10 years ago, I was ridiculed for quitting my Engineering career to build an online business. None of my peers saw the potential in the platform like I did.

10 years ago, I was ridiculed for quitting my Engineering career to build an online business. None of my peers saw the potential in the platform like I did.

They said, “Only invest what you can afford to lose“, so I invested only my life savings, my career and my reputation.

I’m sort of proud that I made it out alive. Paid back my college tuition degree in full and at more than 10 times the speed. I had saved myself from working 9 to 5 for 10 straight years.

Today, I get ridiculed again for investing in another platform that has immense potential. Ignored. Shunned. Written off. But that just motivated me even more.

What can I say, I love having the last laugh.

Disclaimer: I have no experience whatsoever as an investor. I didn’t work in Wall Street. I don’t manage other people’s money.

For the everyday investor, stocks seem like a good way to build wealth. They’re easy to trade and understand. While they have the potential to provide some meaningful returns, there can be extreme downsides.

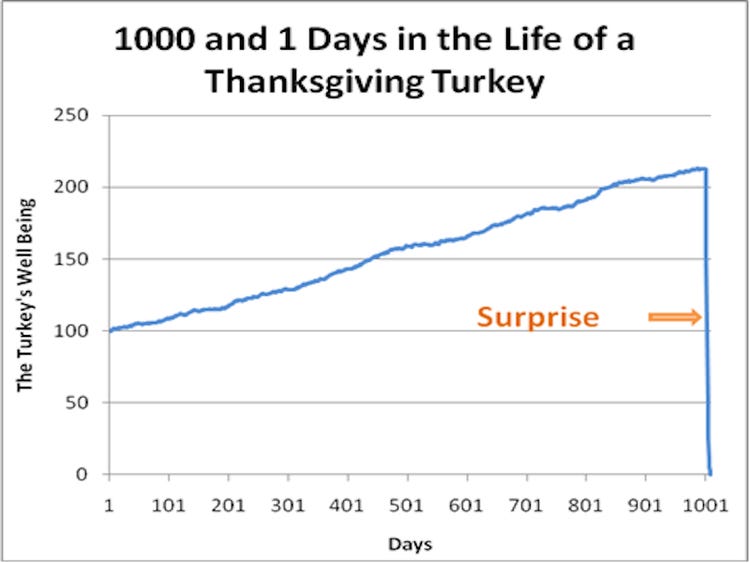

Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race “looking out for its best interests,” as a politician would say.

On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief. – Nassim Nicholas Taleb

That’s what happened on March 12th, 2020; when President Donald Trump abruptly issued the “travel ban” restriction.

Stock markets suffered the greatest single-day percentage fall since the 1987 stock market crash.

The crash was beyond belief. It was the sharpest decline in recorded history. Investors lost trillions of dollars in a single day.

While unceasing stimulus plans have calmed anxious investors for the time being, it is exposing the structural problems in the financial markets that were overlooked during a record 11-year economic expansion.

According to data compiled by Reuters Eikon, the average US worker must now work 126 hours to buy a single share of S&P 500 index. In 1980 it was 20.

The average US worker must now work 126 hours to buy a single share of S&P 500 index.

In 1980 it was 20. pic.twitter.com/GJqYmQHFkM

— Dan Hedl (@danheld) May 24, 2020

Do not invest a dollar until you’ve read the list below on Investing outside the stock market. I wish someone had made this list for me 10 years ago, but nobody did that for me. So I’m doing it for you.

A prudent investor has to understand what I consider to be the basics. We’ve gone so complicated in finance that every mom-and-pop investor is literally gambling away their retirement savings on the stock market.

1) Spend Time Buying Assets

Buy more money with your money. Until you generate more than enough, don’t spend it on frivolous things like a university education, a house or a car.

Contrary to popular belief, these are things that lead people into debt. Debt are the invisible chains of servitude. Don’t fall into debt for stuff that doesn’t generate income for you.

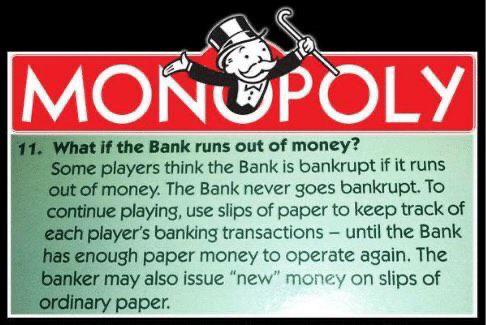

If you don’t understand how the whole monetary system works, just start with rule #11 from the Monopoly board game. Central banks can create money out of thin air to buy assets, while you have to trade your earthly hours for it.

Question is, can you earn money faster than they can print?

Praet: As a central bank, we can create money to buy assets #AskECB https://t.co/zTQuU4y1ch

— European Central Bank (@ecb) March 12, 2019

… and what is the whole point of the game?

The idea is to force the other players into bankruptcy. Leaving the winner with all the assets and no customers.

Inflation has destroyed more than 90% of the dollar’s purchasing power. By 1990, an annual income of $10,000 was required to buy what took only $1,000 in 1914.

That incredible loss in value was quietly transferred to central banks and the government in the form of hidden taxation.

