I’ve written a 12-Day series on self-publishing tips and guides to help you start your Kindle publishing, building a passive income and ultimately quit your day job!

If you’re new to ThinkMaverick, you might want to check out how Kindle Publishing changed my life and make sure you go through this 12 Days Self-Publishing series:

Day 1: 5 Things Beginners Need to Know About Kindle Publishing

Day 2: 7 Reasons Why You Should Create an eBook for Your Business

Day 3: How to Write and Publish an eBook

Day 4: How To Find Profitable Niches To Publish Online

Day 5: The Biggest Mistake I Made In Self-Publishing and How You Can Avoid It

Day 6: 6 Steps To Sell More Books on Amazon

Day 7: Designing Book Covers That Sell

Day 8: 7 Most Common Self-Publishing Mistakes You Should Avoid

Day 9: 40 Ways to Promote and Market Your Book

Day 10: 49 Inspirational Marketing Tips From Top Authors

Day 11: Top 10 Best Tools for Self-Publishing Authors

Day 12: 12 Best Platforms to Self-Publish Your eBook and Make Money

One of the hardest things about being a non-US self-publisher is losing an extra 30% of your hard earned money to Uncle Sam.

One of the hardest things about being a non-US self-publisher is losing an extra 30% of your hard earned money to Uncle Sam.

That said, if you’re publishing a book on Amazon Kindle Direct Publishing as a non-US person, on top of the 30% cut taken by Amazon, Amazon will also automatically withhold 30% of your royalties for tax purposes. And all you left with is a meagre 40%…

There’s no easy way to deal with it. Under the U.S Tax Laws, all US-based companies like Amazon, iBooks, Barnes and Nobles must deduct 30% tax on behalf of the US government from any royalty earned by non-US self-publishers.

It doesn’t stop here…

Even though you’ve paid 30% tax to the US, you still have to pay taxes in your own country. The legal term for this is known as double taxation.

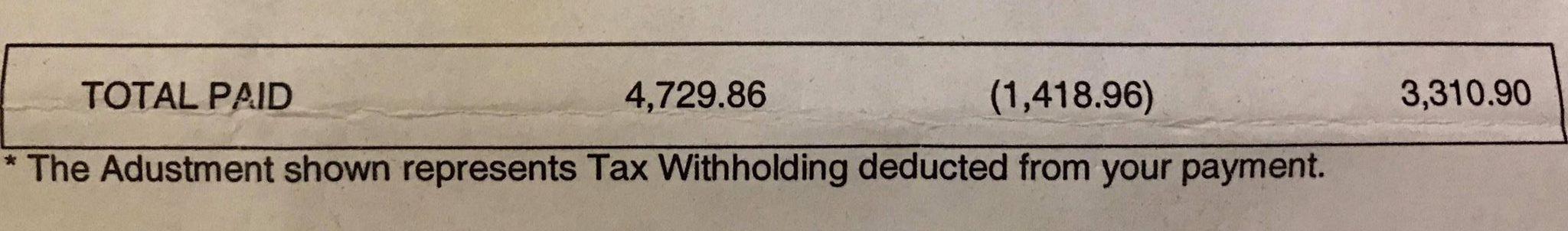

Here’s an example of one of the earnings I made from Amazon KDP. As you can see, Amazon straightway deducted a whopping $1,418.96 from my total earnings and the take-home pay was only $3,310.90 for that particular month. Don’t forget I still need to declare and pay tax in my country. That’s a bitter pill to swallow!

Fortunately, depending on where you live or where your company is registered, you can take a few steps to reduce your US tax withholdings or even remove it altogether.

In this article, I’m going to show you how to reduce your tax withheld in the U.S depends on where you live/where your business is incorporated:

- For those who live in a country that has an income tax treaty with the U.S.

- For those who live in a country that does NOT have any tax treaty with the U.S.

HOW TO REDUCE THE 30% U.S. WITHHOLDING TAX

1. Tax Treaty between your Country and the U.S.

First and foremost, it’s very important to know whether your country of residence has any tax treaty with the U.S.

Here’s a list of countries which has an income tax treaty with the U.S. If you’re a citizen or resident of any of this country, then you’re ELIGIBLE to apply for a reduced (or zero) rate of US tax withholding.

- 0% tax withholdings: Austria, Belgium, Canada, Czech R., Cyprus, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Netherlands, Pakistan, Russia, Slovakia, South Africa, Sweden, Switzerland, UK.

- 5% tax withholdings: Australia, Barbados, Bulgaria, New Zealand, Slovenia, Spain, Thailand

- 10% tax withholdings: Bangladesh, China, Estonia, Indonesia, Israel, South Korea, Mexico, Poland, Portugal, Sri Lanka, Turkey, Ukraine, Venezuela

- 15% tax withholdings: Egypt, India, Philippines, Tunisia

To see the full list of countries, you can go to the IRS website.

