I Hodl Bitcoin.

I Hodl Bitcoin.

My greed is killing the planet. So say the Eco Justice Warrior.

Yet I believe what I’m doing is simply getting rid of unwanted parasites from governing the world.

I’m voting with my money.

I’m not buying bitcoin to make a quick buck.

I have held on to my bitcoin through 85% drawdowns. Even when I was up by more than 500%, I didn’t sell any because I believe that one day I wouldn’t need to sell it at all.

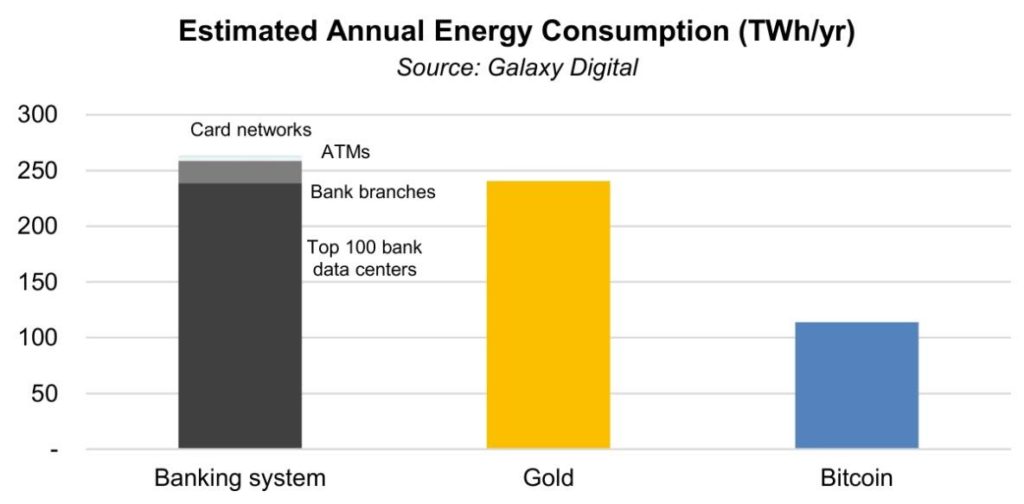

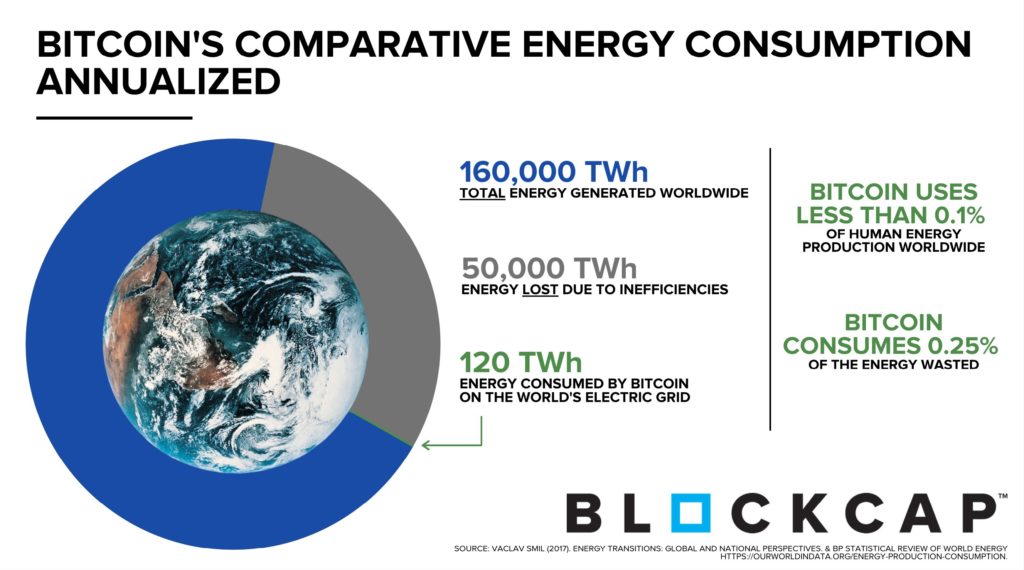

Yes, Bitcoin does consume a lot of energy.