That’s why it’s important to learn how to build your wealth. Wealth are assets that appreciates over time even while you’re asleep.

You’re not going to get rich one day working for your boss. You must own an equity, a piece of business or an asset in order to gain your financial freedom.

If you have little capital from the start, whatever money you make, reinvest it right back in yourself. I started with self-education (not to be confused with a college education).

And the truth is, rich people acquire assets — things that make them money over time — while poor people just get liabilities, junk that won’t make them any money.

The more junk you buy, the less freedom you’ll have. Chasing the hottest new device, the cool car, or trendy toy is a one-way ticket to the poorhouse!

Rich people read things, do things, say things, avoid things, and spend their money on things very differently than everyone else. Rich people are usually far more financially literate than their poor counterparts; they understand money, and how to make money work for them.

Rich people buy luxuries from the money their money made them; poor people buy luxuries from the sweat of their brow and hard labor.

2) Learn the History of Money

Growing up, I wasn’t poor — I was in a middle-class family where my dad could afford to bring me travel once a year and also gave me a formal education. Millions of people had it harder than me!

Still, I saw firsthand what financial insecurity was. My dad lost his job because of internal company restructuring, and our family was forced to rethink our living standard. We had to forgo many of the luxuries we took for granted.

From that day onward, I made money a high priority in my life. I didn’t want to experience that kind of financial distress again, and never want my family to, either. So I’ve spent thousands of dollars and untold hours on courses, coaching, books, and learning about money.

While my peers were out looking for a job, I bootstrapped down and learned about money. I learned how to survive on my own making money with nothing but my laptop and an internet connection.

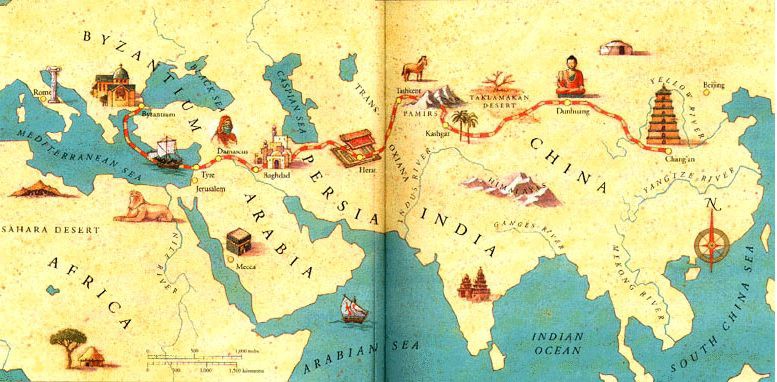

Over time, I gradually built cash flow for myself. I had to learn the history of money. There was no other way. It’s the lifeblood of my business. It put food on my table.

For most people money is just a piece of paper or numerals inside a bank account. They take it for granted. Born inside the system, they tend not to question it.

Lots of people in my generation don’t remember a time when folks didn’t believe in paper currencies. There was a time when money was cattle, shells, stones, beads, metal, plastic and then paper. Today, bits of information of 1s and 0s denotes how much money we have.

Gold was used as money many decades ago… It was the economic “barometer” for sound money.

Without understanding where money comes from, you will struggle to understand why it’s always so difficult to keep up with paying the bills.

Most people don’t pay enough attention to their money. Most only worry about how much they get paid. Or whether their assets are going up or down in value; they rarely worry about whether their currency is going up or down.

Most people don’t pay enough attention to their money. Most only worry about how much they get paid. Or whether their assets are going up or down in value; they rarely worry about whether their currency is going up or down.

Think about it. Right now how worried are you about your currency declining relative to how worried you are about how your stocks or your other assets are doing?

If you are like most people, you are not nearly as aware of your currency risk and you need to be. Be skeptical. Dig deeper!

People tend to think that a currency is a permanent thing and that “cash” is a safe asset to hold. But that’s not true because all currencies devalue or die. You have no choice but to explore the risk or hedge against such an episodic event.

There are a thousand things to learn. Start by studying the history of money.

- How to Escape the Rat Race (And… the Origin of New Year’s Day)

- The Changing Value of Money

- WTF Happened in 1971

- The Big Cycles Over The Last 500 Years

- The Story of Your Enslavement

- The Stories We Tell About Money

- The Bitcoin Standard

- The Internet of Money

- The Bullish Case for Bitcoin

- “Today’s Money vs. Bitcoin”

3) Observe Trends That Are Happening in Society

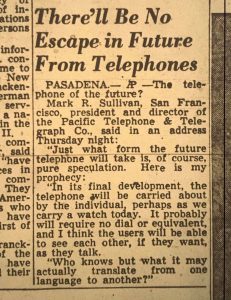

Possibly one of the greatest tech predictions in history. Written in The Tacoma News Tribune, 1953.

What’s going to change in the next 10 years?

What does society need 10 years from now and who’s working on it?

Think about the most important tectonic shifts happening right now. How is the world changing in fundamental ways?

Can you identify a leading edge of change and an opportunity that unlocks? You need to be thinking in terms of decades. Not months or years.

The mobile phone explosion from 2008 – 2012 is the most recent example of this. Before that it was the internet, credit cards, electrification, flight, automobile, etc… going all the way back to the discovery of “fire“.

