Wouldn’t it be great if you could take out a loan using your crypto as collateral fast when you really need it -without having to sell your precious Bitcoin?

Wouldn’t it be great if you could take out a loan using your crypto as collateral fast when you really need it -without having to sell your precious Bitcoin?

Yes, you can.

Borrowing funds through a Bitcoin loan is now possible. It’s easier, faster and cheaper than taking a traditional bank loan.

The other day I wrote a guide on earning interest on your cryptocurrency as a lender.

Today, I’m going to share some of the best Bitcoin loans sites that allows you to borrow money by offering your cryptocurrency as security for repayment.

| Bitcoin Loan Sites | Borrow Against Crypto |

|---|---|

| YouHodler | Get Instant Loan Now |

| CoinRabbit | Get Instant Loan Now |

| Binance | Get Instant Loan Now |

| SALT | Get Instant Loan Now |

| BTCPOP | Get Instant Loan Now |

What is a Bitcoin Loan?

Bitcoin is changing the banking and financial services industry in a big way.

A Bitcoin loan is basically a new type of financing product, enabling people around the world to get an instant loan backed by Bitcoin.

Bitcoin Loan vs Traditional Bank Loan

Similar to a traditional loan, you borrow money and then pay it back with interest. The loan is usually repaid in monthly installments, but you can choose to make a lump-sum payment to pay off your loan early.

Here, however, the similarity ends.

Bitcoin loan and traditional bank loan are different in several ways:

First, Bitcoin loan offers lower interest rates (than a bank).

Second, your credit score doesn’t matter. Bitcoin loan sites simply don’t care about your credit score. Good or bad, you’ll get approved as long as you have enough Bitcoin to put down as collateral and pass KYC (Know Your Customer) procedure.

Third, you can quickly get cash in your bank account in less than 24 hours with Bitcoin backed loan.

On the contrary, getting a bank loan is extremely time-consuming. This is not a viable option if you need money fast. Not to mention, it’d be a complete waste of time if your loan application is rejected after waiting for weeks or even months.

If “Collateral” is a new term for you, watch this short video to understand it better:

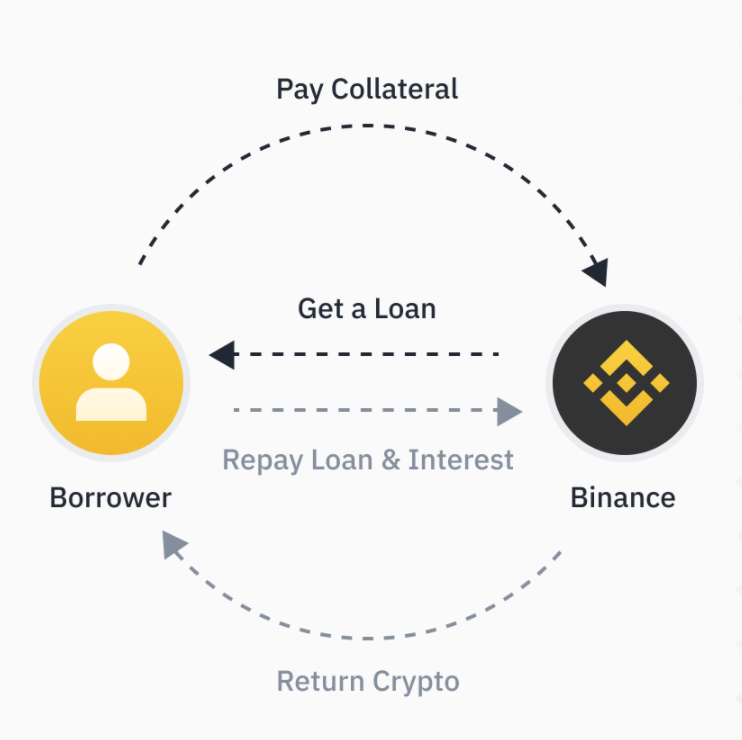

How does Bitcoin lending work?