“Bitcoin uses as much energy as the Netherlands“. “Mining Bitcoin could turn it into the fifth largest CO2 emitter in the world, surpassing even Japan. That means its dirtier than some of the biggest polluters in the world!”

Hold that thought. Since when is using electricity bad? Do I get to question how much electricity you have wasted? Should we survey the ROI of every industry or just shut down the Internet and power plants, and roll civilization back to the stone age?

First, if you really think that energy consumption is bad for the planet… Stop Googling. Stop driving Teslas. Stop using iPhones. Stop dancing on TikTok. Stop surfing YouTube. Stop turning on the heater. Stop turning on the air conditioner. Stop building golf courses.

This may come as a surprise, but every little thing we do consumes energy. That light you left on to ward off robbers. Xmas lights that fill your nights with warmth and joy. Leaving your computer running throughout the night…

The average American waste 58 percent of all the energy that’s being produced. In 2008, The New York Times published a study that estimates around 71 percent of energy generated for transportation is wasted, 66 percent is wasted in electricity, 20 percent is wasted in commercial and residential buildings, and 20 percent is wasted in manufacturing.

As long as people are willing to pay for the energy they are using, who am I to say its bad? If you ask me; “What did you waste energy on today?” I find that to be rude, I don’t waste energy on anything, in my view.

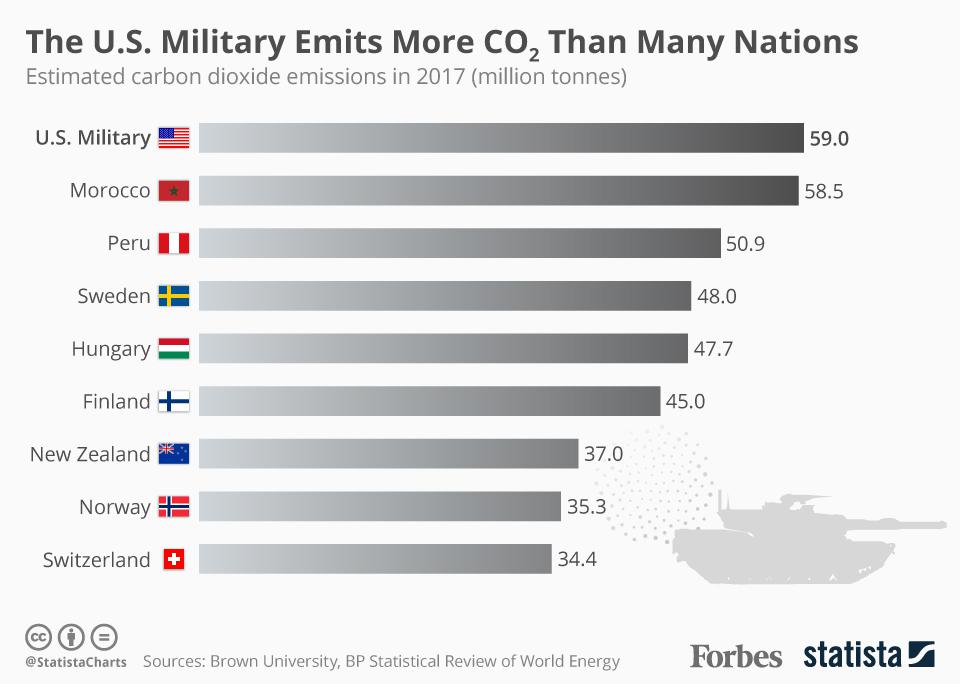

If you're blasting BTC for its energy use, you should attack these 1st to optimize impact

-US military

-Air conditioning

-Gold mining

-Clothes dryers

-Vampire electronics draw

etcIf you're not attacking those 1st, maybe it's not BTC's energy use you really have a problem with?

