Are you looking for the best P2P Crypto exchange where you can trade without any privacy concerns?

Are you looking for the best P2P Crypto exchange where you can trade without any privacy concerns?

If you want to buy crypto anonymously and instantly – then look no further, this list is for you plebs out there.

Bitcoin was created by Satoshi Nakamoto as a “peer-to-peer electronic cash system”.

Ironically, many crypto traders, hodlers and investors are still relying heavily on centralized exchanges like Binance to trade crypto.

However, if privacy is a big deal to you, then using a P2P crypto exchange will likely put those concerns to bed. (Read on, I’ll explain in detail)

If you don’t have time, here is a TL;DR list of the 7 best P2P crypto exchanges:

- LocalCoinSwap – Buy Bitcoin, Ethereum and other cryptocurrencies using 250+ payment methods with no KYC.

- OpenPeer – A decentralized P2P exchange that uses smart contract based escrow system where you can trade directly from your self-custody wallet like Metamask, Trust Wallet or Coinbase Wallet.

- Binance P2P – Highly Liquid P2P Crypto Marketplace, KYC is required.

- Whalesheaven – P2P Cross-chain trading for whales & sharks.

- Hodl Hodl – Buy/sell Bitcoin with No KYC/AML. Available worldwide, except US.

- Remitano – Buy crypto in 30+ countries, including US. Buy a max $1,000.00 daily with phone verification.

- Paxful – Buy and sell digital currencies using over 350 different payment methods. 6 million users.

What are P2P Crypto Platforms?

Peer-to-peer (P2P) crypto platforms let people trade their crypto coins directly with each other, without a centralized book order or matching engine like Binance. It’s like meeting up with a friend the old fashion way to trade Pokémon cards – you just decide between yourselves what’s a fair trade.

Most P2P platforms use an “escrow system” to ensure a smooth flow order between a seller and a buyer. The process more or less looks like this:

- After the buyer agrees to buy, the seller puts the crypto into a special locked account on the exchange.

- This crypto stays locked until the seller says they got the buyer’s payment.

- Once confirmed, the crypto is then released to the buyer.

This system ensures both parties keep their promises and everyone is protected.

P2P vs Centralized crypto exchange

The key difference is that P2P crypto platforms simply provide a platform for individual traders to connect and negotiate trades directly with each other, rather than trading against a central liquidity pool.

On P2P exchanges, buyers browse seller advertisements and agree on terms like price and payment method through individual messaging or an integrated chat system. Sellers offer terms like minimum/maximum trade sizes and supported payment methods.

Once terms are agreed, buyers send a payment outside the exchange and sellers release the agreed crypto funds from their wallet to the buyer’s wallet. This transfer is usually done via an on-chain transaction on the respective blockchain.

Some P2P platforms provide escrow services to secure the trades, but the order matching and settlement occurs directly between the buyers and sellers. There is no centralized order book being matched like on a traditional exchange.

This peer-to-peer nature aligns with the decentralized ethos of cryptocurrencies, but it also means P2P trading platforms have a much lower liquidity than centralized exchanges. The prices and availability depend solely on what sellers are actively advertising rather than pooled liquidity.

| P2P Exchanges | Supported Countries | Payment Methods | Pros/Cons |

|---|---|---|---|

| LocalCoinSwap | Global | 300+ methods | No KYC/AML, Non-custodial, Start trading w/ email Up to 1% fees ad posting |

| OpenPeer | Worldwide | 20+ methods | Decentralized, non-custodial, smart-contract escrow |

| Binance P2P | Global; Geo Restrictions apply | 100+ methods | Highly Liquid P2P Market Up to 0.35% fees ad posting |

| Whales Heaven | Global | Cryptocurrency | WH Cypher multichain multisig wallet is required to trade p2p, Setup OTC Deals, Threshold Sig protection |

| Hodl Hodl | Worldwide -except the United States | 108+ methods | No KYC/AML Fully decentralized |

| Remitano | 30+ countries, including US | bank transfer, cryptocurrency | Buy BTC, ETH, BCH, XRP, LTC, USDT |

| Paxful | Global | 300+ methods, including Cash in Person | Best exchange for gift cards to Bitcoin |