As you may know, Bitcoin is not controlled or associated with any central government or financial institution. Thus, you’re actually borrowing funds from another cryptocurrency user (also known as crypto lender), not bank institutions.

As a borrower, you can get cheap loans against your Bitcoin/ cryptocurrency.

If you find yourself struggling with an unexpected expense that comes your way and you need a large sum of cash right away, you can get a loan in fiat money that you can repay at your own pace by using Bitcoin as collateral.

Keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account.

This way, you can easily and quickly get access to the money that you need, without liquidating your coins at a low price (the main focus of this article).

On the other hand…

As a lender, you can generate significant returns by lending out your unused Bitcoin and other cryptocurrencies.

If you’re already owning some bitcoins and are committed to holding it for the long term, you can lend your crypto assets to others, and gain interest on the loan. For more information on how to earn interest on Bitcoin, visit this article with all my tips.

Here’s how it works:

- Go to Youhodler and sign up for a free account.

- Verify your identity. Complete KYC with the relevant documents by submitting your national ID or passport.

- Click “New Loan” and select which cryptocurrency you want to use as collateral: Bitcoin, Ether, or Litecoin.

- Submit your application and get approval within 24 hours.

- Send your coins to the Youhodler wallet address and receive your funds instantly, from anywhere in the world.

Note: You’ll need to provide some personal details and information on the nature of your loan including — name, address, DOB, phone #, SSN, source of your crypto being used as collateral, reason for the loan, wallet public key, bank information.

Rather than spend cryptocurrency and deal with accounting headaches, you can get a USD denominated loan in case you need it while conserving your crypto.

Here are 5 best websites that offer crypto to USD loans to get you started. Each bitcoin lending site has different loan interests, custodians, terms and conditions.

As always, we recommend performing your own due diligence before taking a bitcoin loan for cash, since all investments involve varying degrees of risks.

Bitcoin Loan Platforms Types of Collateral Loan length Loan Limits Features YouHodler BTC,

ETH,

LTC,

XRP, AND 15+ CRYPTOUnlimited Min:$100

-The highest loan to value ratio (90%)