If you’re not so lucky where your country of permanent resident doesn’t have tax treaty with the U.S., just like me (Malaysia), then you HAVE to pay the FULL 30% tax.

But there’s still way to deal with it by incorporating a business entity in the US. Last year, we finally took the initiative, set up a C Corporation via Stripe Atlas for just $500 (one-time fee) and solved it once and for all. I will talk about it later.

If your country is in the US tax treaty list, then move on to the next step…

2. Get your TIN (Taxpayer Identification Number)

To claim tax treaty benefits to reduce your withholding, you can provide either one of these TIN when completing the tax form:

- Employer Identification Number (EIN)

- Individual Tax Identification Number (ITIN)

- Income tax identification number issued by your country of residence

Note: You’re still able to publish and sell your books on Amazon without providing any tax identification number. But, in order to enjoy reduced tax benefits, you must get your TIN from the IRS.

For Corporations and Non-Individuals: Employer Identification Number (EIN)

Getting an Employee Identification Number (EIN) is one of the easiest ways to reduce 30% tax withholding. At the time of this writing, you can apply for an EIN by telephone, fax or mail.

The fastest way to get your EIN is through a phone. Call the IRS +1 (267) 941-1099 (not a toll-free number). Open Monday-Friday 7 AM- 10 PM US Eastern Time. They will ask you to provide details such as your name, address, reason for calling etc. At the end of the call, you’ll be given an EIN immediately. Remember to write down the number, you’ll need it for the next step.

For individuals: Individual Tax Identification Number (ITIN)

The process of getting ITIN can be daunting. You can’t get ITIN by calling. To apply for an ITIN, you have to do it by mail or in-person at the IRS office.

It’s a very slow process which may take up to 8 weeks to complete. Plus, it requires you to submit certain documents such as your passport and an official ITIN letter along with your application to the IRS. If you’re interested, check out the official guideline here.

International Tax Identification Number

This is the best option if you’re residing in a country where your own local tax number is accepted by the IRS. This means that you can use the tax identification number issued by your country of residence to claim the tax treaty benefit. You don’t have to apply for EIN or ITIN.

For example, residents from the United Kingdom use National Insurance number (NI), Canada Social Insurance Number (SIN), Australia (Tax File Number) and France (INSEE code).

3. Complete your Amazon Tax Information

Once you have your EIN/TIN/International tax number ready, now you’ll need to enter the number on KDP’s online Tax Information and submit to Amazon.

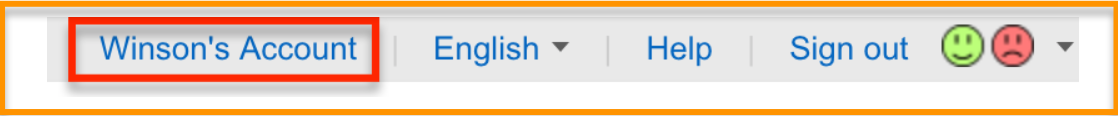

- Login to your KDP account.

- At the top right of your window, click “Your name -Account” ( “Winson’s Account” as an example here) to go to your account.

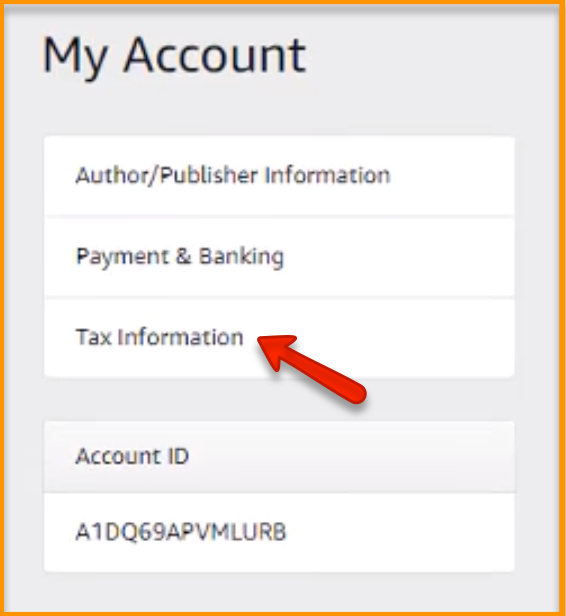

- Next, click “Tax Information”.