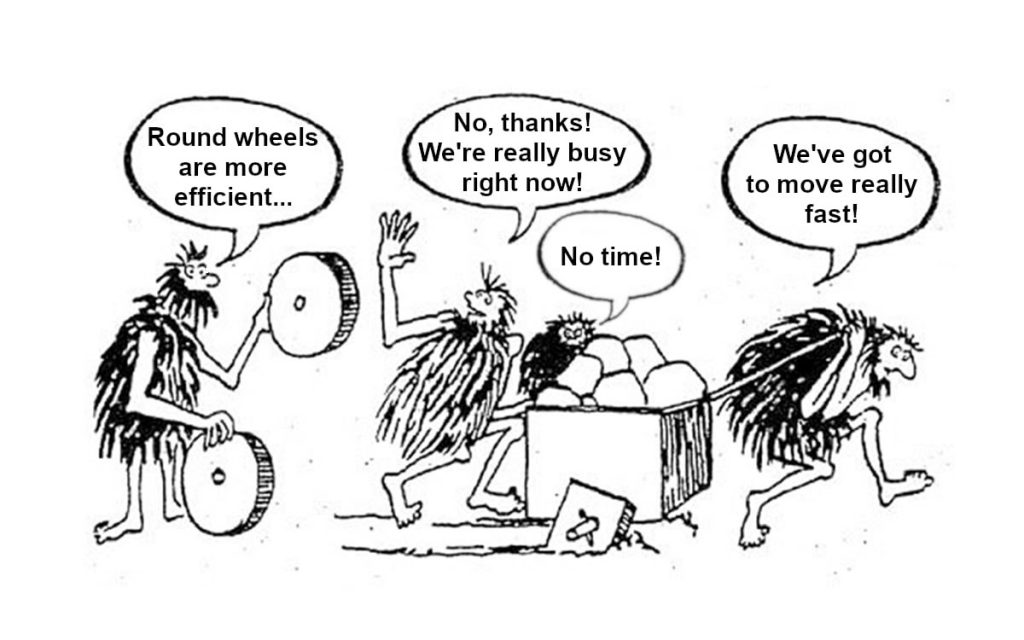

At one time, even these ideas seem radical to the mass majority.

We are overdue for another!

Horse and buggy people believed that automobiles need to be backed by horses. pic.twitter.com/GLGyT4vRQZ

— Winson Ng [🔑₿] (@WinsonNg12) September 8, 2019

You want to be able to project yourself 20 years into the future, and then think backwards from there. Trust yourself – 20 years is a long time; it’s ok if your ideas about it seem radical.

In 1994, Jeff Bezos was faced with the biggest decision of his life: should he quit his “well-paying” job as NYC hedge fund manager to create an online bookstore… or should he stay put?

Physical bookstores were dominant back then. Bezos imagined a future where everyone would shop for books online instead. The dinosaurs never saw it coming.

He decided to drive across the country and buy the domain rights to Amazon.com. The rest is history.

Adapt or Die… That is the rather pressing theme he had in mind at that time.

Lost video from 1997 of @JeffBezos explaining how he got the idea of Amazon pic.twitter.com/NTcdvHk1oe

— Scott Galloway (@profgalloway) November 8, 2019

Remember, this was a time when the internet was still in its infancy. It’s slow (takes hours to send a single photo). Noisy dial up tones. Too technical for grandma to use.

Yet, Bezos understood the potential implications of building the world’s biggest bookstore on earth on the internet.

His point is you can’t put 3 million books in print in a single physical bookstore. But you can do that the new way, using web & ordering online from distributors & publishers.

— dᴜʀᴡᴏᴏᴅ, TV/VCR Repair (@_Durwood) September 28, 2019

His genius is in figuring out a real solution to a problem, solved by leveraging a fast emerging technology that few understood at that time.

Building another Internet isn’t going to be the money maker, but leveraging on the infrastructure to solve existing problems were.

