You don’t have to sell your Bitcoin or crypto assets if you need cash quickly.

You don’t have to sell your Bitcoin or crypto assets if you need cash quickly.

Whether it’s a house that needed repair, a job loss or funding for your small business, you can always take out a loan using your cryptocurrency as collateral fast when you really need it -without having to sell your favorite coins.

Interestingly, debt is a powerful tool that can be used to your advantage.

As Robert Kiyosaki said, Good debt helps you get rich, Bad debt makes you poor.

Bitcoin is the best performing asset of the last decade and was up 300% in 2020.

To give a clearer picture, let’s see the value today of $1,000 invested five years ago:

- Bitcoin: $51,269

- Shopify: $46,905

- Etsy: $22,320

- Nvidia: $15,688

- Tesla: $14,010

- PayPal: $6,471

- Apple: $4,850

- Amazon: $4,718

- Netflix: $4,385

- Microsoft: $3,790

- Facebook: $2,553

- Google: $2,290

The market is emphatically telling us that Bitcoin is worth holding.

By borrowing cash against your Bitcoin holdings, you can get loans for low rates (1% – 7.5%) with no credit requirements.

Consider the fact that Bitcoin average annual price change over past 5 years is over 100%. Taking a crypto-backed loan is a no-brainer.

You get cheap loans almost instantly. And you’ll get your Bitcoin back once you pay off the loan. This way, you don’t have to worry about missing out on a future bull run.

So keep your Bitcoin and use cash.

The challenge, though, is to find a reliable and secure crypto lending platform to get a loan in Bitcoin, as it’s a company you have to trust storing your bitcoins.

While there are many great crypto loan sites out there, YouHodler is one of the most secure, reputable and trustworthy sites that allows you to get a cash loans by offering your cryptocurrency as security for repayment.

The same platform also allow you to also to lend out your cryptocurrency and earn interest (I won’t go into details but you can learn more about earning interest on your Bitcoin in this guide).

In this article, we’ll discuss how YouHodler Crypto Loan works and how to get started with YouHodler so you can get a loan in cash against your cryptocurrencies right away!

If you already have a YouHodler account, it’s profoundly easy for you to get involved. If not, register now so that you can take part in this new financial revolution.

What is a Crypto-backed Loan? How does it work?

A crypto-backed loan is a fairly new financial product that allows people around the world to get instant cash in different local currencies by using cryptocurrency as collateral.

A crypto-backed loan is a fairly new financial product that allows people around the world to get instant cash in different local currencies by using cryptocurrency as collateral.