-accept TOP 20 coins as collateral

- get loans in EUR, USD, CHF and GBP

- No fees for crypto deposits or withdrawals. CoinRabbit BTC,

ETH,

BCH,

DOGE

XRP, AND 15+ CRYPTOUnlimited Min:$100 - No KYC, No Registration

- No Fee Binance Crypto Loans BTC,

BCH,

XRP,

ETH,

EOS,

LTC7,

14,

30,

and 90 daysMin: 100 USDT/BUSD

Max: 2,500,000 BUSD/10,000,000 USDT

- take small loans quickly SALT BTC,

ETH,

XRP,

LTC,

BCH,

Dash,

Dogecoin

PAX Gold3 to 12 months Min: $5,000

Max: $25,000,000-Borrow up to 70% LTV

- No origination fee BTCPOP BTC,

ETH,

LTC

BCH,

CLAMup to you Min: 0.01BTC - Peer-to-Peer lending platform

- take a Bitcoin loan without verifying ID

5 Best Sites to Borrow Against Your Bitcoin

1. YouHodler

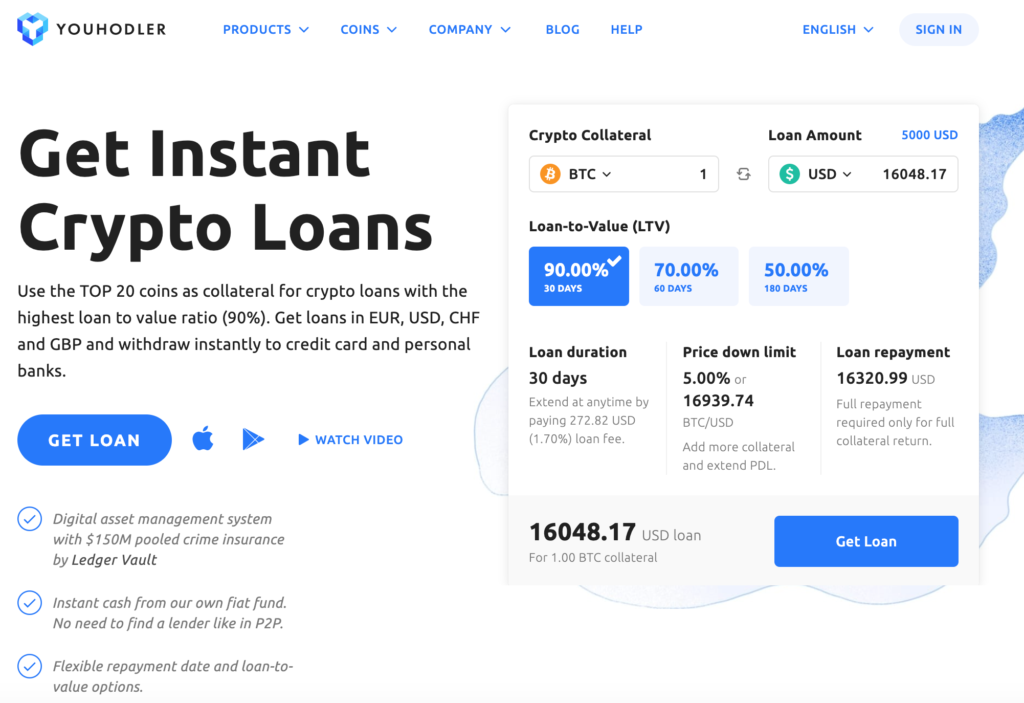

First on the list is YouHodler– an EU and Swiss-based cryptocurrency platform that allows you to earn better interest rate as well as borrow funds against your crypto deposits.

YouHodler Crypto Loan allows you to access money fast without selling your investments.

All you need to do is deposit any of the TOP 20 coins as collateral into your YouHodler account and you’ll receive cash in EUR, USD, USDT or BTC.

The platform offers the highest loan to value ratio of up to 90%! Meaning that you can take a fiat loan up to 90% of your crypto value.

The interest rates as well as LTV vary depending on the duration of the loan:

- Duration – 30 days. LTV – 90%

- Duration – 60 days. LTV – 70%

- Duration – 180 days. LTV – 50%

Twenty cryptocurrencies are accepted as collateral, including

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Uniswap (UNI)

- Compound (COMP)

- Maker (MKR)

- Stellar (XLM)

- Binance Coin (BNB)

- Paxos Gold (PAXG)

- DASH

- EOS

- Bitcoin SV (BSV)

- Ethereum Classic (ETC)

- TRON (TRX)

- Huobi Token (HT)

- Augur (REP)

- Cardano (ADA)

- Basic Attention (BAT)

- Monero (XMR)

- Tezos (XTZ)

To get the most out of YouHodler, check out my YouHodler review here.

Pros:

- User friendly and well integrated for beginners.

- A wide range of collateral options. YouHodler accepts the TOP 20 cryptocurrencies as collateral.

- Safe and secure. All your crypto assets are safe guarded with Ledger Vault digital asset management system.

- Pay interest once at the end of the loan term.

- No fees for crypto deposits or withdrawals.

- Unlimited loan durations. Extend at anytime by paying 272.82 USD (1.70%) loan fee.

- Get instant loan as low as $100

- Low interest rates

- No credit checks – Putting crypto as collateral to get a loan is fast and easy.

- High Loan to Value ratio (90% LTV)

- Flexible repayment options

- Mobile app is available for both Google Play and App Store, making it easier to manage your crypto investment on the go.

Cons:

- Not available to US citizens

Get Instant Crypto Loans at YouHodler

.