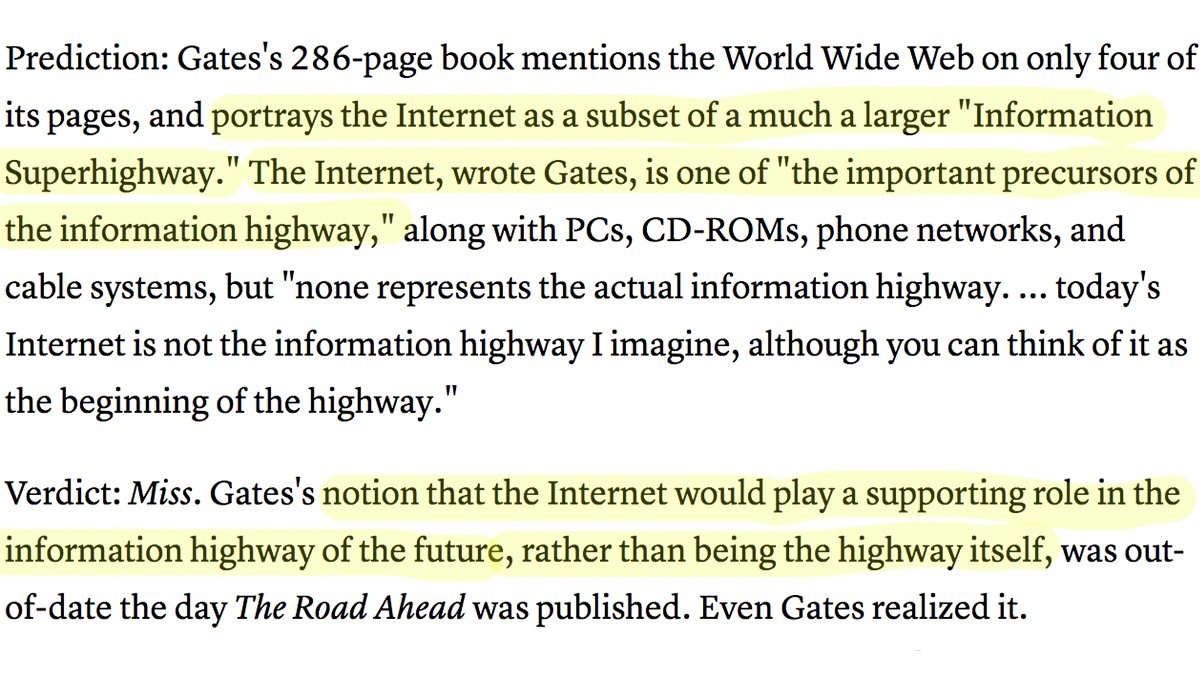

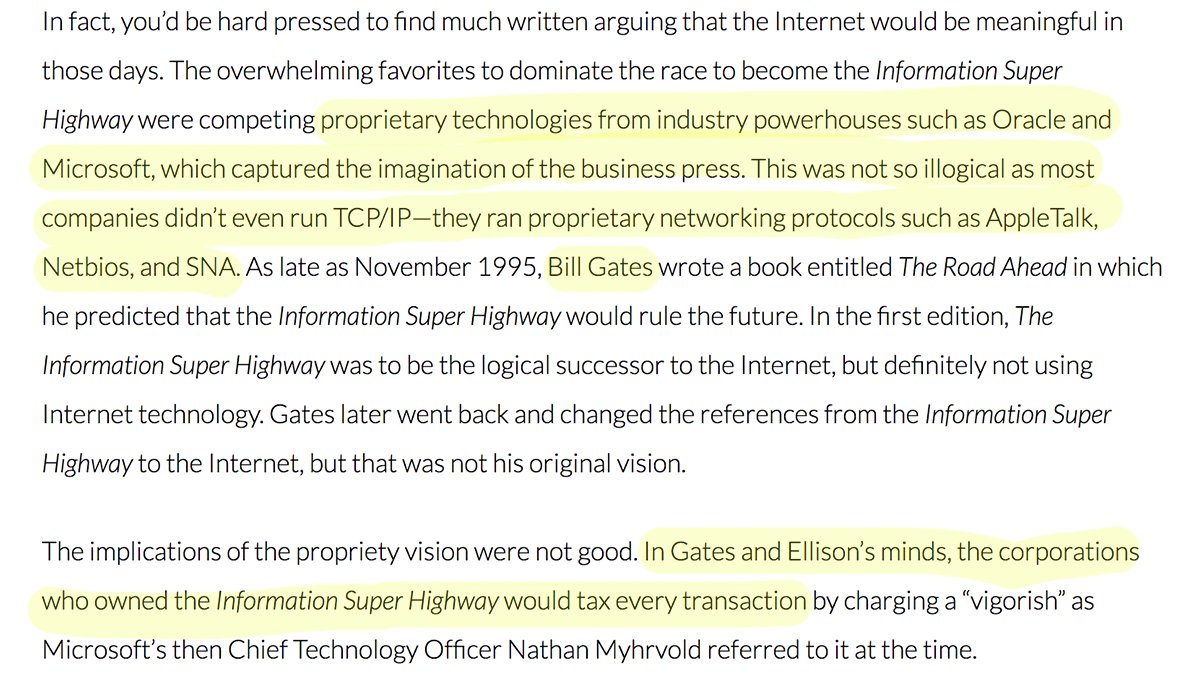

Even Bill Gates got it wrong …

25 years ago, Gates was so convinced that “the internet” would be replaced by a proprietary internet technology owned by some corporation like Microsoft or Oracle.

It turned out that “the internet” was the highway itself, not some proprietary technology or gatekeeper that would tax the beejesus out of every transaction that 8 billion people make on the internet.

In such a tectonic shift, the world changes dramatically that the big incumbents usually fail to understand or get it in time.

They usually get beaten by something they normally regard as fringe technology. Something they believed were of no threat to their own industry.

Look at what Uber did to the taxi business, or how Airbnb is taking on the whole Hotel industry. Literally, no one from the old system ever saw it coming.

Look at what Uber did to the taxi business, or how Airbnb is taking on the whole Hotel industry. Literally, no one from the old system ever saw it coming.

But how do you get good at differentiating real trends from fake trends?

Simple. Real trends are used a lot by a small number of people. Fake ones are used a little by a lot of people.

Any time you can think of something that is possible this year and wasn’t possible last year, you should pay attention. Tesla, Uber, Airbnb, Bitcoin was like this for me. After I experienced and used it, it was clear we weren’t going to be calling cabs for much longer.