7 Best P2P Crypto Exchange in 2025

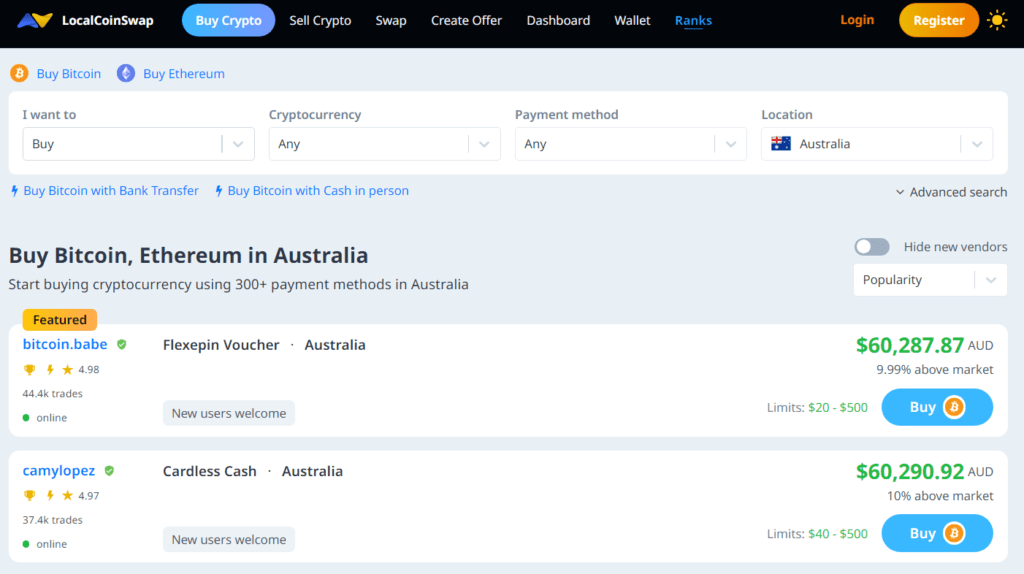

1. LocalCoinSwap

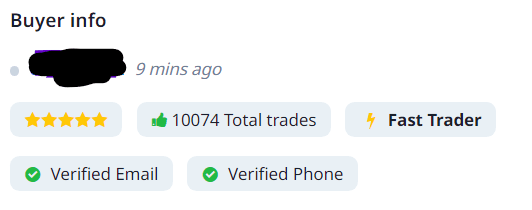

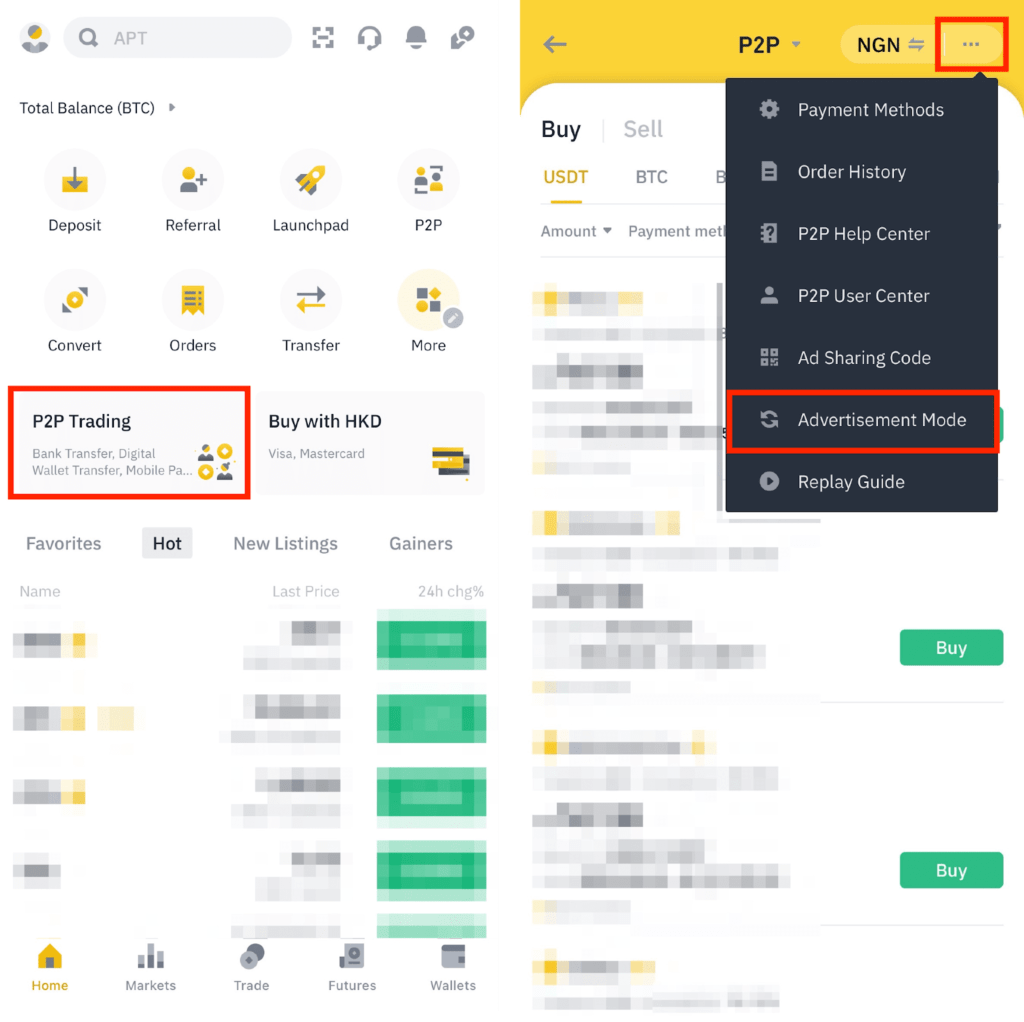

Ever since the closure of Localbitcoins P2P exchange, LocalCoinSwap has taken over the mantel as one of the world’s most popular non-custodial P2P marketplaces for crypto traders worldwide. Not only can you trade crypto with 300+ payment methods, but you can also start trading with just an email alone.

You can start creating an advertisement on LocalCoinSwap for just a 1% fee, and that let’s you trade over 20 major types of cryptocurrencies like Bitcoin, Ethereum, Tether and USDC. If that is a hassle and you don’t want to wait for a buyer, you can simply use LocalCoinSwap’s in-house swap exchange.

Enjoy the benefit of buying and selling bitcoin, while remaining completely anonymous on this platform. Be sure to check out a local trader’s rating, total number of trades & terms and condition before you step into a trade. Some traders may require you to have a verified phone number before they accept your proposal. You can Get All those details right here.

