What comes to your mind when you hear the word “Bitcoin?

What comes to your mind when you hear the word “Bitcoin?

A giant Ponzi scheme?

A bubble?

It’s illegal?

While Bitcoin is becoming more mainstream, there’s still lots of myths and misinformation being spread around.

You may have heard your share of Bitcoin baloney.

It’s no surprise.

Because any new revolutionary technology is bound to face such transition issues and challenges.

And what has happened before will happen again.

For example, when the internet was commercialized in the early 1990s. Experts concluded that it has little commercial potential other than as an electrical medium for chat and an outlet for pornography and crime.

However, Bitcoin is not a subject that you can understand overnights.

Even the most tech-savvy among us can get overwhelmed by the barrage of information, technical details about Bitcoin.

To help clear things up, I’ve compiled a list of common myths about Bitcoin, along with some helpful facts to dispel them.

Busting 7 Myths about Bitcoin

1. Bitcoin is a Ponzi scheme

It’s true that there are many opportunistic entrepreneurs made money by promoting their bitcoin-based Ponzi schemes.

For example, some of the cloud mining companies that allow you to buy “shares” or contract in return for guaranteed bitcoin profits.

These thinly veiled pyramid schemes will pay profits to earlier investors with referral profits rather than actual mining profits.

Only the top few people will make money, while the rest will lose their investments.

But Bitcoin is different.

Bitcoin is not a Ponzi scheme.

Bitcoin is open, decentralized, neutral, borderless and censorship-resistant.

Bitcoin is not a company, it’s not a product and it’s owned by no one.

We simply can’t blame Bitcoin for the existence of those pyramid schemes.

If you understand the technology behind it and how it works, you’ll know that Bitcoin has no pyramid structure.

Rather, it’s a free market without any authority, manipulation or any third-party intervention.

If you gamble, trade, and invest in unsafe Bitcoin investment opportunities, you will gain and also lose.

To debunk it once and for all, I suggest you have a look at the detailed report on Ponzi Schemes published in 2014 by the World Bank.

This report was written by Kaushik Basu, former Chief Economist and Senior Vice President of the World Bank, but also Professor of Economics at Cornell University.

In the report, Kaushik Basu says in particular:

“Contrary to a widely-held opinion, Bitcoin is not a deliberate Ponzi. And there is little to learn by treating it as such. The main value of Bitcoin may, in retrospect, turn out to be the lessons it offers to central banks on the prospects of electronic currency, and on how to enhance efficiency and cut transactions cost.

Taking about Ponzi scheme, did you know that our fiat currency today is much closer to a pyramid scheme than Bitcoin will ever be. Which brings to my next point.

2. Bitcoin is backed by nothing

Bitcoin is a fad.

Bitcoin will fail and disappear because it has no intrinsic value.

Bitcoin isn’t backed by government or pegged to any precious commodity like gold.

But hang on a minute…how about our government-issued paper money?

What’s backing our fiat currencies other than a central bank that has 100% control over how much money they can print?

With fiat currency, governments can print infinite money, inflate the amount of its currency, which decreases our purchasing power and even cause 80 000% hyperinflation like Venezuela.

After all, money has value simply because we believe it has value.

Fact: Bitcoin is backed by science, mathematics and cryptography.

Bitcoin has a finite and limited supply of 21 million bitcoins. 1 BTC = 1 BTC 10 years ago, today and for the foreseeable future.

People work 40 hours a week, sacrificing time with friends and family, for their weekly $905 paycheck (on average).

The US central bank prints $2,800,000,000 per week.

What do banks sacrifice to earn their paycheck?

Buy bitcoin, bye banks.

— Rhythm (@Rhythmtrader) May 25, 2019

3. Bitcoin is used for illicit activities

Initially, Bitcoin was enthusiastically taken up by criminals for a range of illegal activities, becoming popular in black markets like Silk Road.

Also, when banks and payment services like PayPal and Visa refused to process donations for Wikileaks, they have no choice but to use bitcoins as a donation method.

But it’s a good sign.

Here’s why…

According to Jérôme Blanchart, a crime historian, criminals have always been early adopters of emerging technology. Cars were first used by bank robbers as a means of escape, while police chasing them on bicycles or horseback.

As Bitcoin gained a significant boost in popularity, criminals have abandoned Bitcoin for another currency.

At present, less than 1% of Bitcoin transactions are related to “illegal” activity.

Interestingly, there are a lot more activities, both legal and illegal, that are conducted using fiat currency.

In fact, Bitcoin is more trackable and less anonymous than cash.

A smart criminal would use cash rather than Bitcoin. But investigators like Bitcoin.