Ask yourself this question, “Could the idea be huge if it worked?”

There are many good ideas in this world, but few have the inherent advantages that can make it highly successful. Most ideas don’t generate a valuable accumulating advantage as they scale.

This property is obvious for Facebook or Airbnb, but it’s often subtle. Some may sound ridiculous at first, but makes perfect sense. It could be counter-intuitive. Hard to understand. Easily misunderstood.

If you discovered an idea that might have that property, let me know. The opportunity for us to participate in these trends are massive.

4) Understand the Innovator’s Dilemma

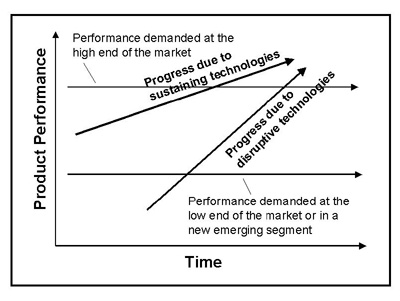

The Innovator’s Dilemma explains how innovation takes place, and why its common that market leaders and incumbents fail to seize the next wave of innovation in their respective industries.

The Innovator’s Dilemma explains how innovation takes place, and why its common that market leaders and incumbents fail to seize the next wave of innovation in their respective industries.

In the book, Clay Christensen demonstrates how disruptive technologies almost always arise from the fringes, where they start out as insignificant, or toy, solutions.

Great companies fail at identifying disruption due to the very nature of success. A Paradox.

How can you continue to focus on addressing customers’ needs that promise profits and at the same time focus on ideas that they reject; that offers lower profit and underperform existing solutions. It’s akin to flapping one’s arms with wings strapped to them in an attempt to fly.

The root of the problem lies within the failure of valuing new innovations properly.

“If you dislike change, you’re going to dislike irrelevance even more.” — Gen Shinseki

… and that’s how whole industries get disrupted or even threatened by an emerging technology.

Why did the auto dealers in New Jersey work to get Tesla’s direct sales model banned in the state?

Why does Uber have to battle taxi and limousine commissions in order to do business? Uber drivers complete 15 million rides per day.

And why didn’t Hilton or Marriott start Airbnb? Airbnb sees 500k stays per night.

The scale that these companies reach in just a matter of years is truly mind-boggling compared to their predecessors.

Institutions will try to preserve the problem to which they are the solution.” — Clay Shirky

The Shirky Principle’s observation is similar. It declares that complex solutions (like a company, or an industry) can become so dedicated to the problem they are the solution to, that often they inadvertently perpetuate the problem.

Banks, for example were a brilliant solution to the problem of securing money in the past where violence was predominant. But over time as more capital flowed into the banking system, money became intertwined with banking.

The two became one system — money/banks. The problem with banks is that they are in the business of debt. They make money by giving out loans. More debt means more money for them.

Today they can give out loans without needing any kind of reserves. Which means they can create money out of thin air. Banks can create almost all of our money as debt. This video explains how:

The bankers are dictating policy today because money and banking are no longer separated from one another. And that should be a huge concern for humanity.

They inadvertently perpetuate the continuation of the monetary problem to which they are the solution to. In effect problems and solutions became a single system.

Then about 12 years ago, Bitcoin emerged from the trenches of the 2008 Financial Crisis as an optionality to the current financial system.

Satoshi Nakamoto, a pseudonymous programmer released the open source codes for Bitcoin, a network that allows peer-to-peer transmission of cash denominated in bitcoins (BTC) over the internet without needing any intermediaries.

With only 21 million BTC, Bitcoin exhibits gold-like scarcity but with the additional property of being able to transmit over a communication medium.

Ignored and laughed at in the beginning as a geek experiment; today various “experts“, politicians, economists and nations are proposing a ban on Bitcoin. In many countries, money is still a system of control. Bitcoin sidesteps the need for any government intervention.

That action in itself, implies that Bitcoin could render these people obsolete.

In Bitcoin’s case, the solution that Nakamoto proposed was barely working, at first, and therefore ignored.

It solved the marginal problem of Double-spending that no-one in computer science could figure out until Nakamoto published the 9-page whitepaper.

Do you think Bitcoin is a little too difficult to catch on?

Here's instructions that you had to follow to send "letters" with a computer. pic.twitter.com/nfwr9KO6Jt

— Bitcoin (@Bitcoin) October 29, 2019

Disruptive technologies always start out solving marginal problems at first, and therefore ignored.

In the beginning, the internet was only used by scientists to transmit and share data with one another. Who would have predicted that 30 years later, everyone could use it to send cat photos, stream live events or even access 1.2 million terabytes of information in the palm of their hands.

The Internet broke the cartel of information. It didn’t pose a threat to powerful people or organizations at first; but as the network grew, it gave individuals the power to undermine authority and challenge their monopoly of information.

As a result, various despotic nation states even today still propose internet bans and censorship to curb the rise in individual freedom and power to the people.

Today, Bitcoin is breaking the cartel in finance. It is giving individuals the power of banking at their finger tips, which is essentially security, trans-portability and storage of value. And that seriously undermines those in power.

Bitcoin is a tool for freeing humanity from oligarchs and tyrants, dressed up as a get-rich-quick scheme.