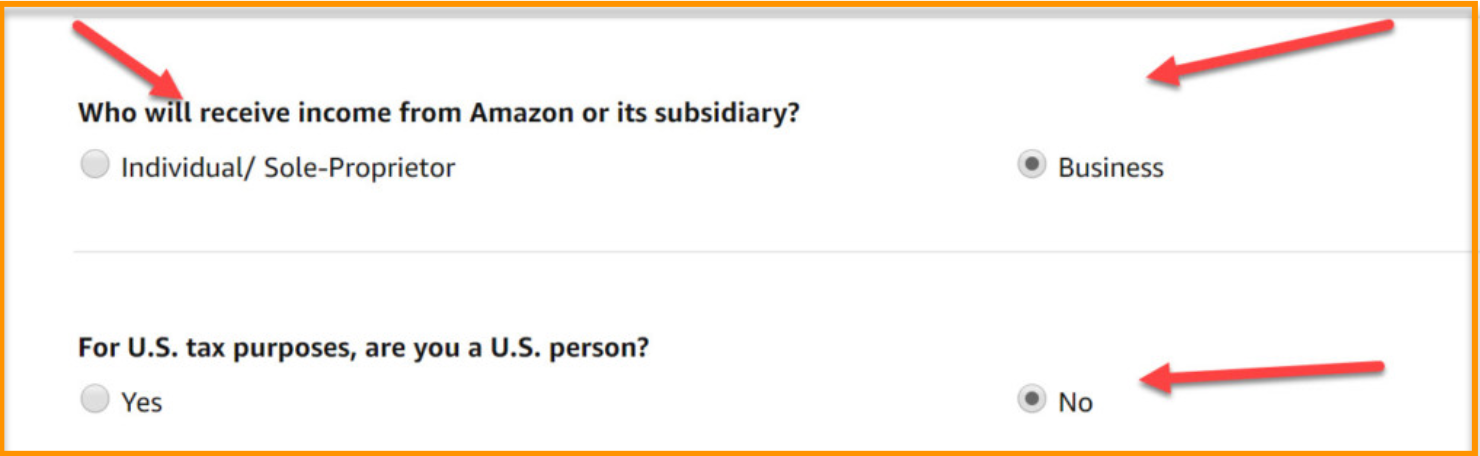

- Now you need to answer a few questions about your tax information. Choose “Individual/Sole-proprietor” if you operate under your name and choose “Business” if you operate as a business/company.

- Then, choose “No” for a non-US person.

- Next, enter your address.

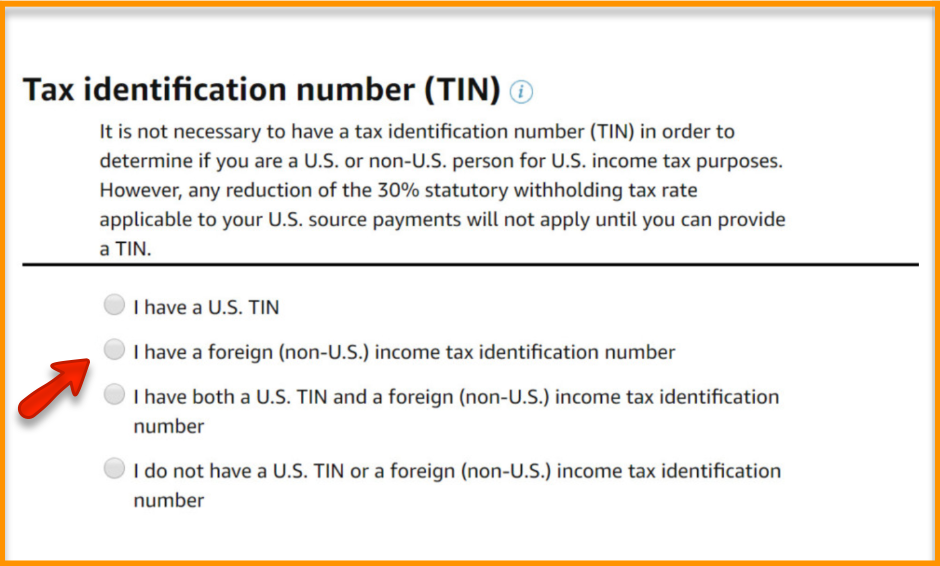

- You can choose to enter EIN/ITIN or your local tax number (for certain countries). Choose the option that’s applicable to your case and fill in your tax number accordingly.

- Once you’ve completed this tax interview, click “Complete Tax Information.”

- That’s it. Now you’ve submitted your tax details and Amazon will reduce/remove your tax withholding according to the information provided.

This seems to be a quite straightforward and simple case for those who live or have company in a country that has a tax treaty benefit with the US.

But as far as I’m concerned, how about those reside in countries that are not in the treaty list?

As we’re living in Malaysia, we must pay the 30% US tax. For years, we have been paying tens of thousands to Uncle Sam.

Which brings me to the next point…

4. Countries without Income Tax Treaties with the U.S.

As required by U.S. tax laws, Amazon will withhold a full 30% tax from royalties earned if you live in countries that do NOT have tax treaties with the US.

