flexible Deposits or Locked.

- Select the crypto you’d like to deposit to earn interest and click “Subscribe”.

Earn Stablecoins FAQs

Why are Stablecoins important?

Stablecoins offer investors & traders the convenience to transact crypto more seamlessly. They form a bridge between volatile cryptocurrencies and stable real-world currency, like USD.

How can I earn more USDC?

There are several ways to earn more Stablecoins like USDC from crypto affiliate programs, Crypto savings accounts, or simply asking to be paid in it.

Why is the Stablecoin Interest rate so high?

Stablecoins have become the go to asset for crypto loan companies. Borrowers get a loan from you via these platforms in search of a bigger return via trading strategies, Staking, DeFi. They get anywhere from 20% to 30% APY which gives them a good cushion.

Which Platform Offers the Highest APY?

Flynt Finance currently offers 16.76% APY and pays out weekly. No other platform can offer anywhere close to this interest rate.

Is USDC safe to store my money long term?

USDC’s main claim to fame is its transparency, it provides monthly attestations of its reserves. While not as extensive as a full audit, it still puts Centre ahead of other Stablecoin operators in terms of transparency. However, you still have to trust somebody else & the Fed to not to inflate the USD. For BTC, 21 mil is all I need to know.

Earn Stablecoins Conclusion

Rather than letting your USD savings sit in your old and lame bank account, it’s becoming more important than ever to learn how to store it in a Stablecoin like the USDC.

Moreover, these platforms make it fast, secure, and a piece of cake. Crypto doesn’t have to be as complicated as it sounds, if you dedicate yourself to learning how to beat inflation with Stablecoins. These are essential tools to help you navigate an uncertain future where technology and money gets redefined in more nuanced ways.

There are tools for everything from Stablecoin loans to Hardware wallets.

In this post, we discussed 6 top platforms for earning you more interest rates. You may not use all of these platforms, but it only takes one to have a positive impact.

Have you had success with any of these savings platform? Would you add any others to the list?

If you think any of your friends would find this helpful, share this post with them.

I’ve handpicked a few guides for you to read next:

- Crypto 101: The Ultimate List of Cryptocurrency Resource

- 10+ Easy Ways to Make Money with Bitcoin and Cryptocurrency

- 4 Best Ways to Convert Bitcoin to Cash

- What is a Bitcoin Private Key, How to Protect It?

- 10 Interesting Bitcoin Facts You Should Know

- 7 Best Sites to Instantly Swap Cryptocurrency (At the Best Rate)

- The Best Bitcoin Rewards Credit Cards to Earn Free Bitcoin on Every Purchase

- 7 Best Ways to Earn Passive Income with Cryptocurrency

I live and breathe making an income online.

I’ll be sharing more ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails.

P.S: This Bitcoin resource is One of – if not the most – comprehensive resources for learning about Bitcoin with over 20 categories ranging from history to buying BTC, setting up a wallet, technical information, mining, security, and trading. Enjoy!

Disclaimer

Keep in mind that I’m not a financial advisor, my recommendations shouldn’t be used as professional investment advice.