Every entity tends to prolong the problem it is solving, progress sometimes demands that we let go of problems. We can then look to marginal solutions and ask ourselves, what marginal problem is this solving that might be a more appreciated problem later on?

5) Overcome Domain Dependence

A “domain” is an area or category of activity. Some people can understand an idea in one domain, say medicine, and fail to recognize it in another, say, socioeconomic life.

Or they get it in the classroom, but not in the more complicated texture of the street.

Humans somehow fail to recognize situations outside the contexts in which they usually learn about them.

This is something that Nassim Taleb, the mathematician explained in the book Antifragile.

Why is overcoming domain dependence important? Because it helps us identify legitimate investment opportunities outside of our realm. What we normally call “Thinking Outside the Box.”

Humans like to think in boxes. Each box contains the knowledge we acquired throughout our lifespan to help us go about a certain activity.

However, a box also implies that we’re mentally handicapped, unable to recognize the same idea when it is presented in a different context.

It’s also the reason why so many “experts” and researches fail to comprehend disruptive technologies and thus formulate an incomplete understanding of an entirely new “domain”.

A vivid illustration of domain dependence as explained by Taleb is as follows:

- A banker paying a porter to carry his luggage, and then afterward going to the gym to lift free weights trying to replicate natural exercises using kettle-bells as if he were swinging suitcases.

- A doctor recommending exercise as a good way to staying fit, but then writes a prescription for antibiotics in response to a trivial infection to keep a patient from getting sick.

- A gifted person in languages may find that she’s not able to transfer concepts from one tongue to another, hence needing to relearn the words e.g. “Chair” or “love” or “apple pie” every time she acquires a new language. Unable to recognize “house” (in English) or “casa” (Spanish) or “byt” (Semitic)

It is as if we’re doomed to be deceived by the most superficial part of things, the packaging or the gift wrapping.

This is why we don’t see investments that are not correlated to the mainstream stock market. We can’t recognize the marginal solutions to the larger problems until it’s too late.

So to traditional finance people, Bitcoin looks like an all-out attack on their business model.

It’s the same with the auto dealers in New Jersey trying to ban Tesla from selling directly to their customers. Large hotel chains that can’t understand why people would rent their homes to total strangers.

… and taxi drivers who fear Uber is taking away their jobs.

Remember Jeff Bezos’ mantra? Adapt or Die. You cannot stop the march of progress.

What’s the risk of domain dependence?

- You miss a growth opportunity and become a Luddite. Turn bitter and angry from losing your job.

- You get blindsided more quickly than you can react with new products and regulations from your bought and paid-for politicians.

- You fail to identify the once in a century opportunity that may not come again in our lifetimes.

How does one overcome domain dependence?

- Be an independent thinker

- Hire people from outside the industry

- Be introspective about your thought process

- Get ideas from new people who are eager to learn

- Collect so many unrelated ideas until they fuse together to form brand new ones

- Exit your domain and start from scratch

- Be a generalists. Meander across domains more and practice cross-pollination.

We will only start to attain wisdom or rationality when we make an effort to overcome and break through our domain dependence.

6) Look for Information Asymmetry

The best way of building wealth other than investing in the stock market is to look for asymmetric bets. Put simply, placing relatively small amounts of money on well-researched bets for life-altering gains.

Venture Capitalists frequently use “asymmetric bets” to invest in ideas with explosive upside potential.

There are a few ways of identifying such asymmetry:

- Listen to contrarian indicators ( e.g. 2008 Sub-prime mortgage risk )

- You find the mass majority has an extreme lack of understanding in the area

- Often exhibits extreme volatility

- Antifragile (things that benefit from shocks)

- Loves volatility, stressors, randomness, disorder

The greatest wealth is created by investing in something you believe in before people even understand it.

Look for the favorable side of the asymmetry. Meaning, find something with more upside than downside. If you have more to lose than gain, then it implies that it is an unfavorable asymmetry.

Investing in the stock market is an example of an unfavorable asymmetry. i.e. Similar to a turkey on day 1001.

What do investors in Wall Street, Goldman Sachs and JP Morgan know firsthand that mainstream mom-and-pop investors don’t? Inside information.

Therefore, you have zero edge. If you find out that Warren Buffett is investing in Apple, and you want to copy his trade, by the time you find out on CNBC or on Twitter, you are already on the losing end.

What makes you think you have an edge over hundreds of hedge fund companies who are closer to the source of the news?

Big hedge funds find an edge by doing some form of insider trading.

Billions of dollars are spent every day subtly manipulating the market without regulators being aware of it. If they get caught, they just pay a small fine of a couple of million dollars. It’s still profitable.

Your life savings are at the mercy of these people.

Sure. You could get lucky and profit from the ride. But you could also lose everything. You have more to lose than gain.

That is why, it’s important to get an edge. Look for asymmetric bets like VCs. Put no more than 10% of your liquid net worth into well-researched asymmetric bets that are favorable.

These are intelligent speculations.