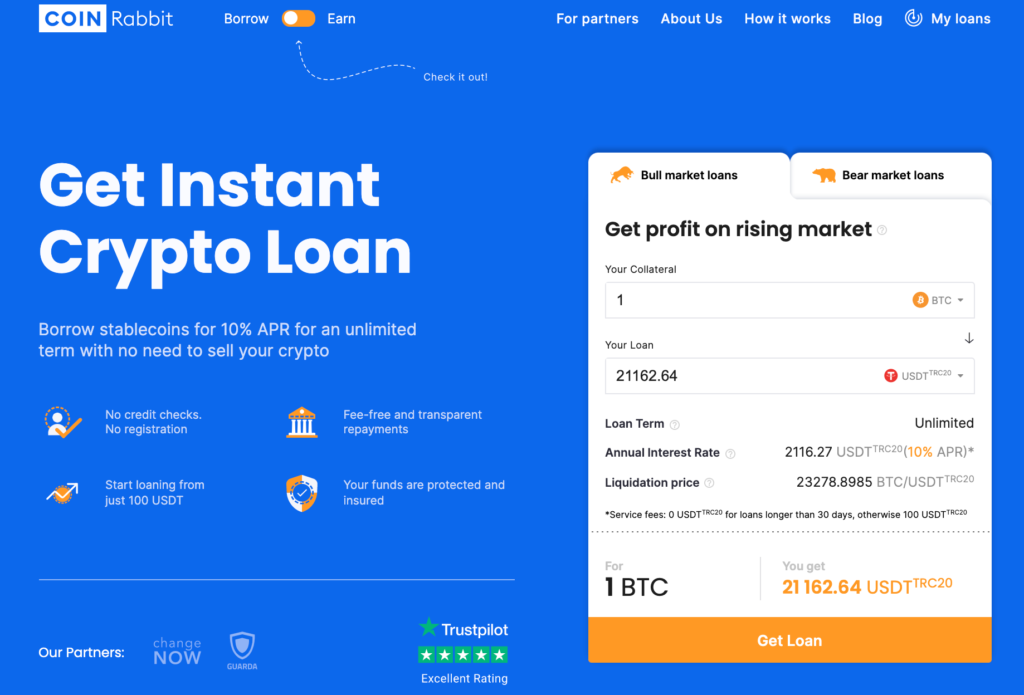

CoinRabbit is one of the easiest ways to get quick loan on your cryptocurrency. No credit checks. No registration. No KYC.

You can start loaning from just 100 USDT for 10 APR% with unlimited loan term. This means that you can take the loan for as long as you want and get your collateral back anytime.

To get started, simply deposit a minimum $100 worth of crypto of your choice to CoinRabbit. As of writing now, CoinRabbit has a fixed 50% loan-to-value (LTV), meaning they will give you 50% of collateral value as loan.

Say you deposit 1 BTC and it costs $50,000, you will get $25,000 in Tether. You can close your loan anytime and get back your 1 BTC whenever you want, no question asked.

However, do note that, there’s an extra $100 service fee if you close your loan under 30 days. For most coins it’s only $50!

The interest is calculated monthly and is included in the repayment amount.

CoinRabbit supports many different types of cryptocurrencies for collateral deposits:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Firo (FIRO)

- NANO (NANO)

- Dogecoin (DOGE)

- Ripple (XRP)

- Digibyte (DGB)

- Monera (XMR)

- Chainlink (LINK)

- Uniswap (UNI)

- Compound (COMP)

- Maker (MKR)

- ZRX

- Yearn Finance (YFI)

- Chiliz (CHZ)

- Synthetix (SNX)

- Enjin (ENJ)

- Sushi (SUSHI)

- Bancor (BNT)

- Fantom Token (FTM)

Pros:

- Beginner friendly

- High Privacy. No KYC, No registration.

- A wide range of collateral options. CoinRabbit supports many popular cryptocurrencies as collateral.

- All your crypto assets are safe guarded with ChangeNOW and Guarda Wallet.

- No fees for crypto deposits or withdrawals.

- Unlimited loan durations.

- Zero Fees. You only need to pay $100 fee, if you close a loan under 30 days.

- Get instant loan as low as $100

- No credit checks – Putting crypto as collateral to get a loan is fast and easy.