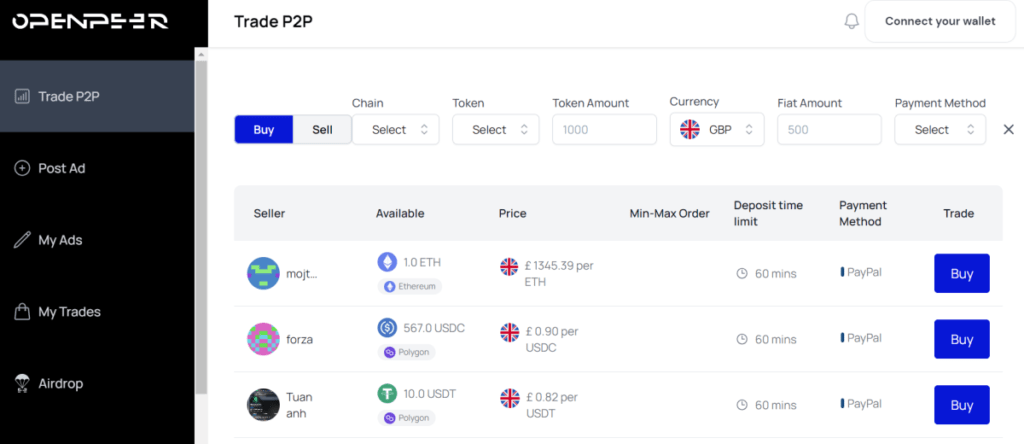

2. OpenPeer

OpenPeer is a relatively new but fast growing decentralized P2P exchange. Unlike P2P exchanges offered by centralized exchanges, OpenPeer is a decentralized P2P exchange that never takes custody of your funds. It has a smart contract based escrow system where you can trade directly from your self-custody wallet like Metamask, Trust Wallet or Coinbase Wallet.

The platform currently doesn’t support Bitcoin trading but you can buy USDT in 100+ fiat currencies and payment methods and then later trade the USDT for Bitcoin on a variety of decentralized exchanges like Thorchain.

OpenPeer supports trading on EVM networks like Ethereum, Binance Smart Chain, Polygon and Arbitrum.

KYC is optional but some other traders do require you to go through OpenPeer’s ID verification system in order to place trades with them. OpenPeer doesn’t take any fees from buyers but charges a 0.3% fee when selling crypto through the protocol.

