If you’re looking for the best crypto margin platforms to trade leverage in bitcoin, this is THE List.

With over 25+ hours worth of research, this list is an incredible way to give you an inside look into twelve top crypto exchanges out there.

We’ll cover everything you need, including overall features, markets, supported pairs, margin trading fees, ease of use and security. Check out the cool trading features:

Below is a comparison of the Best Margin Trading Crypto Platforms w/ Leverage:

- Binance ★★★★★ – Best for Liquidity and Reputation (Our Pick)

- Bybit ★★★★☆ – Best for Beginners (No KYC < 2 BTC) (Our Pick)

- Phemex ★★★★☆ – Best for Membership Privileges (Our Pick)

- Bityard ★★★★☆ – Best for Simplicity (Our Pick)

- Blackbull ★★★★☆ – Best for CFD

- Kraken ★★★★☆ – Best for Safety Standards

- Kucoin ★★★★☆ – Best Crypto App

- Bitfinex ★★★☆☆ – Best for Pro Traders

- Huobi ★★★★☆ – Best for Rewards & High Leverage

- Bit.com ★★★☆☆ – Best for Options Margin Trading

- BitMEX ★★★☆☆ – Best for P2P Trading Crypto-Products

- Stormgain ★★★★☆ – Best for User Experience (↓)

Here, I’ll offer you my two cents to help you understand leverage a little better. When used the right way, leverage can have a very big impact on the quality of your life as well as finances.

Like a knife, leverage can both be useful and risky at the same time.

The society you see before your eyes is achieved through many different types of leverage. It requires much less energy to build a 10 story building when you leverage the time, technology, and skills of a handful of engineers than doing it all on your own.

Whether you’re building a business on the internet, selling on Amazon, branding on Instagram or gambling at a casino, you need to understand leverage and how it can affect your life.

But, never ever mistake someone using leverage for being a genius.

Just because someone ”made it” trading crypto, doesn’t mean they’re an expert worthy of your attention. Most of the time, it’s nothing but a puff of smoke. For every story of rags to riches, there are thousands more that lost it all overnight.

Crypto is already and incredibly volatile asset. Margin trading amplifies that even more by allowing traders to potentially multiply their gains in bull or bear markets. But with great returns lies even greater risk.

Buying bitcoin and Hodling itself is already a superior form of leverage. You are leveraging the network of millions of volunteers and hardcore believers around the world to come work for you. They work 24/7/365 and you have to pay them nothing.

They are writing the code, securing the network, building infrastructure, scaling payment rails, providing liquidity, employing global marketing campaigns, and much, much more.

Everyone is rallied around a single idea — to usher in this new decentralized monetary paradigm.

Think about that for a minute…

If you ever wanted to hire millions of people around the world to come work for you, it would cost billions of dollars. You would have to build a massive global corporation to support them all. Try dealing with the daily nightmare of coordinating 1 million employees and you’ll understand what a powerful leverage it is.

Remember there are only a handful of companies in the world that employ over 1 million people.

What Does Margin Trading on Crypto Mean?