As you publish more books and your royalty incomes grow, setting up a company in one of the countries with tax treaty with the US is a smart move.

Remember it’s not about your nationality, but rather depends on where your company is registered or where you currently live.

By starting a company, you’re publishing books as a company. You will be able to enjoy benefits including, but not limited to:

- You will get an EIN for your business. Depends on which country you choose to register your new company, you can remove/reduce the tax withholding immediately.

- You can deduct expenses and operating costs like advertising, marketing, cover designing, proofreading services, buying a laptop and investing in a course etc.

- It’s easy to scale and grow your royalties.

- Depends on the type of company that you form, you can avoid any personal liability for any potential losses associated with your business.

Of course, it only makes sense to go through the process of forming and managing a company if you’re making money in publishing books. As everyone’s situation is different, it’s best to talk to some qualified International tax advisors/lawyers to help with your tax issues.

At present, we’re operating as a company in the United States of America. With Stripe Atlas, anyone around the world can start an internet company without physically being in the U.S.

At first, we felt a bit overwhelmed and intimidated but Stripe Atlas just made incorporating a business in the US so much easier.

All we need to do is submitting relevant information (company’s name, founder’s name, address, business nature etc) and make a payment of $500. Within 1 week, we get a bank account in the US, form a company, obtain our Employer Identification Number (EIN) and get our debit cards mailed to our local address.

I only wished I had done it sooner. It removes the biggest headaches of high tax withholding imposed on foreign countries.

Less tax is withheld from your royalty means more money in your bank!

Having a bank account in the US also means that you’ll be able to receive monthly royalty payment via wire transfer. Which is more convenient compared to receiving checks.

Once you set up a company, the process of upgrading your KDP account to a business account is pretty easy. Go to your KDP dashboard, enter your company details (name and address), fill in your EIN number in the tax information section, update your payment method and bank details. You can also email Amazon KDP about the change and they’ll update the information in your account.

To set up a company in the US with Stripe Atlas, you’ll need an invitation.

If you’re interested about forming a corporation + open a business bank account in the US (without physically being in the U.S.), click here to access the special Stripe Atlas Invitation link (only for my readers).

Here’s a comprehensive guide on how to open a company and a bank account in the US as a foreigner, I’ll walk you through the process of setting up an online business + get your EIN number + open a US bank account in easy-to-follow steps.

Conclusion

When it comes to reducing the US tax withholdings, there’s a way for everyone regardless of where you live.

Using your local tax identification number (if possible) and getting an EIN number are two easy ways to avoid the 30% US tax withholding.

Less taxation, more royalties!

What do you think?

What’s your experience about avoiding the 30% US tax? Do you have any tips or advice to share with us?

If you have any problem or question, feel free to comment below.

Also read:

- The 1% Rule: The no brainer secret of making four figure a month in kindle publishing

- How to create 3D book covers for free (9 Best Free Tools)

- Self-Publishing: Pros and Cons of Publishing with Draft2Digital

- How I Opened a Company and a Bank Account in the USA as a Foreigner

Are you ready to join me on Self-Publishing?

Sign up now to get the Daily publishing e-course for Free!

Hi Jenny, are you setting up the US company as a single member LLC but then that is treated as sole proprietorship and it is required to provide the owner’s LIN instead of the LLC’s EIN for tax interview from Amazon. As Singapore doesn’t have Tax Treaties with US, that implies a 30% tax withholding which means setting up a company makes no difference? Please let me know if I get it wrong, thanks!

Hi John,

No. Once you’ve setup C-Corporation in the US (that’s the only choice for foreign via Stripe Atlas), you’ll be given EIN number, which you can submit to Amazon and remove your tax withholding to 0%. With that said, you’ll need to file an annual return and pay tax based on your revenue. Does this answer your question?

Hi Jenny

How much percentage tax we need to pay yearly on revenue?

It depends on your country of residence.

If there’s a tax treaty between your country and US, you can apply for reduced (or zero) rate of US tax withholding. And you just have to pay tax to your country accordingly. Did I answer your question?

I’m living in Vietnam, which doesn’t have tax treaty with US. If I setup a company in US via Stripe, does it mean I have to pay tax twice? One for the US company and the other for my country if I withdraw money from US to my country. Thanks.

Hi Mai,

Yes, I think there’s no way to avoid paying tax to local government if you’re withdrawing salary from your US company.

Do you think setup a UK company can avoid paying 30% withholding tax? Since UK has tax treaty with US, it should be 0%, right?

Hi Mai, yes. You can do that.

Hello. I’m thinking of doing what you did here to avoid the 30% tax, but I have a few questions. Do you pay taxes for the company you made in the US? Corporate taxes, local taxes, and such.

Hi Pedro, yes, corporate tax and local tax.