If you’ve been following Bitcoin for a while, you may have heard that the next Bitcoin (BTC) halving is likely to occur in May 2020.

If you’ve been following Bitcoin for a while, you may have heard that the next Bitcoin (BTC) halving is likely to occur in May 2020.

For the uninitiated, Bitcoin halving is an important event that will take place every 4 years, wherein the amount of BTC created awards to the miners will be halved (divided by 2).

Since 50% less Bitcoin will be generated every 10 minutes, this event can potentially have a dramatic impact on the value of Bitcoin.

The previous halving events (first happened in 2012 and again in 2016) have both boosted the Bitcoin’s price at least 10x.

And the third Bitcoin halving is going to happen somewhere around May 2020.

So, will the next Bitcoin halving pump the price like last time?

Today, I’ll pull back the curtain on exactly what you need to know about the Bitcoin halving, why it’s happening, how it could affect the future price of Bitcoin.

What is Bitcoin Halving?

Every 4 years or so, the number of new bitcoins that are mined and brought into circulation will be cut in half.

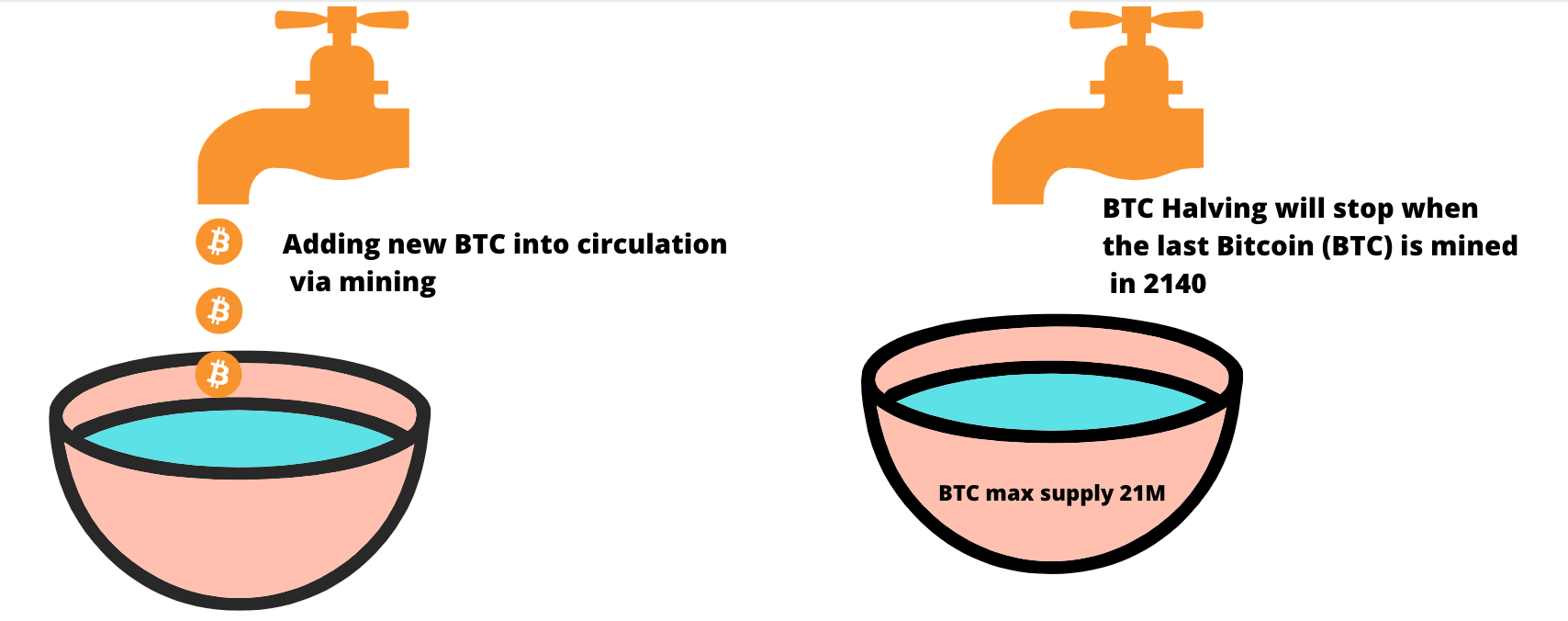

To help you better understand the subject, think of it like a bowl and a faucet. The bowl represents the total number of bitcoins that have already been mined; in other words, the current supply of Bitcoin on the network.