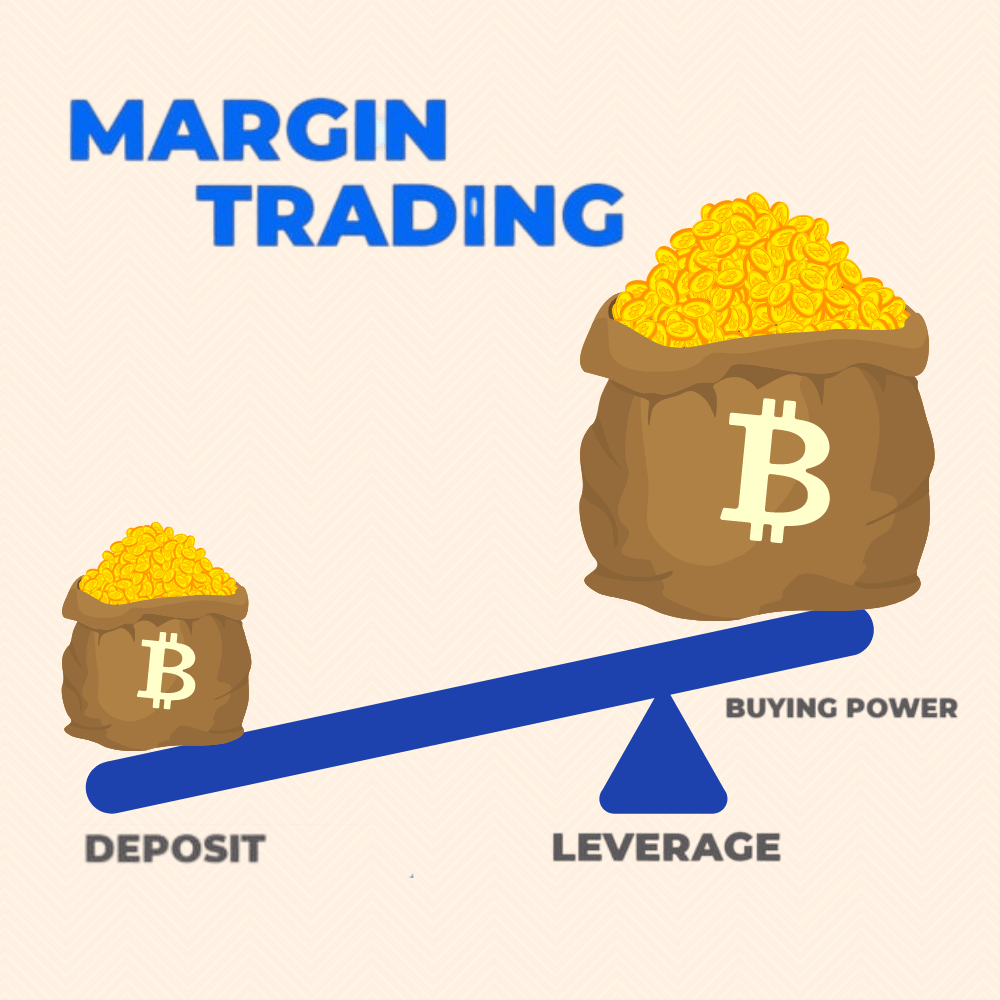

When you are margin trading bitcoin or any other cryptocurrency, you are just speculating the price performance of that asset. This form of trading is similar to spot trading, but with margin trading; you are borrowing funds you do not have.

Using these borrowed funds, offer you a bigger exposure (a.k.a leverage) The funds that were borrowed, in turn, earn interest for the lenders at a rate based on market demand.

Opening a margin trade first demands you to provide some amount of collateral. The collateral is known as the margin. Then, you can select the leverage you wish to trade at. Some Crypto Exchanges offer up to 100x (times) leverage.

For example, you can open a margin position for $10,000 if the leverage ratio is 10:1, you only need to invest $1,000 as collateral. The exchange will lend you the $9,000. Like a loan, you will be charged daily interest payments, and since crypto assets fluctuate wildly, you will have to ensure your margin/collateral is sufficient to avoid being ”Margin Call” liquidated.

12 Best Crypto Margin Trading Exchanges for Beginners

Whether you’re a beginner, intermediate or expert looking for leverage, margin rules differ across asset classes, brokerages, and exchanges. That is why I decided to compare them side by side. This is what I found…

Here is the list of exchanges that offer the best crypto margin trading experience:

1. Binance – Best for Liquidity and Reputation

Binance is the Amazon.com of the Crypto world. They have a thriving ecosystem that rewards users for their loyalty. The more you trade on Binance, the larger your rewards are going to be.

Binance offers Margin Trading of up to 125x as derivative Futures products. But limits relatively new accounts to 20x. Spot margin trading for Cross is only available at 3x; Isolated at 5x. Most platforms are similar. Some only offer Futures trading; others Leveraged Tokens (different derivative products).

What’s the difference between Margin Trading vs Futures trading?

Margin trading involves the underlying crypto asset. In Futures trading, the trader does not own the underlying cryptocurrency. Instead, traders exchange a contract that sets an agreement to either buy or sell at a future date.

==> Get Binance Welcome Rewards up to $100 here <==

To get the most out of Margin Trading on Binance as a beginner, you may want to utilize Binance Leveraged Tokens (BLVTs) denoted by the symbol BTCUP and BTCDOWN. This way you can use leverage without needing to maintain the required margin. So, you don’t get ”margin called” in the process.