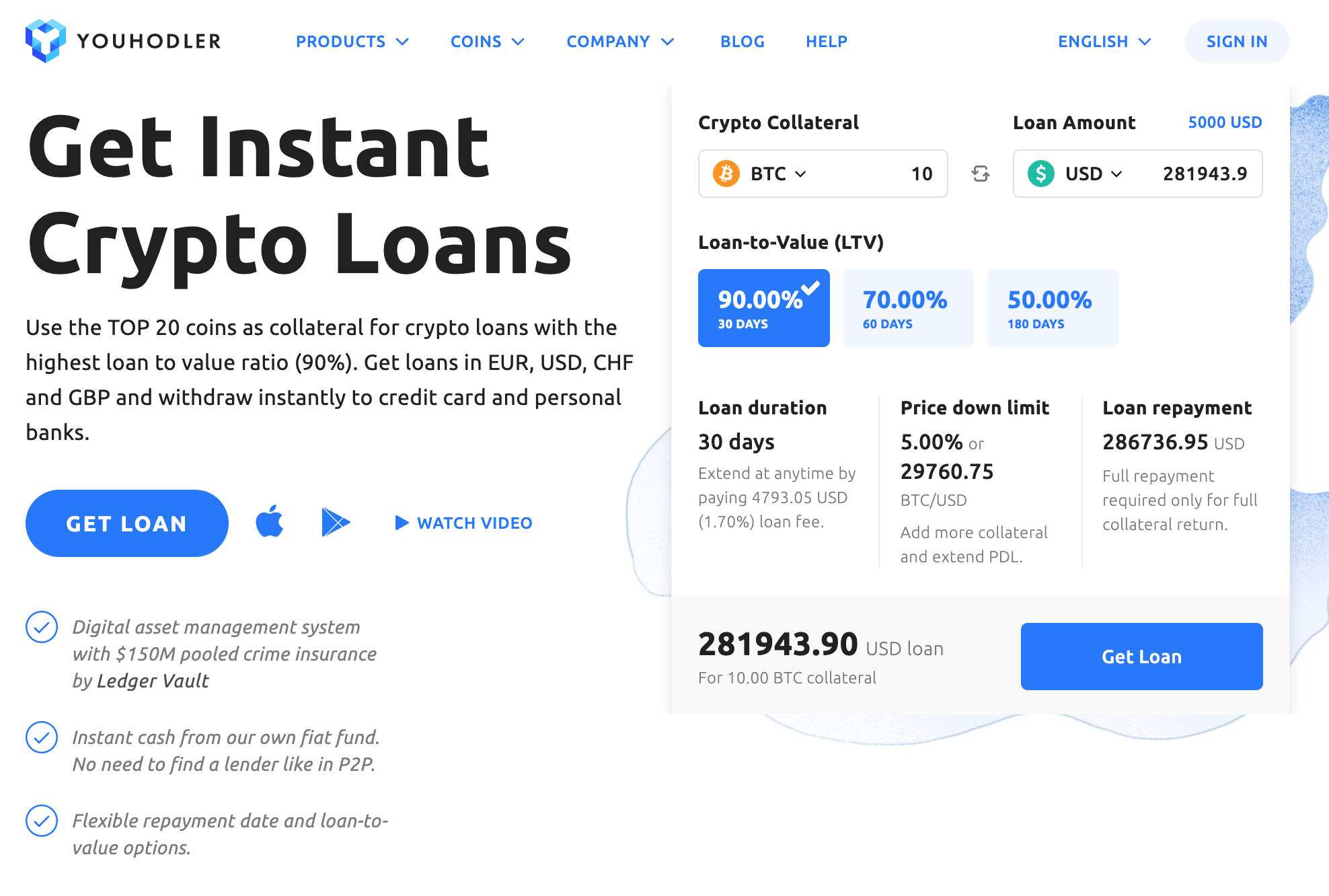

For example, with YouHodler, you can use any of the top 20 cryptocurrencies as collateral for a loan in Euro (EUR), US Dollar (USD), Swiss Franc (CHF) and Great Britain Pound (GBP).

Just like a traditional loan, you borrow money and then pay it back with interest, plus fees over a predetermined period of time.

Depending on your loans agreement, you repay with regularly scheduled payments. Alternatively, you can make a lump sum payment to settle your loan well ahead of time.

But, that’s where the similarities end.

Because Bitcoin is not issued or controlled by a central bank. Your credit score doesn’t matter here. There’s no discrimination.

Bitcoin simply doesn’t care about your education level, geography or credit worthiness. As long as you have enough crypto to put down as collateral and pass the KYC (Know Your Customer) process, you will get a loan in fiat currency.

Plus, you can withdraw money instantly to credit card and personal banks.

What’s more, the interest rates are often lower. You save yourself from paying exorbitant fees and built-up interest.

Perhaps the most obvious advantage of using crypto-back loan is that you can get instant access to cash without having to sell your precious cryptocurrency assets.

With a limited and finite supply of total 21 million and huge demand from institutions, the price of Bitcoin is only going to increase with time.

Here’s how it works:

- You deposit a minimum $100 worth of crypto into your YouHodler wallet.

- You decide which coins to use as collateral and take a loan for 1 month, 2 months or 6 months.

- You get cash in local currency with options to withdraw via credit card or bank transfer.

- At the end of the loan period, you pay back the loan plus interest and you’ll get back your Bitcoin or crypto.

Why choose YouHodler for your crypto-backed loan?

Founded in 2018, YouHodler is an EU and Swiss-based cryptocurrency loan platform that offers the highest loan to value ratio of up to 90%!