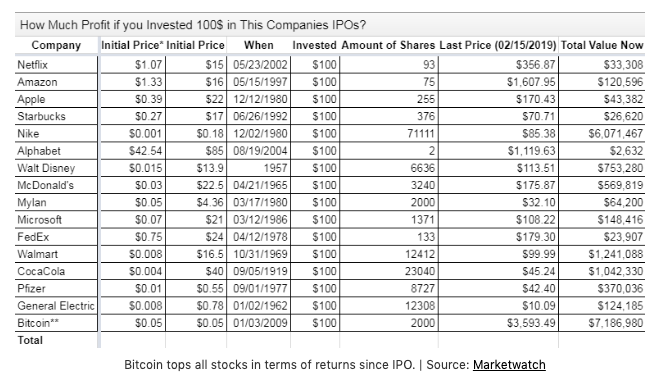

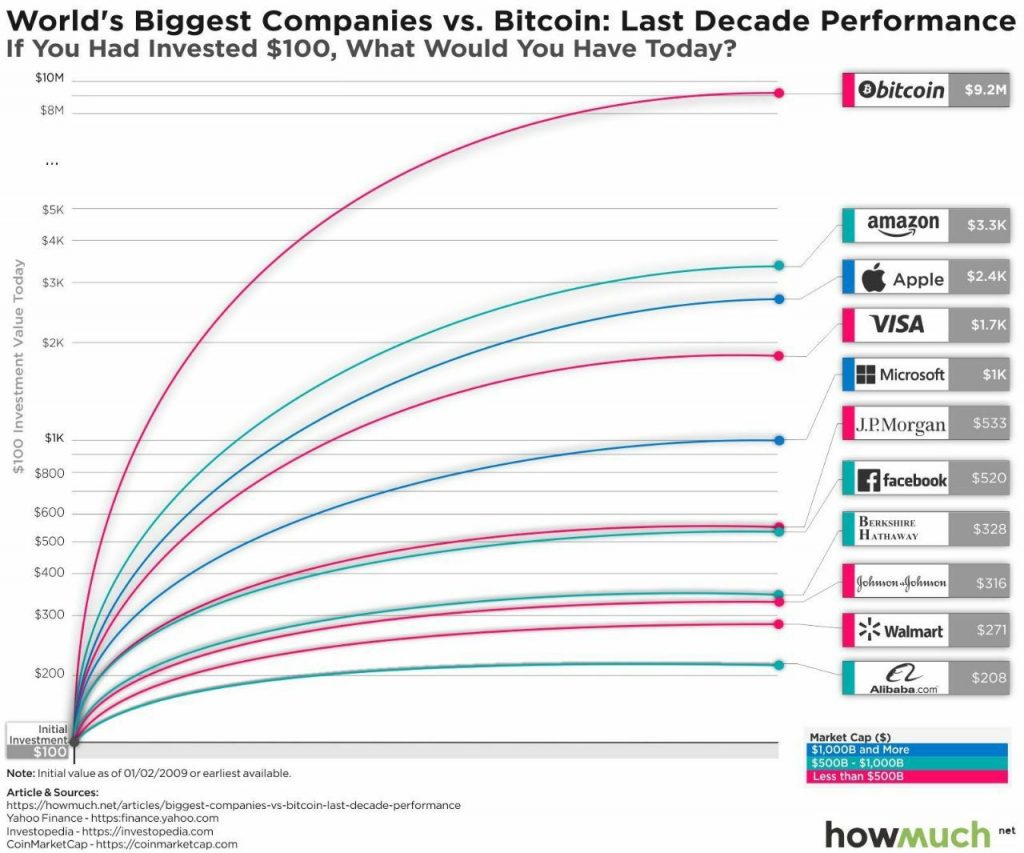

For example, If you invested $100.00 in Bitcoin in 2009, that investment would have outperformed the IPOs of the companies below exponentially 👇👇👇

Today that $100 investment is worth $19,000,000+.

Today one bitcoin (1 BTC) is priced around $9,200. Less than 5% of the world owns Bitcoin. It’s difficult for ordinary folks to understand because of its volatility and disruptive nature.

It’s not trying to out-innovate VISA or PayPal, it’s just taking on the global hegemony of the U.S. dollar. A hundred-trillion dollar disruption.

Bitcoin hasn’t crashed to zero despite numerous hacks on exchanges and bad publicity. It seems to thrive on it instead.

Politicians, economist and traditional finance people hate it because they don’t have the edge or power over it.

They can’t tax us or charge us a fee for using their banking network, so they’re calling for bans. Labeling it as a scam. Next they will blame it for the collapse of their currency.

For the first time ever, the best asymmetric bet for ordinary folks has been staring us in the face all along!

The simpler and more obvious the discovery, the less equipped we are in figuring it out using traditional methods.

Here’s a hypothetical scenario, (not to be taken as investment advice)

If you’ve a 10% allocation of your portfolio to bitcoin, a 10x additional upside is completely life changing (say, $5M vs. $500k).

A 10% loss however wouldn’t make a difference to you if you have $5M.

See the upside is multiple orders more than what you can lose.

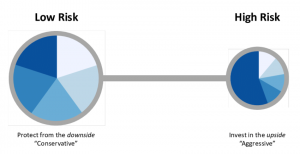

If you put 90 percent of your funds in cash/stocks and 10 percent in what mainstream media calls risky, bitcoin, you cannot possibly lose more than 10 percent, while you are exposed to a massive upside.