Recently, Binance has also announced 0% Trading fees for BTC spot pairs, which normally would result in a 0.1% Maker/Taker fee. For other asset pairs, you can get a 25% discount if you use BNB for fees.

What’s important to remember here…

Daily Interest Payments – When trading with margin on Binance, trades will incur daily expenses. Funding fees and interest payments are taken into account on all trades, every day. Daily interest expenses can add up quickly, especially when a position is held over a long period. So take note!

Expiration – Margin trades requires your careful attention because they can be traded in perpetuity, or ”continuity”. There is no set date on which the trader agrees to close the trade. Even experts get liquidated from time to time; e.g. Three Arrows Capital.

Now, you can start Margin Trading in 5 simple steps on Binance.

First select your account type:

Cross: Assets can be used for all pair transactions, and the risk is taken by the entire account.

Isolated: The asset is only used for the specific trading pair, and the risk is taken within the specific trading pair account.

Second, tap on Transfer to move your assets into your Cross/Isolated margin account.

A box will appear, and you have to choose the asset and the amount you want transferred into your Binance Margin Account. Click confirm.

The maximum borrow amount is determined by your collateral and individual borrow limit for the specific coin.

Fourth, Margin Trading is the same as the Spot Trading.

You apply your trading strategy based on Limit, Market or Stop-limit orders.

Regardless of the repayment amount, you need to repay the interest first. The system will start calculating the interest rate of your loan in the next hour based on your latest borrowed amount.

Start Margin Trading with Binance

(Promo: 0% BTC trading fee)

2. Bybit – Best for Beginners (No KYC < 2 BTC)

Bybit is incredibly popular with beginners who are looking to start trading on margin for the first time. With over 30 million visits per month, it is a highly favored platform because you do not need to complete your KYC in order to start trading at low amounts.

If you find it difficult to decide which exchange to trade on, why not take up Bybit’s very attractive welcome reward, you’d be crazy to pass up the chance to claim up to $4,000.

While most cryptocurrency exchanges require traders to submit their personal information in order to start margin trading, Bybit doesn’t make this compulsory with the 2 BTC daily withdrawal limit.

When using Margin trading for the first time, you’ll have to activate it through Enable Margin.

This means that anyone, from (almost) anywhere in the world, can simply sign up for a free account using an email ID, deposit funds and start trading on Bybit exchange without ID verification.

They do, however, geo-block website visitors from specific countries including USA, North Korea, Iran and Syria. If you’re in one of the restricted countries, you can still use a VPN to access Bybit.

Currently, Bybit offers 3x Spot Margin Trading and up to 100x leverage derivatives.

Fees are highly competitive for starters:

Here’s a tip for beginners looking to experiment, try the Copy Trading feature and learn from expert traders.

Start Margin Trading with Bybit

(Up to $4,000 in bonus when you reg. & deposit here)

3. Phemex – Best for Membership Privileges

Launched in 2019, Phemex is a Singapore-based cryptocurrency and derivatives trading platform led by former Morgan Stanley executives. Serving around 5 million active users in over 200 countries, Phemex supports 137+ contract trading pairs with up to 100x leverage and 238+ spot trading pairs, making it easy and efficient to trade and buy cryptocurrency.

They are the first major exchange to pioneer a premium membership model that offers a variety of rewards to its users. To be eligible for the premium membership & various bonuses, you will need to complete KYC, otherwise you may trade anonymously.

Phemex brings professional banking level service and quality to its users. Their platform offers a high-efficiency order matching engine that minimizes downtime and overload.

Premium membership features:

For beginners, Phemex is one of the best margin trading platforms because it has everything under the sun:

- Fee Structure: -0.025% maker fee and 0.075% taker fee

- Up to $180 Welcome Bonus for new users

- Earn crypto with up to 11% APY interest income on various crypto assets

- Free academy with 450+ carefully curated articles about crypto & trading

- Sub-Accounts: create sub-accounts to try different trading strategies. You can try out long positions, short positions, trading bots in each sub-account.