— Dan McArdle (@robustus) March 26, 2021

Second, consuming energy is not the same as releasing carbon emissions into the atmosphere. According to IEA estimates, Bitcoin produces three times less CO2 than Switzerland.

The average person breathes out around 500 litres of the greenhouse gas CO2 per day – Multiplied by 8 billion on the planet.

That’s why I find it preposterous when people look at bitcoin and feel like it’s the planet’s problem child. They don’t buy carbon offsets either when they get on a plane to travel.

People generally don’t spend years understanding this energy ‘narrative‘ that’s being paraded all over mainstream media before commenting. So they tend to go along with the loud Marxist chants of an eco justice warrior.

The fact is that energy is abundant in the universe. It can neither be created nor destroyed; energy can only be transferred or changed from one form to another. Einstein said it, not me.

Debating about energy consumption is like complaining about the laws of gravity, or the cycle of the tides, whether or not you like or dislike it. Our entire modern civilization is built on energy utilization.

Most of these climate bloggers/journalists understand that writing about “Why bitcoin is bad for our climate” gives them the most eyeballs.

At the end of the day, it is easier for a bystander to critic than to advocate for its merits if he/she hasn’t done the work necessary to understand why Bitcoin will bring about an overarching positive change in the world.

At its most foundational level, Bitcoin is honest money.

To outsiders, Bitcoin looks and feels like a Pyramid Scheme. The price just keeps going up and crashing roughly every 4 years.

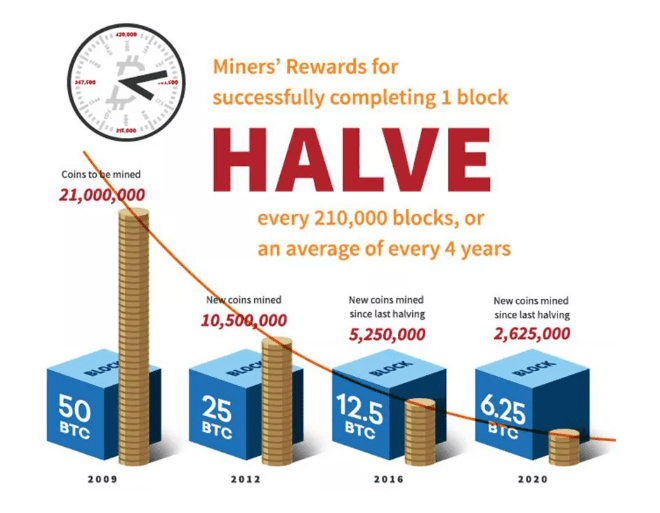

The reason is simple. Bitcoin was designed with a limited supply of monetary units known as bitcoin (BTC). 1 BTC is equivalent to 100,000,000 satoshis (sats)

This introduces a feature of scarcity into the network. More importantly, Absolute Digital Scarcity. Absolute scarcity means the value can never be diluted by the producers of these monetary units.

This creates a dynamic whereby there is real-time market demand for a static supply of 21 million BTC in circulation. (There is no central authority dictating the release of these units. It follows a pre-programmed schedule known as halvings)

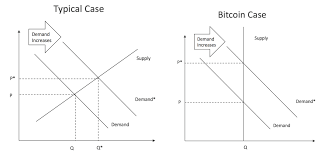

In any other economic good, supply meets rising demand thereby pushing price to stay relatively constant. In Bitcoin’s case, supply is fixed permanently. As demand rises, you cannot produce more BTC, hence the price rises over time as long as demand stays constant.

While Bitcoin’s limited supply makes it desirable as an inflation hedge or a store of value, this is ultimately a double-edged sword, as an inelastic supply is unable to adjust to elastic demand, making them vulnerable to large price volatility.

“Volatility is the price you pay for performance.” – Fund manager Bill Miller

How is Bitcoin’s Digital Scarcity Enforced?

In centralized systems like our current financial establishments, i.e. banks, payment apps, central banks, or gold; we have to ”Trust” a third party to look out for our best interest.