The faucet represents the new bitcoins that will be mined and added into the bowl.

At present, 18 million have been mined, leaving under 3 million bitcoins to mine.

Every 4 years, the faucet is turned off a little bit, With the passing of time, water flowing through the faucet becomes slower until it completely turned off. This process is referred to as a “halving”. With that said, eventually what we have in the bowl will be the maximum supply of 21 million bitcoins (BTC).

No new coins will ever be created after that.

Why Bitcoin Halving is Happening?

New bitcoins will be distributed into the network as an incentive for miners automatically, without control of any government, banks or organization.

Unlike traditional currencies like USD, GBP, AUD, which central banks can print the money supply at will, Bitcoin has a limited supply of 21 million.

And thus, Bitcoin is different to our current fiat currencies which use an inflationary model.

When Satoshi Nakamoto first created Bitcoin in 2009, he set up some rules in the bitcoin protocol to keep inflation under control.

- Bitcoin has a hard supply of 21 million.

- Every time 210,000 blocks (or roughly 4 years) were mined in the blockchain, bitcoin reward would be halved. The Bitcoin halving process will continue to happen until around 2140, when all 21 million coins will have been mined.

When is the next bitcoin halving?

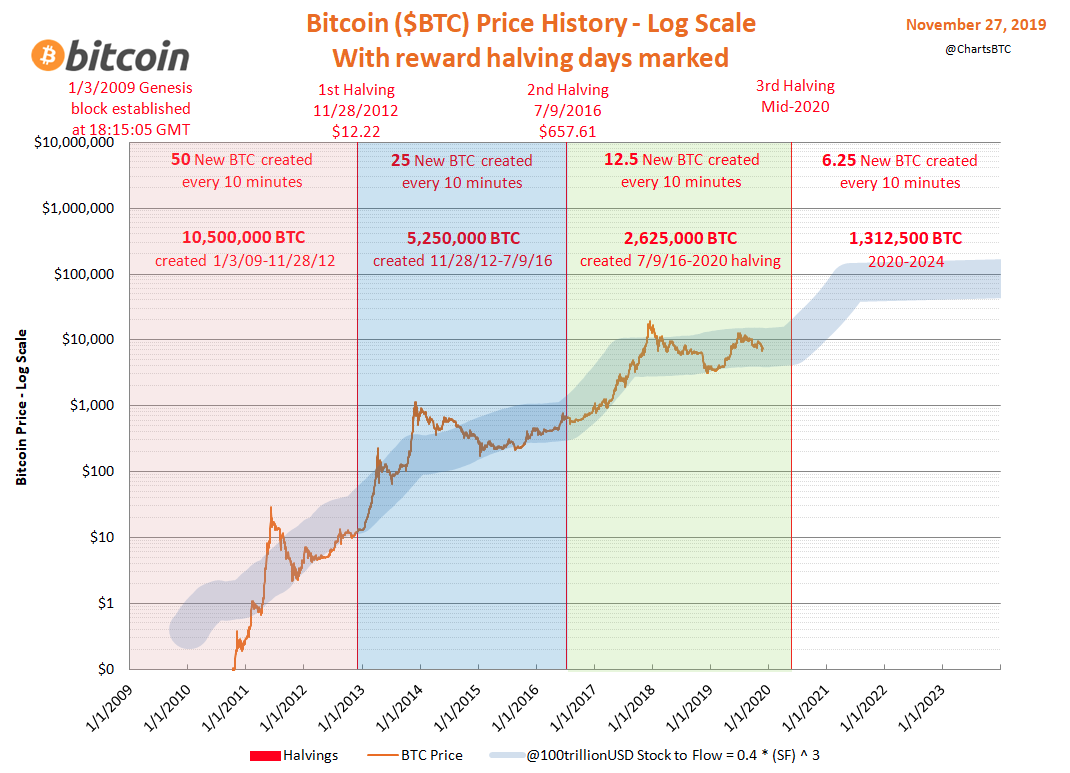

Mining is an expensive process, which requires a lot of electricity and special hardware. At the very beginning, when Bitcoin was invented in 2009, miners used to earn 50 bitcoins as a reward for confirming a transaction.

Then, first Bitcoin halving happened on Nov. 28, 2012, where the initial reward of 50 new bitcoins was halved to 25. When the second halving took place on July 9, 2016, the bitcoin reward was further reduced to 12.5 bitcoins every 10 minutes.

The next Bitcoin halving is expected in May 2020, in which miners will receive 6.25 bitcoins for each block successfully processed.

This halving process will continue happening after every time 210,000 blocks have been issued, until the last Bitcoin (BTC) is mined in 2140.

This halving process will continue happening after every time 210,000 blocks have been issued, until the last Bitcoin (BTC) is mined in 2140.

How might it affect the price of Bitcoin?

As you can see, a Bitcoin halving will cut down the supply of Bitcoin. Or more accurately, it causes the supply to continue to rise at a decreasing rate.