- Copy Trading: Spectate Top Traders and Find your best trading style

- Simulated Trading: Learn how to trade with zero-risk

- Security: Hierarchical Deterministic Cold Wallet System with 2-level human scrutiny offline signatures

Start Margin Trading with Phemex

(Get $180 in bonus when you sign up here)

4. Bityard – Best for Simplicity

Bityard is a Singapore-based cryptocurrency derivatives exchange that offers Futures trading, Lite contracts and Leveraged Tokens. The platform aims to bring the ultimate simplified trading experience to its customers upholding the concept of “Complex Contracts Simple Trade”.

Getting started with leveraged crypto trading on Bityard is fast and simple. You don’t need to complete KYC because the platform doesn’t handle any fiat transactions. Say, if you want to buy USDC to trade, you will need to purchase it via a third party platform and then deposit USDC directly to your account.

What sets Bityard apart is their Lite Contracts (CFDs) a derivative way of speculating on crypto’s price without requiring the buying and selling of any crypto assets.

A cute little gimmick feature is their daily mining earning activity that allows traders to earn a small amounts of crypto each day (in coupons), with simple clicks that you can use to offset your trading fees.

Start Margin Trading with Bityard

(Bityard offers incredible 40% referral commissions)

5. BlackBull Markets

BlackBull Markets is a New Zealand-based forex and CFD broker that was founded in 2014. They offer a wide range of financial instruments for trading, including currency pairs, indices, commodities, and even cryptocurrencies.

One of the things that sets BlackBull Markets apart from other brokers is their focus on providing fast execution and tight spreads. This can be really important for traders who need to get in and out of positions quickly, or who are looking to take advantage of small price movements.

In terms of trading platforms, BlackBull Markets offers the popular MetaTrader 4 and MetaTrader 5 platforms, which are widely used by traders around the world. These platforms are known for their user-friendly interface and advanced trading tools, so it’s no surprise that BlackBull Markets has chosen to offer them to their clients.

The company claims to offer spreads from as low as 0.0 pips, fast execution, and leverage up to 1:500.

BlackBull Markets is licensed by the New Zealand Financial Markets Authority (FMA) and is registered as a security dealer by the Financial Services Authority (FSA) of Seychelles.

It serves over 20,000 day traders in 180+ countries.

In the case of margin trading, BlackBull Markets offer substantial margin trading opportunities with a maximum leverage of 1:500.

Traders can borrow money from the broker to trade cryptocurrencies on margin. This means that you can trade larger positions than you would be able to with your own capital alone.

For example, if a trader has $1,000 in their account and the broker offers a margin ratio of 2:1, the trader could trade a position worth up to $2,000.

So if you’re looking for an all-encompassing trading platform that’s easy to use, look no further than BlackBull Markets.

Sign up for BlackBull Markets. Start trading with MT4/MT5 on desktop, web, and mobile and take advantage of its versatility, including tools for comprehensive price analysis, trading robots, Expert Advisors, copy trading and margin trading.

6. Kraken – Best for Safety Standards

Founded since 2011, U.S based Kraken still maintains an incredible safety record as one of the high-profile crypto exchanges. They are only one of two reputable platforms that still allow U.S. residents access to margin trading, although requirements have now being tighten even further.

To qualify for margin trading on Kraken as a US resident, you must verify to at least the Intermediate Tier and self-certify as an Eligible Contract Participant (ECP). Short for: If you don’t have at least $10 million in assets, you cannot trade on margin here.

For those residing outside the US, you only need to verify up to intermediate tier to trade with leverage.

Overall, Kraken is a safe & reliable platform for those who qualify, however, the strict eligibility requirements exclude most retail traders. While the fees are competitive, the ones I recommended further up the list are better options.

Access or Sign up with Kraken here

(Enjoy incredibly low fees and peace of mind!)

7. Kucoin – Best Crypto App

Launched in September 2017, KuCoin is a user-oriented gamified trading platform with a focus towards rewards and community.

With over 700 digital assets on offer, the platform provides not only margin trading but also spot trading, P2P fiat trading, futures trading, staking, and lending to more than 18 million users in 207 countries.

Note: Zero-interest coupons can be used to borrow funds for use in long or short trades with an interest-free period of 7 days.

When you first enable margin trading on Kucoin, you will receive a free novice bonus pack with a zero-interest coupon worth of 500 USDT.