They don’t in most cases which has led to; spying, censorship, money printing, fraud, security holes, personal data harvesting… etc.

Then the events of 2008 showed us that we simply couldn’t trust our financial establishments anymore. And so on January 2009, Satoshi Nakamoto released the bitcoin software and started mining the first block (Genesis block) on the 3rd day of January.

Like a newborn child, Bitcoin did not start out strong.

It was weak, fragile and vulnerable. But nimble.

It could slip through the cracks undetected early on. Its one unfair advantage.

The idea that was Bitcoin spread like a virus for years. Each participant who downloads & runs the software becomes a node that enforces the immutability of its rules.

One of these rules is the Hard Cap of 21 million BTC. For many investors, including myself, this predictable money supply remain its strongest allure.

But that’s not the most interesting aspect…

I have been particularly fascinated with the burgeoning bedrock of believers who in spite of all indignities, continue to hold onto their bitcoin even after insane market crashes. These group of people find the Bitcoin story so compelling that they’d stake their entire life savings including their reputation and career in order to see it succeed.

This map shows concentration of reachable #Bitcoin nodes found in countries around the world. There's 10,000 nodes protecting the network. pic.twitter.com/pU0K4eBZDm

— Documenting Bitcoin 📄 (@DocumentingBTC) May 1, 2021

This isn’t just blind speculation either. This is an integer with a story. A way of sticking it to the man, which could also lead to a giant windfall.

Finding a Single Source of Truth

The internet is a decentralized system. By definition, decentralized systems do not have a single source of truth. (My version of the truth could be different from your truth, hence the age old argument; who is right?)

When money started flowing on the internet, we had no choice but to delegate more trust to the banks. This allowed governments a complete chokehold on our individual sovereignty and privacy.

While our digital economy is engineered to flow with as little friction as possible, banks became a bottleneck. This slow and highly inefficient centralized legacy system maintains a ledger of fiat currencies that underpin all of our worlds economy and wealth.

Trillions upon trillions of dollars of wealth is literally sitting upon an archaic 50-year old IT infrastructure with spiraling costs and inflation added to the mix. This risk and cost is then passed down on to us.

Before Nakamoto invented Bitcoin (The Whitepaper), no one could transact over the internet directly (P2P) without relaying their money through a banking system.

The first time I read Satoshi's White Paper it didn't mean anything to me.

Only once I had understood all the pieces individually could I put the puzzle together. pic.twitter.com/JeBaRuMsig

— Anil (@anilsaidso) January 13, 2021

Today with bitcoin (BTC), two willing parties anywhere in the world can transact directly with each other via the internet without the need of a central bank.

The Bitcoin Network like the internet is open to everyone 24/7 365 days a year. It is permissionless, neutral, borderless, immutable and censorship-resistant.

But without a central authority, how do participants of the Bitcoin network zero in on a single truth?

With a consensus algorithm known as Proof-of-Work (PoW).

Proof-of-Work is essentially a bridge between the digital and the physical realm. It creates an irrefutable history of the Bitcoin blockchain ensuring that double-spending cannot occur at all times.

Double-spending is a huge problem in the digital realm. That's because the internet copies every action, every character, every thought we make while we ride upon it. Every bit of data ever produced on any computer is copied somewhere. The digital economy is thus run on a river of copies. Unlike the mass-produced reproductions of the machine age, these copies are not just cheap, they are free.Click To Tweet

How can you transfer value through a medium that can be copied promiscuously and constantly?

There is simply no way to move digital information from A to B because that information is essentially being copied from A to B. How can you delete A after you’ve transferred value to B?

This is why the double-spending problem is so tricky. Without a central authority, there is no viable method to move value from A to B in a trustless manner. That is why the implementation of Proof-of-Work within Bitcoin is so groundbreaking to those who understand the intricacies of computer science and game theory.