As you can see, a Bitcoin halving will cut down the supply of Bitcoin. Or more accurately, it causes the supply to continue to rise at a decreasing rate.

Think about this… There are 47 million (and counting) millionaires in the world. That means if every millionaire wanted to own an entire bitcoin, they wouldn’t be able to.

There literally is not enough to go around.

Because Bitcoin is scarce and cannot be reproduced infinitely.

Now, look at the price chart history of Bitcoin, we can see that the price of Bitcoin starts increasing at an unprecedented rate after each halving.

Still, Bitcoin is still in its nascent stages, there’s only been two previous Bitcoin halving.

Bitcoin’s yearly lows:

2012: $4

2013: $65

2014: $200

2015: $185

2016: $365

2017: $780

2018: $3,200

2019: $3,400

It’s almost as if there’s a trend.

In general, Bitcoin has increased in value at a very face pace after every halving event, followed by a steady, slow decline until it stabilizes.

“History doesn’t repeat itself — but it often rhymes.” ~Mark Twain.

If Bitcoin follows the price patterns of the previous 2 halving events, Bitcoin’s price could soar to a new all-time high record of $20,000 by 2021.

Over to You

What do you think?

Do you think now is a good time to accumulate more bitcoins before the next halving?

Why and why not?

As always, do your own research and analyze the market sentiment before you invest.

If you’re ready to purchase some bitcoins, check out some of my helpful guides:

- Buying Bitcoin with cash

- Buying Bitcoin with debit/credit card

- Buying Bitcoin with Paypal

- Buying Bitcoin with Bank Account

- Buying Bitcoin from ATMs

- Buying Bitcoin with gift cards

- 10+ Easy Ways to Make Money with Bitcoin and Cryptocurrency

- 10 Legit Ways to Earn Free Bitcoin (#3 is My Favorite)-UPDATED!

- Trading vs HODLing for Bitcoin Investors

I live and breathe making an income online.

I’ll be sharing more of ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails.

P.S: This Bitcoin resource is One of – if not the most – comprehensive resources for learning about Bitcoin with over 20 categories ranging from history to buying BTC, setting up a wallet, technical information, mining, security, and trading. Enjoy!

Disclaimer

Keep in mind that I’m not a financial advisor, my recommendations shouldn’t be used as professional investment advice.