If you put 90 percent of your funds in cash/stocks and 10 percent in what mainstream media calls risky, bitcoin, you cannot possibly lose more than 10 percent, while you are exposed to a massive upside.

In the event of a catastrophic scenario, which no one can predict (like covid-19), your Bitcoin investment becomes more attractive due to extreme money printing like adding fuel to the flame. Bitcoin loves volatility.

On the other hand, someone with 100 percent in so-called “medium” risk stocks has a risk of total ruin (like the turkey dinner) from the mis-computation of risks.

This is what Taleb calls the barbell technique which remedies the problem that risks of rare events are incomputable and fragile to estimation error. A financial barbell strategy has a maximum known loss.

Antifragility is the combination of aggressiveness plus paranoia — clip your downside, protect yourself from extreme harm, and let the upside, the positive Black Swans, take care of itself.

7) Hold Long-term

Building wealth is an incredibly long term game plan.

Brilliant investors often look for asymmetric bets to get rich during a market crash. Because that’s the only way they stand a chance of making an incredible return for being proven right.

In times of relative stability however it’s often difficult to find that edge in the market. What investors call Alpha.

The rich then build long-lasting wealth by holding on to their well-researched investments for a long period of time.

I’m talking about decades. At the very least 5 to 10 years minimum.

It takes decades of commitment to building a great team, culture, business model and ecosystem in order for something to reach its full potential. That’s the requirement for long-term greatness.

You want something to be adopted by millions or billions of people? Well that takes time. Ambitious projects take time to play out.

The longer you hold on to something, the less it feels like gambling. The more work you’ve done to understand the project.

There's this myth that you could've been lucky and bought Bitcoin in 2012-13 and be up 100x+ now.

Actually you'd have sold at 5x or more likely 0.5x b/c you don't know why you put money in in the first place.

Investing is belief and thesis, not luck.

— Su Zhu (@zhusu) July 12, 2019

People say investing is like gambling. This is sort of true. But when you hold onto your investments over a very long time horizon, you’re taking advantage of market inefficiencies and the lack of “general public” understanding.

That’s why it’s important to not try to out-predict short term price movements. Ignore Technical Analysis (TA) Gurus – Don’t day trade! Don’t read the News!

This gives you a competitive advantage. Being right and patient is all that matters.

Best investments over the past decade:

- Bitcoin: +8,990,000%

- Netflix: +4,177%

- Amazon: +1,787%

- Mastercard: +1,126%

- Apple: +966%

- Visa: +824%

- Starbucks: +800%

- Salesforce: +792%

- Adobe: +790%

- Nike: +587%

- Microsoft: +556%

- Costco: +542%

- Disney: +423%

- Google: +335%

- McDonald’s: +325%

Food for Thought: If only the majority of investors were patient enough.

For day-traders? Well, they would have sold after they made some money. Or they could have sold at a lost. They may triple or 5X their money, but that is it. The lack of a vision, belief and understanding don’t build fortunes.

I wish I had kept my 1,700 BTC @ $0.06 instead of selling them at $0.30, now that they're $8.00! #bitcoin

— Greg Schoen (@GregSchoen) May 16, 2011

Also, If a project has a growing capacity of 50% per year or more, where else are you going to get that kind of returns and growth? Hold the asset. Take some profits. But never sell everything.

Investing long-term introduces emotional temptations to trade when doing nothing would be best. This applies to both abrupt price movements up or down.

Look over the shoulders of great investors. They take advantage of the lack of general understanding by buying and holding assets that are under-priced and less in demand now, but will be extremely valuable in the very distant future.

In 2015 I sold 800 BTC to buy a house for my family.

In 2018 I sold my house and bought back 50 BTC.

People who thinks I'm crazy for selling my house please know that my only regret is to have sold my bitcoins.

Investment in Real Estate is now garbage comparing to #Bitcoin. https://t.co/fK2ynLELFp

— Bitcoinization (@bitcoinization) August 13, 2019

We’ve only just begun…

In the world of Bitcoin, there’s so much more to delve into. That’s why I created The Zodiac Collection, that tells the story of Bitcoin and the cryptocurrency revolution from every angle you can dream up.

There’s a lot of exciting stuff to read — I’ve selected a few of the stories, to start with, below.

Want to Find out More about Bitcoin? Check out our latest mind-bending content here.

Follow my Tweets to learn my latest insights.

I certainly don’t want to overload your brain with the library of Bitcoin resources we have here.

Here are some special picks:

How to Invest in Bitcoin if You Missed the Bull Runs. – An honest look into investing in Bitcoin; if you decided to get into Bitcoin after reading about it in the mainstream…

- CoinMama Walkthrough Guide for Beginners: Buying BTC with USD/EUR Cards

- Buy Bitcoin With Paypal Instantly on these sites (Explained Step-by-step)

- How to Buy Bitcoin In Different Countries [+International Infographic Guide]

- 7 of the Fastest Ways to Buy Bitcoin (BTC) Today!

- How to Capitalize on the Bitcoin Halving (and Profit in the process)

- How to Buy Bitcoin At Discount

- 12 Popular Types of Bitcoin ATM Near Me (In Locations Worldwide)