Proof-of-Work is essentially ”proof” that you had expended energy to get the work done. Because work requires energy. There’s no way around it. You can’t lie about it. You can’t purchase it.

Trust must be earned with the work you have accomplished, over time. It cannot be faked or counterfeited (at least for long). It cannot be copied.

This has to be carried out through the process of Mining.

Bitcoin miners compete to solve complex mathematical puzzles in order to earn an incentive (a reward in BTC). This propels them to expend as much energy as they can in order to solve the puzzle faster than the competition. The winner would then receive bitcoin as a reward.

It’s important to note that this large amounts of energy is not wasted, as it plays a key role in securing Bitcoin from attackers by making it impossible for them to gain a 51% control over the network.

After 12 years of running PoW on the Bitcoin blockchain, it is now impossible to hack the Bitcoin network using this mode of attack. Andreas Antonopoulos, a computer scientist explains:

Andreas Antonopoulos – 51% #Bitcoin Attack pic.twitter.com/4YcAkHSY6W

— Dennis Parker (@Xentagz) February 24, 2018

Proof of Work fundamentally gives Bitcoin its immutability. A resistance to change.

As a result, it is the first digital monument of its kind.

In the realm of cyberspace where information can be changed, manipulated or falsified on a whim, this is an incredible breakthrough.

Much like The Great Pyramids is to our world in the physical domain. It is a declaration to every other civilization in history: “behold, this is the measure of our civilization … this is proof of work … proof of abundant resources … this cannot be built cheap.”

It took centuries of human labor to build, and would equally take a proportionate amount of energy to demolish The Great Pyramids today.

While we have sufficiently advanced technologies at our disposal that could demolish it in a matter of months; it would be incredibly foolish for posterity to even consider demolishing an artefact of time; a symbol of human ingenuity, culture and history.

To this very day, no one else could muster the immense resources needed to build another monument at the scale or on par with The Great Pyramids of Egypt.

"The #Bitcoin blockchain is the new wonder of the world, with more work and human ingenuity than went into the Great Pyramids of Egypt. The biggest computation ever done. A digital monument. A verifable artefact of digital gold – the foundation of a new digital age." – @Adam3us

— Documenting Bitcoin 📄 (@DocumentingBTC) June 1, 2021

Understanding how the pyramid is constructed stone block by stone block is also a great way of understanding how Bitcoin’s Proof-of-Work chain of blocks are mined.

A pyramid can only be built in one direction: upwards. It starts with a base, on top of which new layers are added. If a stone block (or piece of history) is to be altered, the pyramid layers would have to be broken down, the block replaced and built back up. Historic blocks become more secure as the pyramid rises, and immutability of the pyramid is directly proportional to the energy that was utilized to erect them. If you could imagine that the pyramid construction continued throughout the centuries until today, with the latest technology being used as it became available, the first layers of the pyramid would be immensely secure as they would be protected with layers of energy that includes three industrial revolutions of technological advances. How is a Pyramid Constructed?

Today, Bitcoin is the most decentralized system we have on the planet. An open, public, permissionless, borderless, neutral, censorship-resistant blockchain. A first of its kind.

While The Pyramids, The Great Wall, Taj Mahal or the Colosseum were all dedicated to a certain culture or religion, Bitcoin represents the first declaration of Proof of Work that has no leadership, culture or geographical borders. This also means that the Bitcoin blockchain is not bounded by the rise and fall of nation states or civilizations. It could in theory go on ad infinitum.

This discovery, this gift of absolute digital scarcity is as important as the discovery of the Number Zero. True digital scarcity can only ever be discovered once.

Why is there a need to reinvent the wheel?

Truly disruptive inventions; for example the incandescent light bulb, automobile or even air travel are always found at the fringes of mainstay solutions, where they often start out as insignificant toys.

When the light bulb was first introduced, people were skeptical and paranoid about its wizardry. While the automobile were deemed a menace to public safety.

Bitcoin isn’t any different. It is a ”Menace” of global economic proportions.