Kucoin allows Isolated Margin trading at 10x and cross margin trading at 5x. Trade up to 100x on Futures; but this is restricted to a leverage of 5x unless you complete KYC.

You can start a margin trade on Kucoin in 4 easy steps:

Note: If you are new to using leverage, it is recommended to keep your debt ratio below 50%.

Tip: By buying, holding & using KuCoin’s native token (KCS), you can enjoy additional benefits like 20% off trading fees as well as up to 50% APR to just hold it in your account. Also earn extra Stablecoin rewards when you access their Rewards Hub on the app.

Start Margin Trading with Kucoin

(Sign up here for a 500 USDT Free-interest coupon)

8. Bitfinex – Best for Pro Traders

Bitfinex is the longest-running and most liquid major cryptocurrency exchange. Founded in 2012, it has become the go-to platform for professional traders & institutional investors.

Bitfinex allows users to trade with up to 10x leverage by receiving funding from their onsite peer to peer margin funding platform.

Users can enter an order to borrow the desired amount of funding at the rate and duration of their choice, or they can simply open a position and Bitfinex will take out funding for them at the best available rate at that time.

Trading derivatives (up to 100x) on Bitfinex is only available to Intermediate, and higher-level verified users in approved eligible jurisdictions.

Bitfinex’s Margin Funding feature is also highly popular. It provides a secure way to earn interest on fiat and digital assets by providing funding to traders wanting to trade with leverage. Users can offer funding across a wide range of currencies & assets, at the rate and duration of their choice.

What is Margin Funding?

Margin Funding on Bitfinex goes hand in hand with Margin Trading. Through Margin Funding, users with Basic Plus Verification* level and above can provide funds through the P2P (Peer To Peer) funding platform for traders to use in Margin Trading and earn interest that is generated. If you are not a trader and prefer safer investments, this feature is for you.

Users that hold their native token, UNUS SED LEO, are also entitled to additional benefits such as:

- Trading fee discounts

- Funding fee discounts

- Multiplied Affiliate earnings

Overall, Bitfinex is a platform for professional and expert traders looking for more liquidity. While the platform is easy to navigate, their more advanced feature may confuse Margin Trading beginners.

Explore Bitfinex or Sign Up

(Join their Affiliate program & earn here)

9. Huobi – Best for Rewards & High Leverage

Founded in 2013, Houbi is one of the world’s leading cryptocurrency derivatives exchange service with a broad range of markets that offer up to 200x leverage.

Founded in China but following the Chinese government’s crackdown on crypto exchanges in 2017, Huobi has rapidly expanded its crypto services to serve the international market.

Their mobile app (iOS and Android) is highly gamified & feature-rich similar to Kucoin’s which allows you to earn, manage, store and trade cryptocurrency on the go.

Take part in Huobi’s $700 Welcome Bonus

(Get 50,000 SHIB tokens just by Signing up with an email here)

10. Bit.com – Best for Options Margin Trading

Bit.com since its launch in 2020, has now become the world’s 2nd largest crypto options trading platform.

This platform uses the Unified Margin (UM) system. It is an upgraded trading and risk management system that offers a one-account solution to traders by allowing them to utilize all assets in the account as collateral to trade all products.

Compared with the classic trading system, the UM trading system (Cross) has the following features:

- Trade margin, futures or options in the same account without transferring funds back and forth

- All currencies in your account (BTC, ETH, USDT, etc.) is reflected in USD value to provide margin

- All collateral currency in the unified account is shared as margin to improve capital utilization.

Options Trading:

- BTC, ETH & BCH options

- Up to 10x leverage

Futures Trading:

- BTC, ETH & BCH perpetual contracts and futures contracts

- Up to 50x leverage

Current Promo:

- Up to 30% APY on savings for new users

- Spot trading competition: Trade & earn 100 USDT daily

- Blink box campaign: Up to 1 ETH monthly lucky draw, guaranteed rewards!

- Year round carnival: iPad Pro + US$1,000 monthly giveaway

- Rewards Center: Up to US$245 trading coupons

Start Trading on Bit.com

(Get up to US$245 off trading fee coupons here)

11. BitMEX – Best for P2P Trading Crypto-Products

BitMEX offers high-leverage contracts that can be bought and sold in Bitcoin. Since their inception in 2016, the XBTUSD perpetual swap contract on BitMEX has been one of the most heavily traded products until its founders got hit by criminal lawsuits.