#HSBC Bank laundered almost a billion dollars for two Mexican drug cartels, they openly customise their branch booths to accept drug sized cases and no one goes to prison. No one pays a penalty.

But, be careful of #bitcoin. It’s money for criminals!

— James ⚡️[Decentmind.io] (@TheCoinWeaver) July 6, 2018

Now: Is our fiat monetary system fraudulent because it’s used or abused for illegal purposes?

I say, those transactions are illegal, but not Bitcoin. Criminals can use any currency as they see fit for their activities.

4. Bitcoin is dead

We as human will eventually die one day, But not Bitcoin!

Bitcoin is literally can never die!

It lives and breathes on the Internet.

As long as there’s some computers running the nodes, as long as there are two participants in the network, the blockchain will continue to function and Bitcoin will live on.

To kill Bitcoin, one would have to destroy all computers, internet and electricity…

Despite major cryptocurrency hacks such as Mt. Gox and Binance, Bitcoin not only survived but grow stronger than ever.

Check this out: Bitcoin is pronounced “dead” over 360 times (and counting…) since2010.

5. Bitcoin mining is a waste of energy

We all need fuel to keep us going.

The same goes to Bitcoin…

In order to generate more Bitcoin, the mining process requires massive amount of computational power, which means it needs hefty amount of electricity.

To the casual eye, it seems like a total waste of computing and electric power.

Think about this for a moment… it’s a waste only if it doesn’t bring us value.

In exchange for huge energy consumption, Bitcoin gives us the first and only truly decentralized digital currency that’s open, public, neutral, borderless, immutable (transactions are final),censorship-resistant (anyone can transact) and trustless (no control by parties).

Energy is needed to run the Proof-of work protocol, which is essential to the operation of Bitcoin.

If spending an intense amount of energy into technology that converts electricity to truthful records, for us to secure our wealth is a waste, obviously you missed the whole point of why Bitcoin being created in the first place.

The real question is how can we use green, renewable energy to facilitate bitcoin mining?

Some innovative miners have already started using abundant cheap solar and hydroelectric power for Bitcoin mining.

Who would imagine that mining cryptocurrencies and agriculture can work together? The first batch of cryptomatoes is ready to be harvested. We are using the excess heat for the tomato greenhouse and it is working:-) pic.twitter.com/U7qqKTshqO

— Kamil Brejcha (@KamilBrejcha) March 10, 2018

6. Bitcoin is useless, it is not suitable for everyday transactions

Okay, I got it.

Just because you simply can’t walk into a store and buy a cup of coffee with your Bitcoin doesn’t mean that Bitcoin is useless.

We have yet to reach the stage where Bitcoin plays the role of a unit of currency.

But the number of businesses that accept Bitcoin as a mean of payment is increasing steadily. Such as paying for coffee at Starbucks, booking flights and hotel rooms at Expedia, blog hosting at Hostinger, a Tesla car and even a private spaceflight with Virgin Galactic.

With VISA/MasterCard linked–bitcoin debit cards, you can now spend your bitcoins as easily as your credit card.

Some may argue that Bitcoin transaction fee is too high and slow.

Compared to traditional International wire transfers, using Bitcoin to send funds overseas is actually much cheaper and almost instantly.

As Bitcoin grows and scales, lightning networks also known as “layer 2” payment protocol has made smaller and faster transactions possible.

7. Bitcoin is so expensive, I cannot afford to buy One Whole Bitcoin

I hear this a lot. Bitcoin is just too expensive now.

Well, Bitcoin has never been cheap for years.

It was “expensive” selling at $10 for each bitcoin in 2010.

Then in 2013, it was “expensive” at $1000, and now it’s “expensive” at “$8608” (price at the time of writing).

It’s a common misconception among new users that they have to buy a full Bitcoin to participate.

This also explains why many newcomers would rather pick up some cheap altcoins like Ripple and Dogecoin.

If this describes you, then you need to stop for a moment and reevaluate your digital currency investment.

Don’t get me wrong.

It’s perfectly fine to buy other cryptocurrencies. But before you do that, perhaps you should own some bitcoins as your first cryptocurrency investment.

Here’s the thing…You don’t have to buy an entire Bitcoin.

Instead, you can buy a quarter of a Bitcoin or a tiny fraction of Bitcoin with any amount of money that you have, before going BIG on your investment. (See my guide on What is Satoshi? Convert Satoshi to BTC, USD, EUR and other currencies)

Allocate some money in Bitcoin and keep it safe in a hardware wallet like Ledger Nano S for long-term HODLing investment.