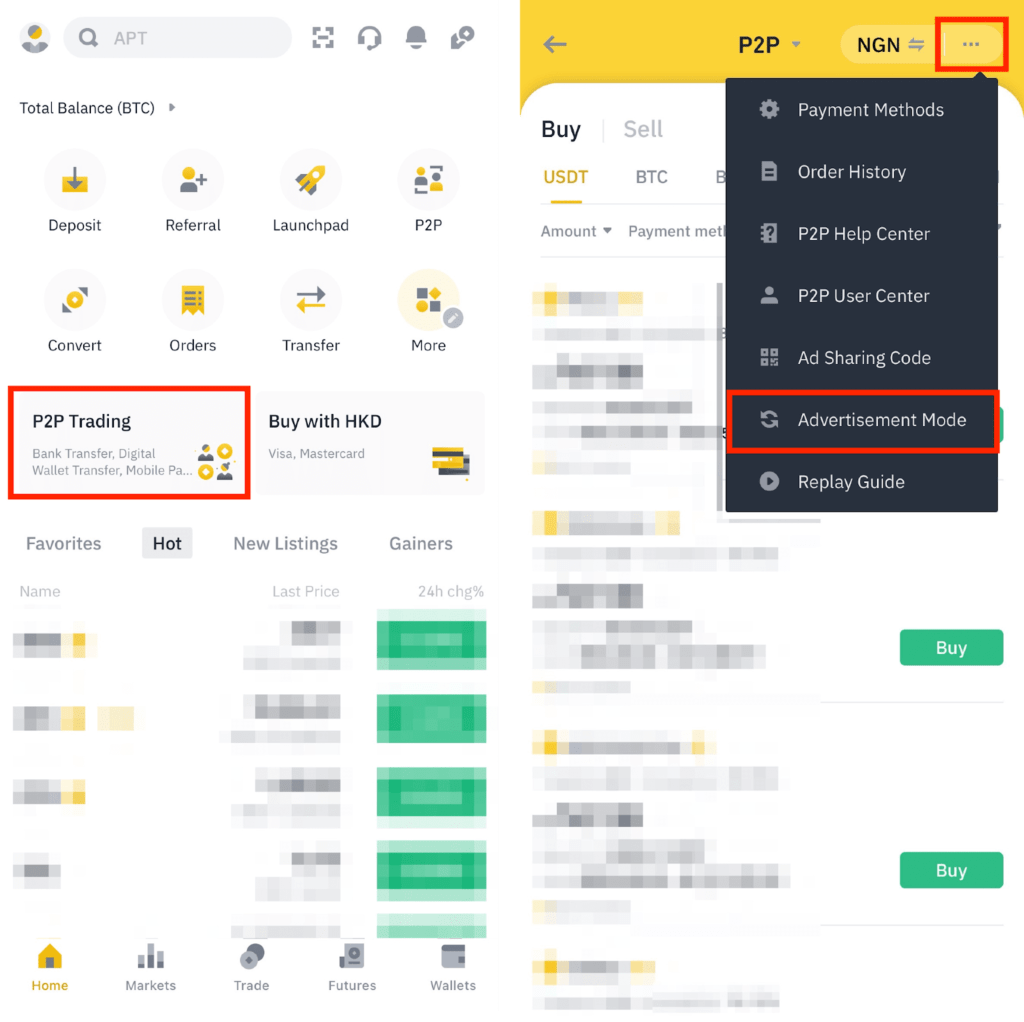

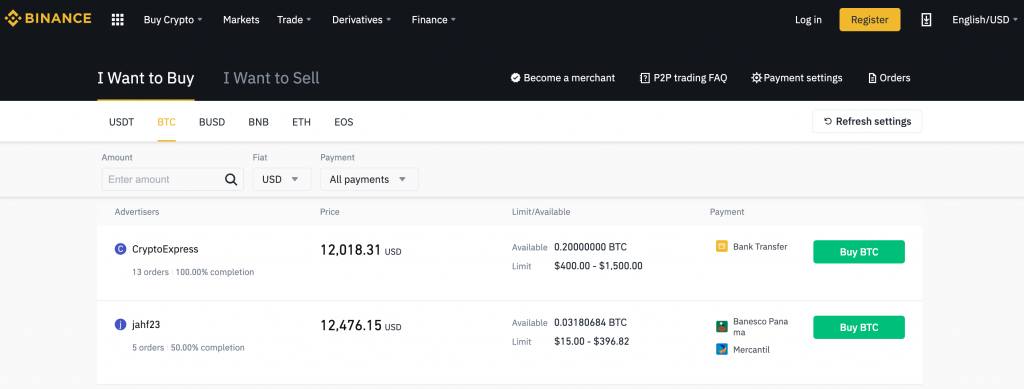

3. Binance P2P

Yes, even Binance has its own P2P Crypto marketplace.

The feedback on Binance P2P has been largely positive although I don’t see the benefit of using it for decentralized trading since users must already be KYC verified to trade on Binance’s main centralized exchange and liquidity pool.

Binance P2P users get to enjoy a wide range of payment methods on offer together with high liquidity. The overall fees are incredibly competitive and loyal members get to enjoy the occasional free/promotional trading. Only trades executed from a posted ad will cost up to 0.35%.