- Flexible repayment options

Cons:

- No mobile app is available

Get Instant Crypto Loans at CoinRabbit

3. Binance Loans

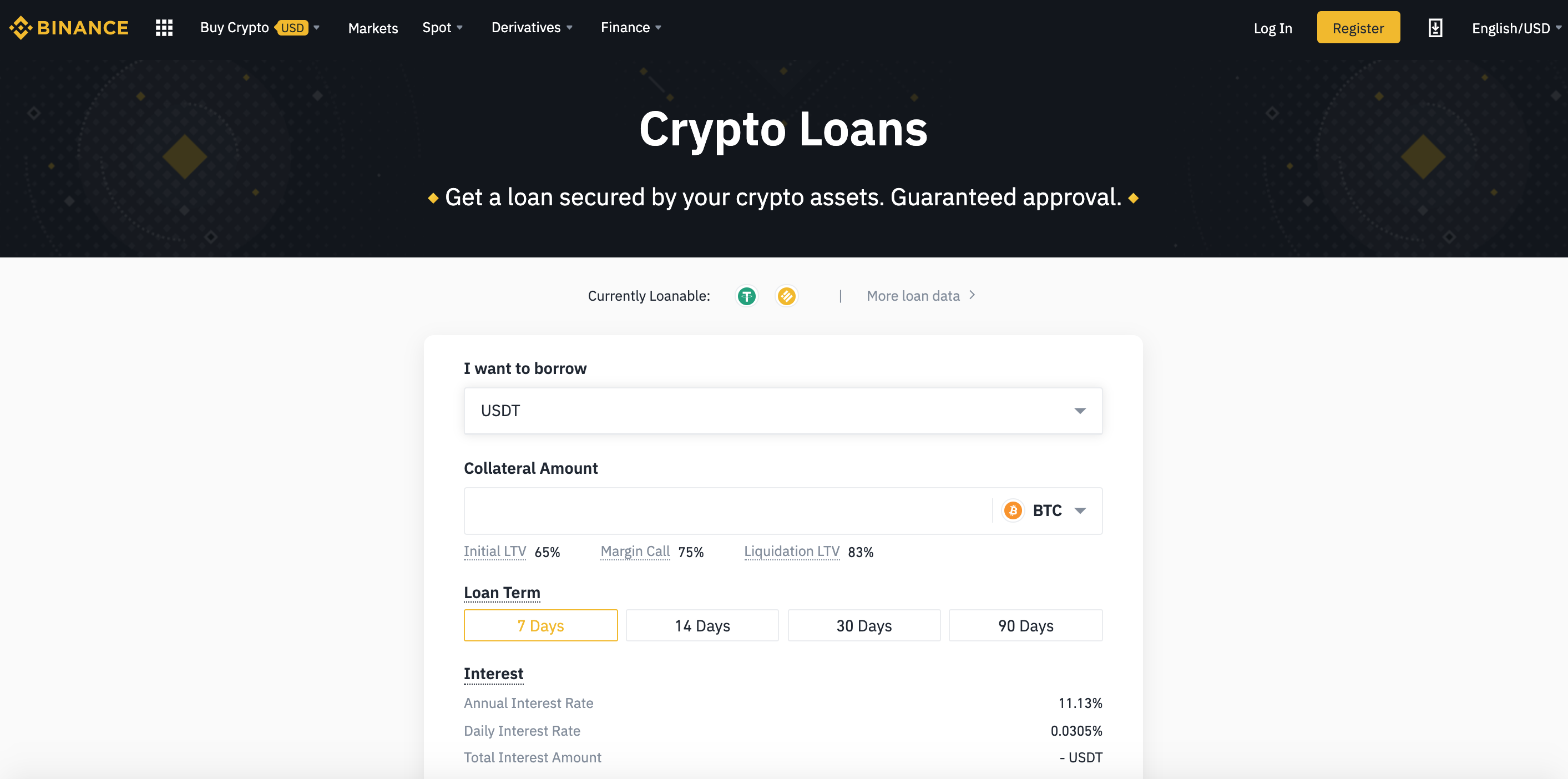

Binance Loans lets you borrow two stablecoins ( USDT or BUSD) against your cryptocurrency (BTC, BCH, XRP, ETH, EOS, or LTC).