Bitmex focuses on cryptocurrency derivatives trading such as futures and margin trading of up to 100x leverage.

The platform is most suited to experienced traders and not beginners who want to start learning how to trade crypto on margin.

However, if you are looking to register and start trading here, be sure to grab their welcome offer of up to 80 BMEX Tokens when you complete a list of activities within 30 days of verification. You can get an additional 10% off your trading fees for 6 months too.

Start Margin Trading with BitMEX

(Get up to 80 BMEX tokens when you sign up here)

12. Stormgain – Best for User Experience

Launched in Jul 2019, Stormgain is a high-leverage trading platform that supports a wide range of crypto services. The app offers a complex yet intuitive interface which is pleasant to the eye.

The StormGain platform offers a whole suite of features including:

- Futures trading with up to 300x leverage

- Free BTC miner

- Interest rates up to 12%

- A built-in wallet

- Purchasing crypto with a credit card

- Demo accounts

- In-app trading signals

You can also take part in their Loyalty program to enjoy more rewards:

— Up to 20% bonus on each deposit.

— Up to a 12% interest rate on all crypto stored in your StormGain wallets

— Up to 20% discounts on trading and exchange commissions..

To learn more, visit the Loyalty program page

Moreover, with the ‘Refer a Friend‘ program, you can earn up to 15% on all brokerage fees your friends pay.

If you’re not ready to trade margin with your money, they also offer a demo account where you can practice trading before you get started for real.

Take advantage of the 50,000 USDT on your demo account, leverage of up to 500x and crypto trading signals in their mobile app.

Start Margin Trading with Stormgain

(Get 25 USDT when you sign up & deposit here)

Margin Trading FAQs

What is Margin Trading Crypto?

Margin trading crypto involves borrowing crypto from the exchange or funding pool to use for your trade. This is also known as leverage, because you can borrow 3x sometimes up to 100x your funds.

What is the risk of trading crypto margin?

Crypto is already and incredibly volatile asset. Margin trading amplifies that even more by allowing traders to potentially multiply their gains in bull or bear markets. But with great returns lies even greater risk. People often lose more than what they invested. Like a loan on interest compounding.

What leverage should a beginner use?

Start with 3x spot margin (progressive increment) and without exceeding more than 10% of your funds. Draw a line at 30 percent

Which Crypto Margin Trading Platform would you personally recommend?

Binance has exhaustive features, but it can get a little daunting navigating against so much noise. I'd say start with Bybit, Phemex or Bityard.

How to reduce the risk of being liquidated? ''Margin Call''

Watch your margin ratio, if it reaches 100%, you will be liquidated. Always make your margin balance is enough to cover sudden crypto volatility. (Which always happens when least expected) Also use stop-loss functions, and not leave too many contracts open in a losing position. Most important: Do not double down!

Best Margin Trading Platform Conclusion

Margin Trading Crypto platforms can be daunting for beginners to work with. But it can be easy, if you thoroughly break down which aspects you’d like to use & avoid the complicated ones.

There are platforms for anyone from beginners to professional traders. It might be a good idea to test trade & register for a couple of exchanges that offer demo accounts before you have a go at the real thing.

Platforms like Bybit as I have pointed out is excellent because you don’t have to start with KYC. Just simply transfer some crypto and you’re on your way.

Evergreen Wisdom:

- Don’t trade more than you can afford to lose.

- Don’t let emotion affect your risk management strategy.

- Remember experts and professional traders alike do get liquidated in crypto because of unexpected volatility.

- Always turn on the two-factor authentication (2FA) to be more secure.

- I also strongly recommend you to use a reliable hardware wallet like Ledger Nano S or Trezor to store your long term crypto assets.

Since cryptocurrency exchanges have been highly vulnerable to thefts and hackers, it’s incredibly risky to keep all your digital assets onsite.

P.S. This article was written not to encourage degenerate gambling behavior but to analyze, learn, compare and guide with my own understanding as well. I genuinely hope it helps you as much as it did for me.

Here’s some helpful blog posts that you can read next: