So now you’ve bought your first Bitcoin or a tiny fraction of Bitcoin that you can afford to invest in, and you keep it on the exchange or a Bitcoin wallet.

So now you’ve bought your first Bitcoin or a tiny fraction of Bitcoin that you can afford to invest in, and you keep it on the exchange or a Bitcoin wallet.

When you think you keep it safe, you start hearing people talking about crypto exchange being hacked, individual being scammed, losing hard-earned money to cybercrimes.

To avoid becoming a victim of this unfortunate but preventable incidence, you should be extremely careful when handling your private keys.

So how do you do this?

While you don’t have to understand the technical stuff going on behind-the-scenes, it’s of utmost importance that you follow one simple rule:

Always keep your private keys safe, secret and don’t reveal to any 3rd parties.

These keys are what make decentralized, peer-to-peer (P2P) transactions on a reliable Bitcoin network all possible.

Understand Private Keys and Public Keys

To help you understand how private keys and public keys work, let us consider the below example based on our mailbox system.

In the conventional postal mail, everyone has a unique mailbox address or number where others can send us letters or parcels.

If someone wants to send you a physical letter, they’ll need to know where to send it which is your exact mailing address.

Similarly, if someone wants to send you a Bitcoin, you’ll need to give them your wallet address also known as public key, a very unique number that directs and identifies you.

Working much like your bank account or mailbox address, you can let anyone know your public keys so that you can receive incoming fund.

Now you have a letter sit in your mailbox. People walking past may know that there’s a letter inside the mailbox but they can never gain access to it and will never know the true identities of both the sender and receiver (except of course, only these two parties involved know).

And only you, as the receiver have the private key to open the mailbox and collect the item.

In the case of Cryptocurrency, just like your mailbox, anyone can know your Bitcoin address or public key to send you Bitcoin. To open and spend the bitcoins, you’ll need a private key or private address, it’s like a unique key of the mailbox.

Anyone who has access to your private keys can unlock your box and steal your bitcoins.

With this in mind, you take full responsibility to store your private keys.

By understanding this basic function of keys has helped me well informed and made better decisions when it comes to choosing the right wallet, protecting my bitcoin and crypto assets.

If you’re serious about protecting your Bitcoin, keep on reading.

What is a Private Key?

A Bitcoin private key is basically an extremely large and secret number/ alphanumerical characters (letters and numbers) that allows you to send or spend your Bitcoins. Usually, it’s a 256-bit long number generated randomly when you create a wallet.

Fortunately, you don’t have to remember it, it’s saved in the wallet file, computer file or some can be printed on a paper wallet.

If you just need to see your coins value in your wallet, you don’t need a private key. You’ll only need a private key for spending, sending or donating your bitcoins. And thus you need to keep it safe and secure.

Important: If you lose your private key and don’t have any backup, you can no longer access your bitcoin wallet to spend your money.

Here’s an example of how a bitcoin private key looks like (in most cases, a private key starts with 5):

5J7ZwJE1fMSjqSTyeBqD4cxickkKA7xFdyHdeZvxmobPBLrey

What is a Public Key?

A public key is another 256-bit long code, mathematically derived from your private key.

As its name suggests, a public key is “public”. It’s made available to everyone to make sure that you’re the owner of a bitcoin address that can publicly receive funds.

Thanks to the strong encryption code base and high degree of randomness, it’s almost impossible to crack a private key.

Here’s an example of how a Bitcoin public key looks like (usually a public key starts with 1):

1krieA3KyYVrLJbSynkML9rriBLZpkPvDR

What is the use of Bitcoin Private and Public Keys?

If you don’t know, the word “crypto” in cryptocurrency refers to cryptography. To simplify it, cryptography is about encoding and encoding information.

With this unique feature of blockchain technology, we’ll be able to perform decentralized peer-to-peer transaction securely without a central authority.

It’s now possible to transfer funds or any digital assets to anyone and anywhere in the world, instantaneously. Simply by matching your public and private keys using clever mathematical equation, transactions can be confirmed on the network without the need of third-party validation.

Having said that, private and public keys play an important role in making these irreversible transactions.

But how does it really work?

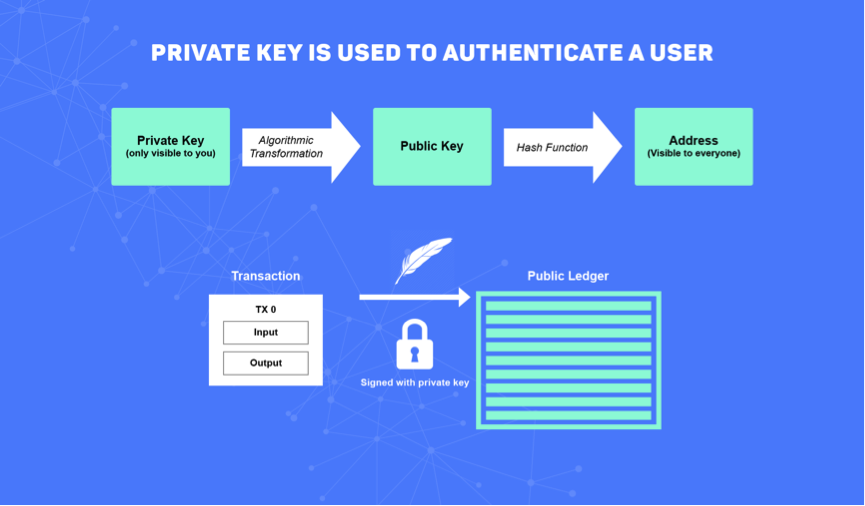

The Private key creates public key, which then creates the address by using cryptographic math functions.

The Private key creates public key, which then creates the address by using cryptographic math functions.

Private key is used to sign the transaction while public key is used to verify and ensure that you’re the owner of the private key.

For each transaction, a unique signature is generated which is a number produced from private key by an equation that anyone can check over the network.

This mathematical function helps to confirm the signature is directed to the particular user who wants to send bitcoin.

You can sign, as many times as you like using the same private key because your private key is still remained secure and never transmitted anywhere. This means no one will know the identity of the user behind the address and thus give a certain level of privacy for users.

Furthermore, all Bitcoin transactions work based on One-Way Function, it’s irreversible, stored permanently and publicly on the network.

“But what if I still don’t really understand the technical aspect of the process”

It’s OK. All you need to do is keep your private keys safe.

If you don’t have a private key, you don’t own your Bitcoin.

If you leave your bitcoins on an exchange, you don’t own your Bitcoin.

If your bitcoins are stored in a third-party hosted wallet, you don’t own your Bitcoin.

Regardless of whatever wallet(s) you’re using, if you have no control of your private keys, you don’t actually own your Bitcoin.

I’ve said it once, and I’ll say it again. Don’t store your money on crypto exchanges or put a significant amount of money in hot wallets.

You won’t want to rely on a 3rd party to look after your money. The beautiful aspect of Bitcoin is to give you full control and power over your own finances.

With more than $9million lost every day due to cryptocurrency hacks, scams, theft, phishing and frauds, keeping your secret digital keys safe is your main priority.

How to keep your private keys safe?

To protect your precious Bitcoin assets, you need to own full ownership of your private keys.

Your money is on the network, and the keys to access your bitcoin are created and saved in the file/wallet. So it’s a crucial step in choosing the right wallet to secure your keys.

There are many different types of wallets with different features and benefits. Some allow you to possess the private keys while some will store these keys on behalf of you.

Here are few reliable wallet options with the safety features to help you make an educated decision in choosing the right wallet according to your needs.

Mobile and Web Wallets (Hot Wallets)

If you’re buying your Bitcoin from an exchange, most likely you already created an online wallet.

The advantage of using a mobile wallet is its convenience, allowing you to monitor, buy and sell bitcoins inside an app. And the web wallets allow you to access your funds on-the-go from any device connected to the Internet.

This kind of wallet works more like an account, which lets you set a password used to encrypt your wallet on their server.

However, most of the mobile and online wallet service providers will store the Bitcoin private keys on behalf of the users.

By using this type of wallet, you’re giving permission to someone else to control your digital keys, and hopefully, they’ll take good care of your money.

Considering the risk involved in case of cyber attacks, there’s a chance that you might lose all your Bitcoin. So use this mobile wallet with extreme care and I won’t recommend using it for storing huge amount of Bitcoin.

Here are some of the best online and mobile wallets, available for both iOS and Android devices:

- MyCelium

- BreadWallet

- Copay

- Airbtiz

- Blockchain

- Jaxx

Desktop Wallets

If you’re looking to send frequent Bitcoin payments from your computer, then desktop wallet maybe the right choice for you.

With desktop wallets, you’re required to download and install software on your computer. And you’ll get your private key and address stored in a downloadable file.

This is a relatively safe option considering you have both the PIN and recovery seed to secure your wallet. But if you lose the file of your private key, you’ll lose your Bitcoin.

If you’re using it properly, it’s very hard to get hacked.

Here are some of the best desktop wallets that available on Linux, Windows and Mac OS X:

Paper Wallets

Bitcoin Paper Wallet

Instead of keeping your private key online, you can actually print it out on a paper wallet in a form of QR-codes.

What you need to do is to have your Bitcoin private keys printed on a piece of paper and store it in a safe or deposit box.

By securing your private keys offline, it’s an effective way to eliminate the risk of digital theft and hacker attacks.

However, unlike web and hardware wallets, once you lose the paper wallet, there’s no way to restore your private key.

Services like BitAddress allow you to make a Bitcoin paper wallet quick and easy.

Since you’re generating important information on a piece of paper, make sure no one is watching you while doing this.

Once the paper wallet is setup up, make sure you disconnect from the Internet before creating the keys. For safety measures, turn your printer into offline mode before actually printing it out. You can also save a soft copy for backup on a USB or external hard drive.

Hardware Wallets (Cold Wallets)

Hardware wallets are perhaps the best and most secure storage option when it comes to storing a significant amount of Bitcoin and crypto assets.

These little electronic devices allow you to store your private and public keys offline and reduce vulnerability and exposure to cyber theft.

Equipped with a highly secure operating system, your keys are remained safe and secure inside a hardware wallet even though it’s connected to a malware infected computer.

As long as you have the 24-word recovery phrases, you can recover your keys and bitcoins even if your device is stolen or damaged. And thus, making it an effective and secure way to store your bitcoin and other digital currencies in the long run.

Trezor and Ledger Nano S are among the most reliable and popular hardware wallets on the market.

Trezor

Trezor was the world’s first Bitcoin hardware wallet. If you’re confused about which hardware wallet to choose from, Trezor is the one that you should trust for securing your private keys and bitcoins.

Trezor was the world’s first Bitcoin hardware wallet. If you’re confused about which hardware wallet to choose from, Trezor is the one that you should trust for securing your private keys and bitcoins.

It allows you to keep your private keys offline, monitor and sign transactions.

Just last month, Trezor officially announced that they’d reduce the price of a Trezor wallet to EUR69, replacing Ledger as the cheapest hardware wallet on the market.

Ledger

Ledger Nano S is another popular hardware wallet for storing your Bitcoin and other virtual currencies. Similar to Trezor, Ledger helps to secure your secret digital keys and allow you to manage and control your funds all in one small device.

Ledger Nano S is another popular hardware wallet for storing your Bitcoin and other virtual currencies. Similar to Trezor, Ledger helps to secure your secret digital keys and allow you to manage and control your funds all in one small device.

By design, you need to manually press on the two buttons on the wallet to sign and confirm each device, making it (almost) impossible for a hacker to gain access.

When you get your new Ledger Nano S, you’re required to create a new PIN code and write down the recovery seed for backup.

If your Nano S gets stolen, it’s well protected with a PIN security and you can retrieve your Bitcoin with any Nano S as long as you remember the 24-word seed.

Conclusion

If there’s only one thing you can learn from this post, let it be this:

Always keep your private keys safe and secret.

Remember if you don’t own your private key, you don’t have Bitcoin.

If you’re a Bitcoin enthusiast, probably you’ll need a hot wallet (mobile wallet) for trading on exchanges and a hardware wallet for long-term HODLing investment.

I hope this beginner’s guide to Bitcoin private keys will help you in selecting the best Bitcoin wallet accordingly.

You may also want to check out this guide: How to Secure your Cryptocurrency? Cold Wallet vs Hot Wallet

How do you keep your private keys? Which is your favorite Bitcoin wallet?

Do you have any other questions? Feel free to leave a comment below.

And lastly, if you liked this post, don’t forget to Pin this!

I live and breath making an income online.

I’ll be sharing more of ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails and a free magazine subscription.

I’ve handpicked a few guides for you to read next:

- What is Bitcoin and why all the fuss with Cryptocurrency?

- What is Satoshi? Convert Satoshi to BTC, USD, EUR and other currencies

- 8 Legit Ways to Earn Free Bitcoin (#3 is My Favorite)

- How to earn Free Bitcoin in less than 1 minute

- CoinMarketCap Alternatives: 8 Best Alternatives to Check Cryptocurrency Prices

Great article

Great post