Bitcoin was underestimated for years. The media proclaimed its death hundreds of times. Most people didn’t think Bitcoin could survive after a 90% market crash. IT was written off. Deemed a ”Tulip bubble” of the 21st century by almost anyone who had a brain.

But what didn’t kill it, only made it stronger.

An incomplete list of events that stressed #Bitcoin but eventually made it stronger. An antifragility list, if you will. pic.twitter.com/kkqCHhtML5

— Travis Kling (@Travis_Kling) June 1, 2021

Many believe that Bitcoin is “just one of thousands of cryptoassets” — this is true in the same way that the number zero is just one of an infinite series of numbers. In reality, Bitcoin is special, nothing even comes close to rivaling its conception till date.

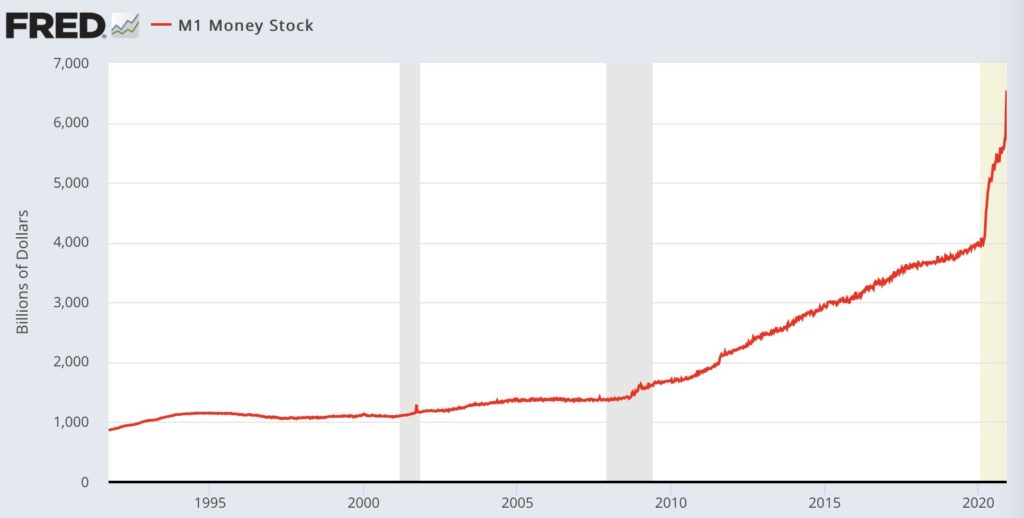

Why Fiat Money is Bad for the Planet

While mainstream media have been spinning tales about Bitcoin’s monstrous energy consumption, they’ve conveniently overlooked the monstrous hidden costs of the banking system and the weaponization of the U.S. dollar.