Once you select the period of your loan term (options include 7, 14, 30, and 90 days), Binance Loans will calculate the collateral and repayment amount that you need to secure the loan.

You give Binance your crypto and you will receive Tether (USDT) or Binance USD (BUSD) straight in your account. You can then withdraw this stablecoin from your account and use it any way you want.

As of writing now, the minimum loan amount is 100 USDT/BUSD. (100 USDT = 100 BUSD = $100 USD)

And you can borrow up to 65% of the value of your collateral for the loan.

Binance also offers another loan product specifically for traders who want to get more crypto to amplify trading results. With Binance Margin, Binance traders can borrow up to 5x the amount of crypto in their accounts. With that said, it’s a very risky endeavor that’s definitely not for amateur investors and traders.

Binance also offers another loan product specifically for traders who want to get more crypto to amplify trading results. With Binance Margin, Binance traders can borrow up to 5x the amount of crypto in their accounts. With that said, it’s a very risky endeavor that’s definitely not for amateur investors and traders.

Pros:

- Anyone can borrow a loan as long as you’re a registered user of Binance

- The minimum amount of loan is very low

- High Loan to Value ratio (LTV)

- A huge variety of crypto available to borrow and use as collateral for a loan.

Cons:

- Only offers short term loan that’s suitable for getting a smaller amount of money relatively quickly

Get a crypto loan with Binance

4. SALT

With a loan limit of min $5,000 to max $25 million, SALT lending is more suitable for crypto HODLers who’re looking to get a big loan instantly with their crypto holdings.

With SALT you can take out a loan with your Bitcoin and other cryptocurrencies such as ETH, XRP, LTC, BCH, Dash, Dogecoin and PAX Gold.

SALT offers a higher LTV of 70%. This means that you can get more dollars out of every crypto collateral that you deposit.

But keep in mind that the total cost of repayment rises as the LTV increases.

SALT uses its built-in digital asset cold storage to keep your funds safe. If SALT platform is compromised in the event of theft, fraud, or other crimes, they promise to cover 100% of your collateral assets held in their cold storage.

Plus, its multi-signature process ensures that no one can move your funds without any consent.

Pros:

- $0 origination fee

- Expansive insurance coverage and Advanced security. Use cold storage and multi-sign to protect your crypto.

- Terms from 3 to 12 months

- Mobile app is available for both Google Play and App Store, making it easier to manage your crypto investment on the go.

- Low interest rate, starting from 5.95%

Cons:

- The minimum loan amount is quite high at $5,000.

5. BTCPOP

BTCPOP is the world’s first Peer-to-peer Bitcoin lending platform that allows you to loan Bitcoin without verifying ID.

However, if you wish to get a Bitcoin loan without any verification, you’ll need to pay a higher interest rate of 25%.

To save yourself from paying expensive interest, I’d suggest you submit personal details and proof of ID and get an instant loan as low as 15% APR (Annual percentage rates).

At first, it may take you some time to get used to the platform. But once you’re familiar with the interface, getting a Bitcoin loan with BTCPOP is a piece of cake.

Even if you’re not in need of urgent cash, you can try out this feature, and start borrowing as low as 0.01BTC and set your own APR limit. This means, you only pay back what you can afford.

BTCPOP is a community-driven platform, and you’re dealing with another crypto lender directly. To increase your chance of getting a loan, you may need to spend time building your reputation by making sure that you pay off all your loans on time.

They store your crypto funds in their offline cold storage. You can also earn some interest by putting bitcoins in their accounts.

Pros:

- Peer-to-peer lending platform

- Borrow up to 500 BTC

- Option to take a Bitcoin loan without verifying ID

- Users can create own custom loan, set their own terms and interest rates

Cons:

- 2% late repayment fee

- Very high APR to take a loan without collateral

Risks and Benefits of Bitcoin Loans

Borrowing money using Bitcoin as collateral is not without risks.