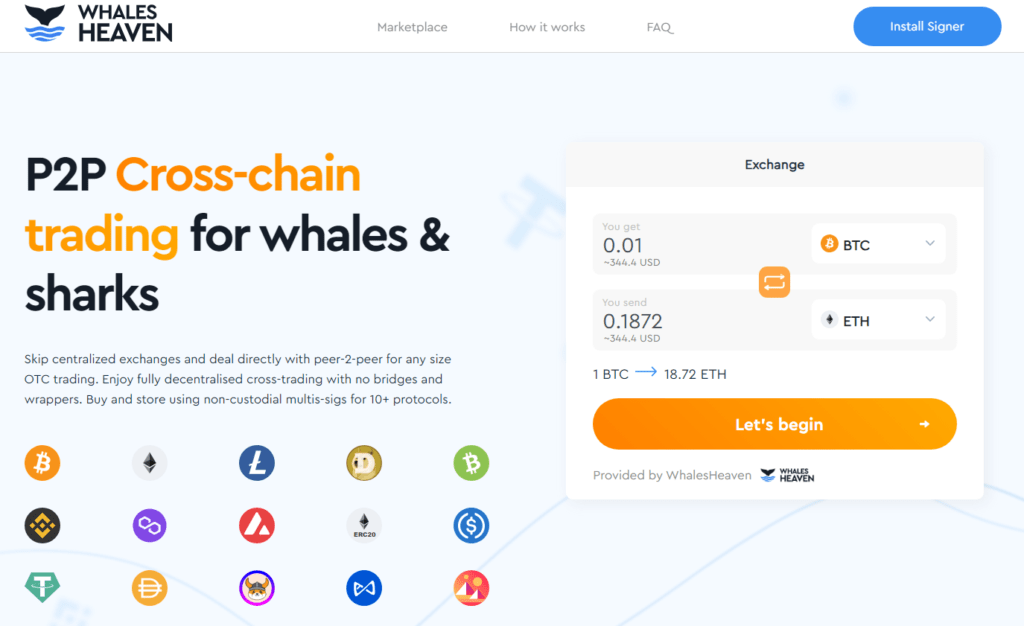

4. Whalesheaven

WhalesHeaven is a peer-to-peer (P2P) cryptocurrency exchange that is specifically designed for large volume traders like OTC trading. It offers a number of features that make it ideal for this type of trader, including:

- Non-custodial: WhalesHeaven is a non-custodial exchange, meaning that users never have to give up control of their funds. This is important for large volume traders, who need to be able to access their funds at all times.

- High liquidity: WhalesHeaven has a high order book, meaning that there are always buyers and sellers available for most cryptocurrencies. This allows large volume traders to quickly and easily execute their trades.

- Threshold signatures: WhalesHeaven uses threshold signatures to secure its transactions. This technology allows multiple parties to share a single cryptographic key, without any one party having access to the full key. This makes WhalesHeaven very resistant to hacking and fraud.

- Customizable trading experience: WhalesHeaven offers a number of customizable features that allow large volume traders to tailor the trading experience to their needs. For example, traders can set their own fees and margins, and they can also create custom order types.

Before you can start trading P2P on WhalesHeaven, you will need to download their WH Cypher Wallet, which is a non-custodial multisig wallet. Their wallet protects you from counterparty risk, unlike most escrow based smart contract systems out there.

WhalesHeaven also supports P2P cross-chain trading, which allows users to trade cryptocurrencies on different blockchains without having to use a bridge.

5. Hodl Hodl

Hold Hodl is a global P2P Bitcoin exchange that lets you purchase Bitcoin directly from a seller without the exchange middleman.. Launched in 2017, Hodl Hodl is fairly new to the world of crypto exchange, but has quickly become a prominent player in the industry.

What makes Hodl Hodl unique is that it doesn’t hold any money during the trade.

Rather, they lock funds in multisig contracts.

Here’s how it works:

- Seller deposits Bitcoin from his wallet into this multisig escrow Bitcoin address.

- Buyer send fiat money to seller.

- Seller releases the locked bitcoins from escrow to buyer’s wallet.

All trades happen directly between buyers and sellers.

Therefore, there’s no KYC/AML compliance requirements, making it a completely decentralized exchange platform.

To start trading on Hodl Hodl, all you need is to sign up for a free account using your email address. Once you click on the confirmation link sent to your inbox, you’re good to go!

Hodl Hodl key features

- Fully decentralized

- No KYC/AML

- Non-custodial P2P exchange

- Global P2P crypto exchange

- Secure: You control the key to the funds in multisig escrow

- Low fees: max 0.6% per trade

- Receive Telegram notifications about your trades

- Add P2P profile from Paxful

If you value anonymity and privacy above all else, Hodl Hodl might be the a good choice for you.

With Hodl Hold, you can buy, sell and trade Bitcoin without providing proof of ID. Both buyer and seller will never has any idea who the other party is, while the multisig escrow ensures safe trading for both parties.

6. Remitano

Remitano is another global P2P trading platform that connect buyers and sellers using an escrow service since 2014.