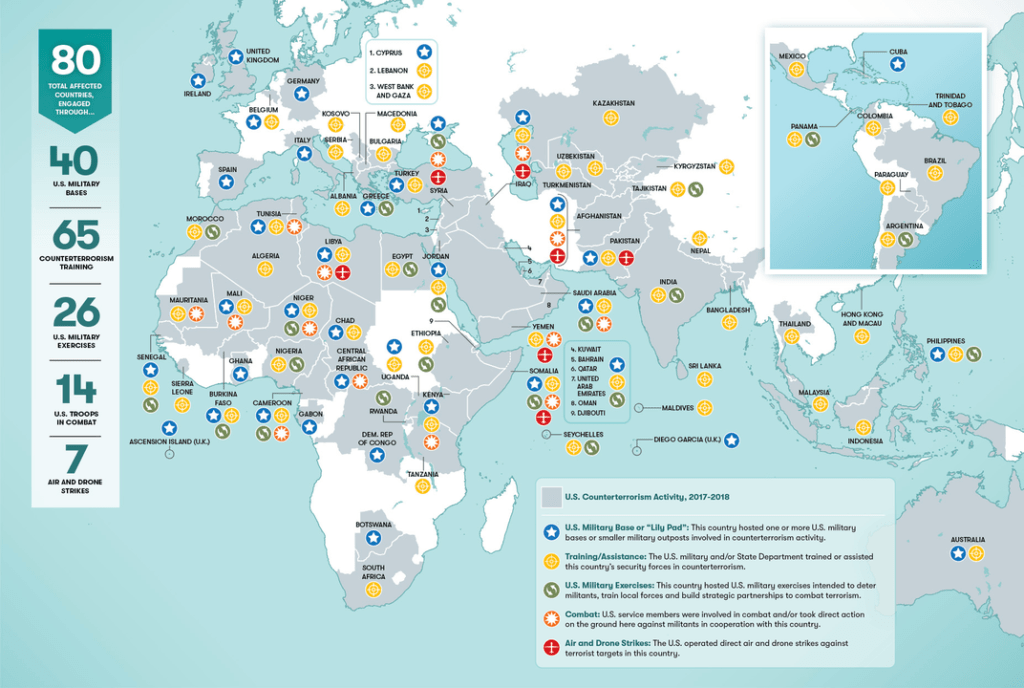

Banking is a monopoly and a cartel of epic proportions while the U.S. dollar is a world reserve currency that relies on oil, dictators, inequality and a military industrial complex.

It’s called the Petrodollar for a reason.

This is What Happens under the US dollar Standard:

1) US dollar only benefits the elite representing less than 4% of the world.

2) A vast military industrial complex is needed to bolster its world currency status.

3) Current financial systems cut off more than 2 billion from the world economy.

4) Keeps us indebted in the pretense of ”consumption” to make the economy appear rich, not us.

5) Easy to debase the currency at a keystroke and rob the savings of billions.

6) Used to fund wars and maintain military infrastructures worldwide.

7) Giant carbon footprint.

8) US dollar is no longer tied to Gold reserves like it was in the past.

9) Using WMDs as an excuse to invade a sovereign country.

10) Terrorism & money laundering just an excuse to invade the financial privacy of billions worldwide.

Exhibit A: Vast network of Military bases worldwide

The logistics and costs of keeping all the military bases in foreign countries functioning in order to enforce US interests around the world is enormous.

Not only that, the US has a huge industry in manufacturing arms for profit.

As a result, their military-industrial complex has got the country by the balls – leaving them with an insatiable appetite for warfare.

While the US dollar requires a powerful military to uphold its interest, Bitcoin’s Department of Defense requires no bullets, no bombs, no ships, no fighter jets, and no soldiers.

All it has is thousands of volunteers and millions of computers around the world cooperating to ensure its vast decentralized network is protected by an ark of energy.

You can’t get more neutral and peaceful than that.

Exhibit B: Spending on Defense???

Over the last decade, US Defense spending was more than the next 10 countries combined. But you should also pay close attention to its carbon footprint which releases more greenhouse gases than Morocco, Peru, Hungary, Finland, New Zealand and Norway.

According to the research from Brown University, the Pentagon would be the world’s 55th largest CO2 emitter if it was a country.

Important to note that this doesn’t get highlighted enough by the mainstream media.

Exhibit C: Carbon footprint of maintaining an army

You could argue that the military is intended to uphold peace in the world.

Not true.

Warlords shed blood over gold/silver mines for millennia

The remote/clean/stranded nature of bitcoin Proof of Work mining ushers in the Pax Bitcoinica–the natural resources of any physical place become less than its invasion cost

Efforts re-target the interstellar#worldpeace

— Zhu Su (@zhusu) March 19, 2021

Military superiority has always been an excuse to exercise power on a large scale and to subvert territories rich in natural resources.

But as we enter the information age, wealth has started transcending into cyberspace; reducing the importance of massed infantry formations.

How can one control a territory whose resources are fettered in cyberspace?

Given where we are going, the bombs, bullets, tanks, ships, and fighter jets aren’t going to be nearly as important as they once were. It would no longer be profitable just to conquer and control a country’s borders for the natural resources of a nation.