When you take out a Bitcoin loan, you temporarily transfer ownership of your BTC in return for cash.

This means that you have no control over your private keys. You have to trust that the Bitcoin lending service will keep your coins safe and won’t run away with your crypto assets.

You’ll only get back your Bitcoin once you repay the loan with interest.

But what if you fail to repay the loan? Then you will risk losing part or all of the collateral that you post.

Generally, you can borrow up to 50% of your collateral value, better known as loan to value ratio (LTV).

This means that you get $1 in US dollar for each $2 of crypto collateral that you put down.

But, in case the value of your crypto assets drops significantly, you will need to deposit more collateral or paying down the loan balance.

However, Bitcoin loan is YUGE!!! and is another step towards Bitcoin mainstream adoption.

Collateralized lending is getting more and more popular among crypto investors.

Here are a few main benefits of taking a Bitcoin-backed loan, rather than selling your Bitcoin or getting a traditional bank loan:

1. There are no credit checks.

If you have bad credit, getting a loan through a conventional method can be very difficult. However, in the eye of Bitcoin, everyone is the same. Everyone gets the same loan terms and interest rates, regardless of credit scores or social status.

2. It’s easy to get started.

You can quickly sign up for a free account on Bitcoin loan and lending platform with your email ID and start looking for a lender.

3. Instant access to money

You can gain access to money when you really need it within a day -without going through a lengthy application process and submitting redundant documents.

4. Keep the massive potential upside of your Bitcoin

If Bitcoin goes up, any gains from the price appreciation are yours to keep, once you pay off the loan.

5. It’s NOT a taxable event

Compared to the alternative of selling your Bitcoin for cash which requires you to pay tax, borrow money against it is not a taxable event. In other words, taking a Bitcoin loan can save you from paying unnecessary taxes.

What’s more, the interest you on the loan repayment may be tax-deductible against your net investment income depending on how you use the proceeds of the loan.

It’s definitely a great way to get tax-free dollars with your cryptocurrency.

Conclusion: Best Bitcoin Loan Sites

Rather than selling off your Bitcoin for cash, you can gain access to hard cash when you need it by taking a bitcoin loan at the lowest interest rate possible,

However, Bitcoin loan and lending is a very new financial industry that comes with its own unique set of risks.

But it should not stop you from embracing the digital transformation of the financial system.

Consider the pros and cons of taking a Bitcoin-backed loan, understand what they are and pick one crypto loan platform that suitable for your needs.

That’s all for now. As the space of cryptocurrency is rapidly evolving, I’ll be updating this post regularly with the latest info, so keep coming back to discover more.

I hope this list helped you hold on to your precious Bitcoin while getting access to fiat money when you need it.

On the other side, these Bitcoin loan sites also provide you passive income-earning opportunities. Simply save your Bitcoin on the Bitcoin platforms, it will automatically generate lucrative returns without any work on your part. Learn how to earn interest on your Bitcoin and cryptocurrency holdings here.

What do you think?

Would you borrow money against your Bitcoin and cryptocurrency? Why or why not?

Last but not least, if this post was of any help to you, please share it on Facebook, Twitter and Pinterest!

If you think any of your friends would find this helpful, share this post with them.

I’ve handpicked a few guides for you to read next:

- Crypto 101: The Ultimate List of Cryptocurrency Resource

- 10+ Easy Ways to Make Money with Bitcoin and Cryptocurrency

- 4 Best Ways to Convert Bitcoin to Cash

- 6 Best Bitcoin Lending Sites to Earn Bitcoin Interest

- How to Invest in Bitcoin: The Ultimate Guide for Beginners 2020

- 10+ Legit Ways to Earn Free Bitcoin (#3 is My Favorite)

- 10+ Bitcoin Security Tips For Beginners

I live and breathe making an income online.

I’ll be sharing more ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails.

P.S: This Bitcoin resource is One of – if not the most – comprehensive resources for learning about Bitcoin with over 20 categories ranging from history to buying BTC, setting up a wallet, technical information, mining, security, and trading. Enjoy!