Founded in 2018, YouHodler is an EU and Swiss-based cryptocurrency loan platform that offers the highest loan to value ratio of up to 90%!

This means that you can take a cash loan up to 90% of your crypto value, giving you more value for your collateral than other crypto service providers.

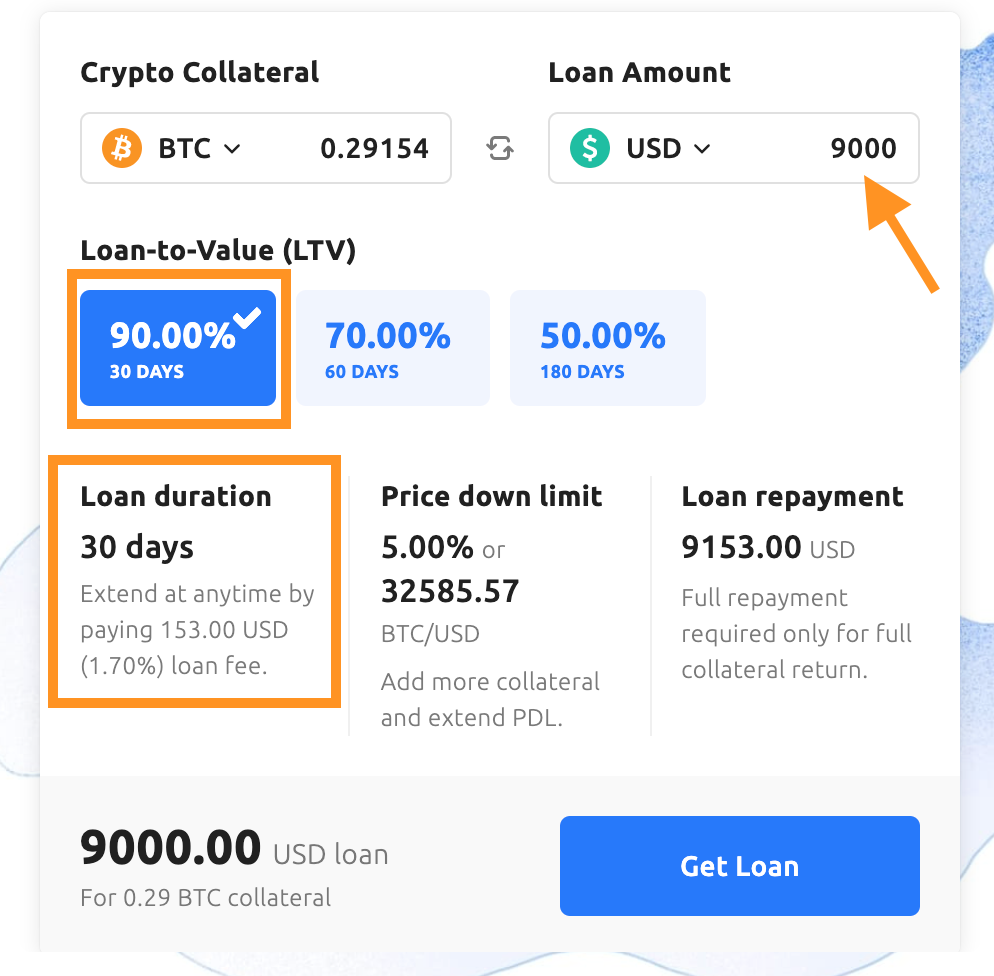

Say, you take a $9,000 loan on 90% LTV. You will need to deposit $10,000 worth of Bitcoin or any coin of your choice to YouHodler. In return, you’ll need to pay an interest rate of 153.00 USD (1.70%) loan fee. This loan fee will be added to the loan balance.

Say, you take a $9,000 loan on 90% LTV. You will need to deposit $10,000 worth of Bitcoin or any coin of your choice to YouHodler. In return, you’ll need to pay an interest rate of 153.00 USD (1.70%) loan fee. This loan fee will be added to the loan balance.

Meaning that you’ll receive $9,000 to your bank account and you have a loan balance of $9,153 with YouHodler.