Foreigners relying on the US dollar are in for the Shock of their Lives!

Exhibit D

The Fed has increased the U.S. dollar money supply by 64.5% since the beginning of 2020. Which mean they’re effectively stealing the purchasing power of honest hard-working people.

Not only that, foreign countries use US dollars to buy up Treasury bonds, and as the bonds depreciate due to inflation, the US government effectively imposes seigniorage on the holders of its currency.

At the end of the day, the question you must ask yourself is this: how much monetary-productive energy is wasted due to money printing?

We can keep using barbaric manual shitcoins that rely on the authority of violence, causing endless conflict & politics.

Or we could upgrade to a peaceful software solution that runs on electricity and cannot be corrupted by politics or violence.

That's why bitcoin is worth it pic.twitter.com/xX6E75WBgN

— Saifedean.com (@saifedean) May 15, 2021

Bitcoin is a quiet protest.

If you’re not happy with your government and voting politicians in doesn’t seem to do the trick.

Vote with your money. Hit them where it hurts, their pockets.

F.A. Hayek in 1984: <em>I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can't stop.</em>Click To Tweet

Convert your outdated, dirty and worthless fiat into bitcoin; the future internet currency that’s open, neutral, borderless and decentralized!

The total energy generated worldwide amounts to 160,000TWh. Out of that total 50,000TWh is lost due to wastage and inefficiencies.

While Bitcoin just consumes 120TWh. That’s less than 0.1% of total energy generated worldwide.

Something to think about when you’re weighing the cost and benefits of Bitcoin. Especially with Bitcoin’s monetary policy (21mil BTC) where there is zero leakage compared to fiat where you’re taxed in the butt by inflation.

Just as the internet dramatically improved our lives tremendously, few back in 1997 could have envisioned how it has transformed our entire way of life in just three decades.

I believe Bitcoin too would benefit humanity in ways we cannot yet imagine.

You and I can now secure our own hard money and transact via the internet without needing to trust ANYONE.

It’s hard to believe that someone invented this and gave it to the world for free.

When you start to think about it, It’s incredible – could a company even develop something like this?

Ask any entrepreneur or visionary, what would it take to build this? and the answer you get is…

How much did it cost to put a man on the moon?

How much did it cost to put a supercomputer in every pocket?

Gold is $8.5 trillion purely as a store of value. You cannot transact gold on the internet.

Amazon, a centralized corporation that runs basically half the internet is worth a trillion dollars, but they can censor and cut people off from using their services.

They’re permission-based.

They’re a monopoly that has the power to censor anyone.

How much would it cost then for an open, global, decentralized, neutral, frictionless payment system to touch the lives of every single human being on the planet unconditionally, that allows them basic access to financial services? A Universal Access to Basic Finance.

Then it begins to dawn on you that Bitcoin could be worth hundreds of trillions of dollars.

At the end of the day I came to a conclusion that shrinking big bank and the US dollar monopoly can only benefit humanity, society and the environment as a whole.

The energy consumption issue has been blown out of proportion by the media as nothing more than a publicity stunt.

Dive down into the rabbit hole yourself and understand why the Bitcoin game theory works and why it will win hands down.

Mining Bitcoin will be the Most Profitable Use of Energy for the Planet

Misconception: Bitcoin mining is wasteful. “Bitcoin is the biggest catalyst for abundant, clean, cheap energy.”

“The energy problem has never been production. The energy problem has always been channeling loss… Here’s the insight: as Bitcoin’s price rises, Bitcoin mining will be the most profitable use of energy in human history that does not need to be located near human settlement.”

The biggest cities are centered around sea ports because oceans offer the greatest return on energy for commercial transportation. “We’ve developed fossil fuels but now fossil fuels are killing us… We’re moving energy (fossil fuels) to where there are people. In a green energy future we may move people to energy… Energy is prosperity… For the first time we have a huge pull towards renewable energy with a profit motive” without government subsidy.

I want to say thank you, Winson, your work is really helpful.