Don’t fall for cheap Altcoins, Tokens and ICOs. Because altcoins don’t last…

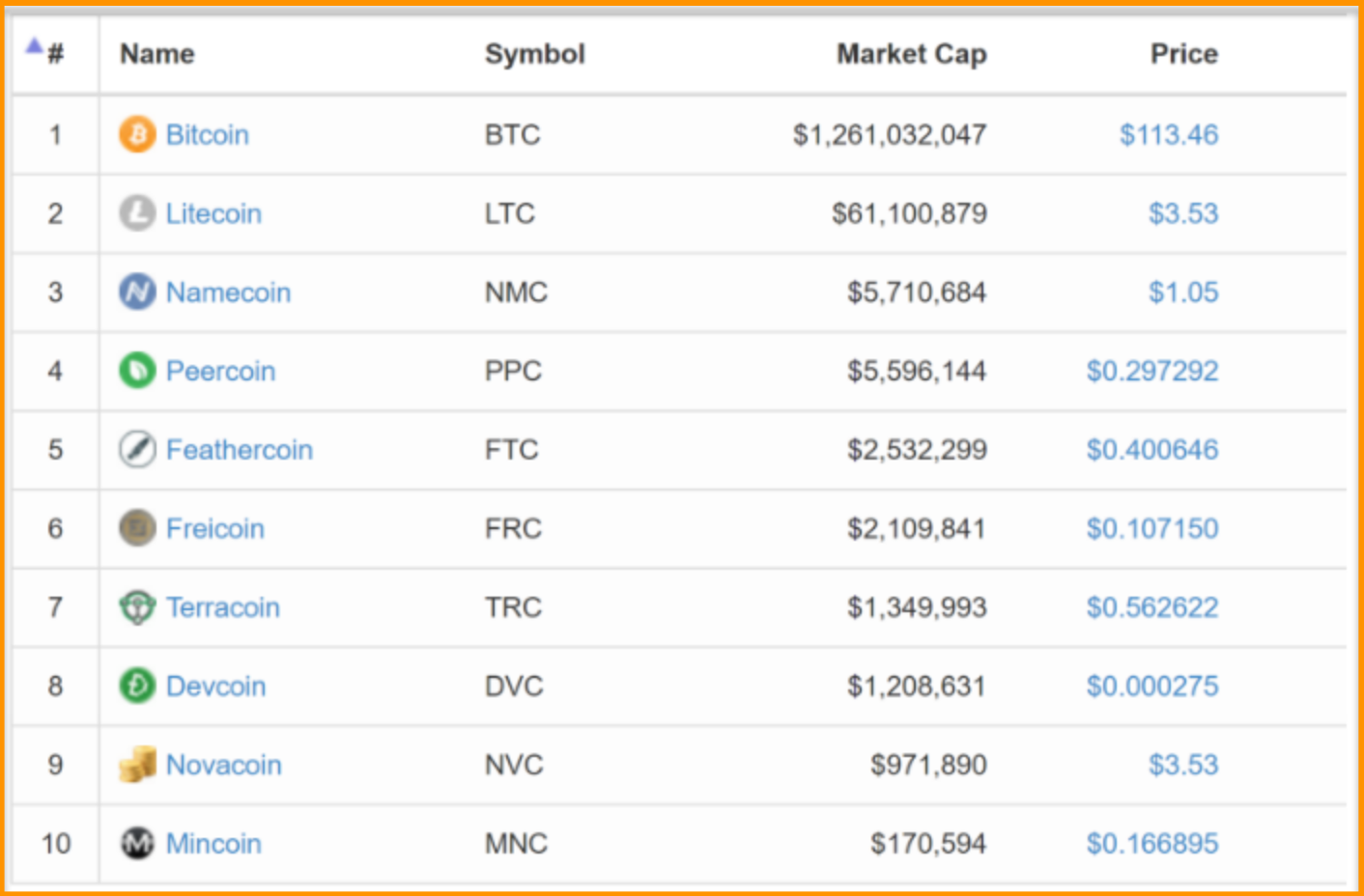

Here’s a screenshot of what it looked back in 2013. How many altcoins still exist today?

Ready to buy Bitcoin? Check out this quick guide.

Conclusion

Now that all 7 of these myths have been cleared up.

Hopefully, you learn something important, have a better understanding of Bitcoin, and make a more informed decision about your cryptocurrency investment.

Do you know any other myths about Bitcoin that’s not included here? Feel to share with us in the comment below.

Like this article? Share it with your friends and families.

Here are some helpful articles that you can read next:

- How to Secure your Cryptocurrency: Cold Wallet vs. Hot Wallet

- How to Setup a Ledger Nano S Hardware Wallet

- Crypto 101: The Ultimate List of Cryptocurrency Resource

- What is Bitcoin and why all the fuss with Cryptocurrency?

- How to buy Bitcoin and other Cryptocurrencies