You can use it to easily and quickly buy/sell crypto (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Tether USDT) in more than 30 countries around the world, including the US.

However, you need to verify your phone in order to start using Remitano. A higher trade volume will require higher KYC level, in which you have to submit documents such as passport and identity card.

Remitano charges a small fee for depositing and withdrawing funds, fees vary depending on the chosen payment methods.

Plus, there’s a 1% trading fee for every completed trade.

Don’t be dissuaded by the high fees.

Sometimes, you can find highly competitive price on the Remitano in countries such as Vietnam and Malaysia.

For instance, at the time of this writing, you can buy Bitcoin on Remitano for just 1.0% above market rate.

7. Paxful

Launched in 2015, Paxful is another global P2P Bitcoin marketplace that allows you to securely buy, sell and trade BTC without going through a financial institution.

There are more than 300+ modes of payment. Bank transfer, cash, online wallets (Skrill, Paypal, Neteller), gift cards (Amazon, iTunes), altcoins (Ripple, Ethereum) are some of the popular payment options used on the platform.

Additionally, Paxful also supports buying/selling crypto with Cash in Person. If you want to buy or sell Bitcoin anonymously without leaving any traces of your identity or activity, Paxful can help!

Simply create a free account (No ID verification), and you can start finding someone who’s willing to meet up face-to-face for a cash transaction.

ID verification is only required if you reach US$1,500 in trade volume or wallet activity.

When it comes to fees, Paxful doesn’t charge you for buying Bitcoin. Yes, you can buy Bitcoin with ZERO fees on Paxful, regardless of the amount.

However, if you’re a seller, you’ll need to pay up to 1% fee depending on the payment methods.

- Bank Transfers: 0.5%

- Credit/Debit Cards: 1%

- Digital Currencies: 1%

- Online Wallets: 1%

- Cash: 1%

- Gift Cards: 3% for all gift card types (except iTunes and Google Play), 5% iTunes and Google Play.

While transferring coins between Paxful wallet is free, there will be a small fee to move funds from a Paxful wallet to your own Bitcoin wallet.

Conclusion: Best P2P Crypto Exchange for Altcoin Traders

Overall, if you’re a crypto trader looking to avoid the hassle of being KYC verified before you can trade, you should definitely try using one of these P2P trading platforms.

LocalCoinSwap offers a number of advantages over other P2P exchanges with their wide range of payment methods. You only need an email to start trading which is an added bonus.

You will also get better offers for traders who can quickly and easily execute their trades. Their rating system is incredibly useful if you’re a beginner looking to make your first trade.

What’s more, LocalCoinSwap is a non-custodial exchange, meaning that you never have to give up control of your funds. This is important for all cryptocurrency traders, but it is especially important for altcoin traders, who are often trading high-risk assets.

Overall, LocalCoinSwap is a great choice for altcoin traders. It offers a wide range of supported altcoins, high liquidity, low fees, and a variety of security features. Look for the best P2P crypto offers in your area here.

——

I’ve handpicked a few guides for you to read next:

- Crypto 101: The Ultimate List of Cryptocurrency Resource

- 10+ Best Cryptocurrency Exchanges to buy and trade Bitcoin Cryptocurrency

- How to Buy Bitcoin and Other Cryptocurrencies

- FAQ: Everything You Need to Know About Bitcoin Before You Buy

- 7 Best Ways to Earn Passive Income with Cryptocurrency

- 10+ Easy Ways to Make Money with Bitcoin and Cryptocurrency

- How to Invest in Bitcoin: The Ultimate Guide for Beginners 2022

- How to Sell Bitcoin – The Ultimate Beginner’s Guide 2022

- Trading vs HODLing for Bitcoin Investors

I live and breathe making an income online.

I’ll be sharing more ideas and guides soon. Stay tuned.

If you haven’t already, sign up here to receive my emails.

Hi there! Thanks for posting an informative post.

Thanks for reading 🙂