There’s no hidden fees or daily recurring fees. You only need to pay a one-time loan fee at the end of the loan term.

Besides that, getting a crypto-backed loan with YouHodler is very easy. No more wasting time finding a right lender on other person to person (p2p) lending platforms.

Simply enter the desired loan amount on YouHodler and click “Get Loan”. If you agree to the terms, then deposit your crypto as collateral into your YouHodler account and you’ll receive instant cash directly from YouHodler’s own fiat funds. You can then choose to withdraw your borrowed funds via credit card or bank transfer.

You can repay your loan at your own pace using crypto, fiat or stablecoins.

Once you pay the loan back, you’ll receive your original crypto directly to your wallet.

Most importantly, your funds are safe and protected by Ledger Vault digital asset management system and is covered by $150 million pooled crime insurance.

So, if you ever find yourself struggling with an unexpected expense that comes your way and you need a sizeable chunk of money immediately, getting a cash loan with YouHodler is a great way to ride out life’s tough time while still holding on to your Bitcoin.

Not only that, you can also make use of this crypto loan feature to access new capital for investments, for hedging or leveraging on the crypto market to grow your crypto assets even further.

Here’s a comparison of YouHodler with other competing crypto loan platforms:

How to get a crypto-backed loan on YouHodler

Before you can start using YouHodler, you’ll need to sign up for a free account, complete KYC (Know-your-customer) procedure and wait for their approval. Once your account is approved, you can start using all the features on YouHodler.

Step 1: Transfer crypto to your YouHodler wallet

To get a cash loan, login to your YouHodler account, go to the Crypto Loan page and click “Get New Loan”.

Use the loan calculator to see how much crypto you need to deposit in order to secure a crypto-back loan.

- From the collateral options, choose the cryptocurrency you want to use.

- Enter the desired loan amount in fiat or cryptocurrency

- Choose the duration of loan.

The interest rates as well as LTV vary depending on the duration of the loan:

- Duration – 30 days. LTV – 90%

- Duration – 60 days. LTV – 70%

- Duration – 180 days. LTV – 50%

Make sure you read through the terms before taking the loan. Next, all you need to do is deposit the specific crypto to your YouHodler wallet.

As of writing now, YouHodler accepts top 20 cryptocurrencies as collateral, including:

There is no fees for crypto deposits and withdrawals.

The minimum loan is $100.

Step 2: Get a crypto-backed loan

Once your account is successfully funded, you can expect to receive cash in your selected currency (EUR, USD, USDT or BTC) in a matter of seconds.

You can see the borrowed money appear in the Wallet section of your YouHodler account.

Think of it as a temporary transfer of Bitcoin ownership. You are the seller and YouHodler is the buyer. You have the right to repurchase the Bitcoin or cryptocurrencies for an agreed period of time.

Here are a few options you can use to withdraw your cash:

- Bank wire withdrawal via SEPA and SWIFT – Available worldwide.

- Credit card withdrawal to your MasterCard or VISA – Selected countries

- Crypto withdrawal: use it to exchange for any crypto or stablecoins with their integrated crypto exchange.

Step 3: Get your crypto collateral back anytime

YouHodler offers several options to repay your loan such as:

- Cryptocurrency – pay back your loan in any cryptocurrency.

- Credit card – do note that it could take up to 12 hours for bank card verification

- Bank wire – if you select this option, you may need to verify your address and it could take up to 12 hours

- From your YouHodler wallet -repay your loan using fiat money or any stablecoins from your wallet

- Close now – Choose this option if you’d like YouHodler to automatically sell your collateral at the market value and use the profit to repay your loan. You’ll get the remaining crypto left over in your wallet.

That’s it. Once you pay off your loan in full, you will get back your Bitcoin.

It’s worth mentioning, you can keep your cryptocurrency in your YouHoder wallet and grow your Bitcoin holdings by using advanced features such as Multi HODL™ and Turbocharge. To get the most out of YouHodler, check out my YouHodler review here.

Benefits and Risks of Taking Bitcoin Loan

With that said, getting a loan funded in Bitcoin is not without its risk.

Since you need to transfer your Bitcoin to the other party, you have to trust the crypto platform to manage and keep your crypto assets safe.

Meaning that you have zero control over your Bitcoin.

And you’ll only get back your coin when you repay the loan with interest.

What if you fail to repay the loan?

Then you could end up losing all or part of your collateral.

So why should you take a Bitcoin loan?

Rather than spending your cryptocurrency and dealing with accounting headaches, crypto-collateralized lending is a great solution for crypto enthusiasts who are committed to HODL their coins for the long-term while still having access to cash when they need it.

1. Instant access to cash

With YouHodler crypto loan, you don’t have to sell your Bitcoin or any cryptocurrency when you really need it. Instead, putting your coin as collateral will give you instant access to cash within a day.

There are many ways you can benefit from the loans, such as start a business, buy a new house, paying off your high-cost debit, grow your investment portfolio and so much more.

2. There are no credit checks.

Getting a regular bank loan isn’t easy. It can be giant pain in the ass, especially for those who have bad credit.

On the contrary, borrow cash using a crypto loan platform like YouHodler will give you the same, flexible loan terms and cheap interest rates, regardless of your occupation, nationality, or credit scores.

3. Enjoy the massive potential upside of Bitcoin

You’ll get back your collateral once the loan is fully paid, allowing you to capture the upside potential of your crypto assets.

As you may know, Bitcoin is brilliant for long term saving.

People living in developing countries with weak currency use Bitcoin as a store of value, and those in many developed countries use it as a speculative growth asset.

So it’s the only hard asset you’d like to own for the next 5-10 years in order to get the highest returns.

4. You get Tax-Free money

Borrowing cash against cryptocurrency is NOT a taxable event.

But if you sell your cryptocurrency for cash, you need to pay tax to the government.

So why not using your cryptocurrency as collateral with YouHodler and get cash quickly?

This way, you can avoid paying unnecessary taxes.

Plus, the interest you pay on a YouHodler loan may be tax-deductible against your net investment income depending on how you use the proceeds of the loan.

All in all, this low interest debt crypto instrument is definitely the way to go for crypto investors to get tax-free dollars.

Conclusion

Getting a cash loan without selling your Bitcoin is now possible with YouHodler Crypto Loan.

If you’re in need of urgent cash, don’t rush to cash out your Bitcoin to local currency. Instead, consider putting it on YouHodler as collateral and get instant access to fiat money.

It’s very easy to use, all is done online.

At the end of the loan terms, you’ll still get back your loans and don’t have to pay any tax!

To take a crypto-backed loan, open a YouHodler Crypto Loan and start getting cash using your crypto assets.

On the other hand, if you have excess coins that are sitting on your wallet earning nothing, you may want to deposit your crypto into YouHodler Savings Account and earn up to 12% interest.

If you want to look at other crypto loan platforms before jumping on board – that’s fair. Check out these 5+ Best Bitcoin Loan Sites to Get a Bitcoin Loan

Last but not least, if this post was of any help to you, please share it on Facebook, Twitter and Pinterest!

If you think any of your friends would find this helpful, share this post with them.

I’ve handpicked a few guides for you to read next:

- Crypto 101: The Ultimate List of Cryptocurrency Resource

- 10+ Easy Ways to Make Money with Bitcoin and Cryptocurrency

- 10+ Legit Ways to Earn Free Bitcoin (#3 is My Favorite)-UPDATED 2021!

- 4 Best Bitcoin Lending Sites to Earn Bitcoin Interest

- How to Invest in Bitcoin: The Ultimate Guide for Beginners 2021

- How to Sell Bitcoin – The Ultimate Beginner’s Guide 2021

- Trading vs HODLing for Bitcoin Investors

- 4 Best Ways to Convert Bitcoin to Cash

- 10 Interesting Bitcoin Facts You Should Know

I live and breathe making an income online.

I’ll be sharing more ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails.

P.S: This Bitcoin resource is One of – if not the most – comprehensive resources for learning about Bitcoin with over 20 categories ranging from history to buying BTC, setting up a wallet, technical information, mining, security, and trading. Enjoy!